Alternative text

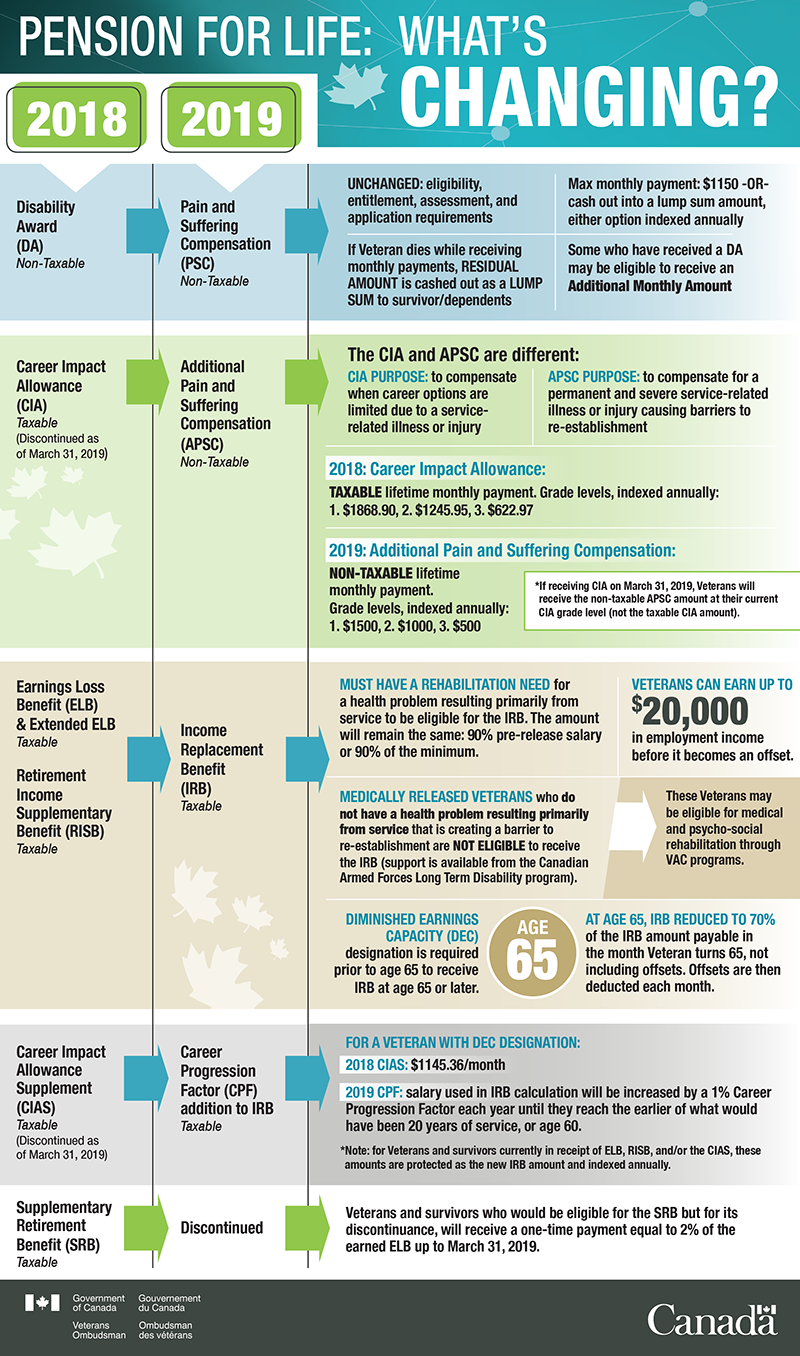

Pension for Life: What's changing?

| 2018 | 2019 | ||

|---|---|---|---|

Disability Award(DA)Non-Taxable |

Pain and Suffering Compensation (PSC)Non-Taxable |

UNCHANGED: eligibility, entitlement, assessment, and application requirements | Max monthly payment: $1150 -OR- cash out into a lump sum amount, either option indexed annually |

| If Veteran dies while receiving monthly payments, RESIDUAL AMOUNT is cashed out as a LUMP SUM to survivor/dependents | Some who have received a DA may be eligible to receive an Additional Monthly Amount | ||

Career Impact Allowance (CIA)Taxable |

Additional Pain and Suffering Compensation (APSC)Non-Taxable |

The CIA and APSC are different: |

|

| CIA PURPOSE: to compensate when career options are limited due to a service-related illness or injury | APSC PURPOSE: to compensate for a permanent and severe service-related illness or injury causing barriers to re-establishment | ||

2018: Career Impact Allowance:TAXABLE lifetime monthly payment. Grade levels, indexed annually: |

|||

2019: Additional Pain and Suffering Compensation:TAXABLE lifetime monthly payment. Grade levels, indexed annually: *If receiving CIA on March 31, 2019, Veterans will receive the non-taxable APSC amount at their current CIA grade level (not the taxable CIA amount). |

|||

Earnings Loss Benefit (ELB) & Extended ELBTaxable Retirement Income Supplementary Benefit (RISB)Taxable |

Income Replacement Benefit (IRB)Taxable |

MUST HAVE A REHABILITATION NEED for a health problem resulting primarily from service to be eligible for the IRB. The amount will remain the same: 90% pre-release salary or 90% of the minimum. |

VETERANS CAN EARN UP TO $20,000 in employment income before it becomes an offset. |

| MEDICALLY RELEASED VETERANS who do not have a health problem resulting primarily from service that is creating a barrier to re-establishment are NOT ELIGIBLE to receive the IRB (support is available from the Canadian Armed Forces Long Term Disability program). | These Veterans may be eligible for medical and psycho-social rehabilitation through VAC programs. | ||

| DIMINISHED EARNINGS CAPACITY (DEC) designation is required prior to age 65 to receive IRB at age 65 or later. | AT AGE 65, IRB REDUCED TO 70% of the IRB amount payable in the month Veteran turns 65, not including offsets. Offsets are then deducted each month. | ||

Career Impact Allowance Supplement (CIAS)Taxable (Discontinued as of March 31, 2019) |

Career Progression Factor (CPF) addition to IRBTaxable |

FOR A VETERAN WITH DEC DESIGNATION:2018 CIAS: $1145.36/month 2019 CPF: salary used in IRB calculation will be increased by a 1% Career Progression Factor each year until they reach the earlier of what would have been 20 years of service, or age 60. *Note: for Veterans and survivors currently in receipt of ELB, RISB, and/or the CIAS, these amounts are protected as the new IRB amount and indexed annually. |

|

Supplementary Retirement Benefit (SRB)Taxable |

Discontinued |

Veterans and survivors who would be eligible for the SRB but for its discontinuance, will receive a one-time payment equal to 2% of the earned ELB up to March 31, 2019. |

|