Table of Contents

Message from the Ombudsman

I am pleased to publish The Actuarial Analysis Follow-up Report. Its purpose is to update my 2013 Actuarial Analysis and evaluate the improvements to the New Veterans Charter since 2013.

The five scenarios analyzed in 2013, which assessed the financial impact of benefits, have been reviewed and updated based on the changes to the New Veterans Charter (NVC) suite of programs since 2013. As well, three new scenarios have been added, including two scenarios of Veterans who have not been deemed to be totally and permanently incapacitated (TPI) and one scenario of a surviving spouse.

I make four recommendations that I encourage the Minister of Veterans Affairs and Veterans Affairs Canada (VAC) to implement in a timely manner.

Guy Parent

Veterans Ombudsman

Veterans Ombudsman's Mandate

The Office of the Veterans Ombudsman (OVO), created by Order in Council, works to ensure that Veterans, serving members of the Canadian Armed Forces (CAF) and the Royal Canadian Mounted Police (RCMP), as well as other clients of VAC, are treated respectfully, in accordance with the Veterans Bill of Rights, and receive the services and benefits that they require in a fair, timely and efficient manner.

The Veterans Ombudsman is an independent and impartial officer who is committed to ensuring that Veterans and other clients of VAC are treated fairly. The Veterans Ombudsman measures fairness in terms of: adequacy, sufficiency and accessibility.

The OVO addresses complaints, emerging and systemic issues related to programs and services provided or administered by VAC, as well as systemic issues related to the Veterans Review and Appeal Board.

Veterans Bill of Rights

The Veterans Bill of Rights applies to all clients of Veterans Affairs. It states:

"You have the right to:

- Be treated with respect, dignity, fairness and courtesy.

- Take part in discussions that involve you and your family.

- Have someone with you for support when you deal with Veterans Affairs.

- Receive clear, easy-to-understand information about our programs and services, in English or French, as set out in the Official Languages Act.

- Have your privacy protected as set out in the Privacy Act.

- Receive benefits and services as set out in our published service standards and to know your appeal rights.

You have the right to make a complaint and have the matter looked into if you feel that any of your rights have not been upheld.”

Executive Summary

This report evaluates the changes that were made to the NVC financial benefits since the 2013 OVO Report: Improving the New Veterans Charter: The Report and its accompanying Review: Improving the New Veterans Charter: The Actuarial Analysis. This updated actuarial analysis looks at the current suite of NVC financial benefits, considering the effects of eight different scenarios on lifetime compensation for Veterans. The scenarios include the five scenarios from the 2013 report of Veterans who are deemed TPI and three new scenarios: two scenarios of Veterans who are not TPI and one survivor scenario.

The key findings of this Report are:

- Four new benefits and eight enhancements to the NVC were implemented, resulting in additional complexity. Communicating and administering the intricacies and interrelationships of these benefits to Veterans and their families has been challenging.

- The increase to the Earnings Loss Benefit has had the most significant effect on NVC recipients in that it increases lifetime compensation for the greatest number of Veterans including those that are TPI, non-TPI and survivors.

- The Permanent Impairment Allowance (PIA) and PIA Supplement (PIA-S) contribute significantly to the lifetime compensation for Veterans who are TPI.

- New benefits such as the Family Caregiver Relief Benefit (FCRB), the Critical Injury Benefit (CIB) and the Retirement Income Security Benefit (RISB), while improving the financial situation for some Veterans, have a limited impact on the broader Veteran population, as few Veterans are eligible for these benefits.

- It is unclear whether the needs of Veterans who are not TPI are being met.

- While lifetime compensation to survivors has increased more under the NVC than under the Pension Act (5 percent more after tax), compensation after age 65 has not been studied to determine if the annual dollar values are meeting the financial needs of survivors.

- Both lifetime and annual compensation totals are important. When you receive the compensation is as important as how much you receive. While the value of the lifetime total may be adequate, depending on when the Veteran receives these payments, there may be times when compensation does not fully meet the Veteran’s, or their family’s financial needs.

To better address the needs of Veterans, the Minister of Veterans Affairs and the Department of Veterans Affairs must review and assess the current financial benefits to reduce complexity and ensure that the needs of Veterans who are not TPI, and all survivors, receive the financial benefits they require over their lifetime, and more specifically, when they are required.

This report concludes that VAC has made a number of improvements to the NVC suite of financial benefits since the 2013 Actuarial Report; however, there remain areas requiring further review and improvement. As a result, the Veteran’s Ombudsman makes the following recommendations:

- Recommendation 1: That the Minister of Veterans Affairs, by 1 April 2019, consolidate financial benefits to reduce complexity and better address the financial needs of Veterans and survivors.

- Recommendation 2: That VAC assess the level of financial support it provides to Veterans who are not TPI to ensure that their financial needs are being met and publish the results of that assessment by 1 April 2018.

- Recommendation 3: That VAC assess the level of financial support it provides to survivors to ensure that their lifelong financial needs are being met and publish the results of that assessment by 1 April 2018.

- Recommendation 4: That VAC review when financial benefits are being delivered to Veterans and their survivors to ensure that their financial needs are being met and publish by 1 April 2018 the benchmarks used to measure that financial support.

Implementing these recommendations will make a positive difference in ensuring that ill or injured Veterans and their families receive the lifetime financial compensation they need and deserve as a result of their service and sacrifice to Canada.

Introduction

The federal government enacted the Canadian Forces Members and Veterans Re-establishment and Compensation ActFootnote 1 (commonly referred to as the New Veterans Charter (NVC)) in 2006 with the intent to support the changing needs of Veterans. The introduction of the NVC shifted the focus from disability in the Pension ActFootnote 2, to encouraging wellness and rehabilitation; consistent with the principles of modern disability management.Footnote 3

At the time the NVC was enacted, these changes were viewed as controversial by some in the Veterans’ community.Footnote 4 One of the concerns raised was that the financial benefits in the NVC were inferior to those provided under the Pension Act, when comparing the NVC Disability Award amounts with estimates of what could have been received through a monthly disability pension under the Pension Act.

The OVO recognized that an anecdotal comparison of the Disability Award versus the Disability Pension, did not fully consider the complete suite of benefits and programs contained in the NVC. As a result, in 2013 an evidence-based framework was developed, and to further the discussion, a four-part series about the benefits available under the NVC was published.Footnote 5 This evidence-based analysis showed that the financial needs of many Veterans were not being met.

Since the 2013 Veterans Ombudsman Report: Improving the New Veterans Charter: The ReportFootnote 6 and its accompanying Actuarial AnalysisFootnote 7, incremental changes have been made to the NVC.

The purpose of this follow-up report is to evaluate the changes that have been made to the NVC financial benefits since 2013, and to conduct an actuarial analysis of the suite of NVC financial benefits, considering the effects of lifetime compensation for Veterans. To do so, the following documents were reviewed:

- OVO reports and recommendations related to improving NVC financial benefits;

- An independent report (Risk Assessment – Benchmark of Benefits for Disabled Veterans under the New Veterans Charter) prepared by Aon Hewitt for the OVOFootnote 8, which provides an analysis of Veterans benefits in comparison with other long-term disability plans in Canada; and

- The Pension Act and NVC legislation and regulations, and VAC policies pertaining to compensation for both economic and non-economic loss, including changes to the NVC financial benefits since 2013.

Methodology

The OVO 2013 actuarial analysis examined the lifetime compensation provided by VAC financial benefits using five scenarios. This report includes these scenarios and three additional scenarios to illustrate the effects of the current NVC financial benefits, including the changes made since 2013. More specifically, this report:

- updates the 2013 five TPIFootnote 9 scenarios to reflect the changes to the suite of NVC financial benefits;

- includes three new scenarios - two examples of Veterans who are non-TPI and one example of a surviving spouse;

- calculates, for comparison purposes, all benefits based on the date of release;

- considers the effect of taxation;

- provides a lifetime compensation total, including both economic and non-economic financial benefits for each scenario;

- considers both economic and non-economic financial benefits in the modeling of lifetime compensation;Footnote 10 and

- does not include other government programs as Canadian Forces Superannuation, Canada Pension Plan, Old Age Security or Guaranteed Income Supplement.

This analysis does not examine the adequacy of the benefits in meeting the financial needs of Veterans.

Background

In 2013, the OVO produced an evidence based framework and a four-part series about the financial benefits available under the NVC.Footnote 11 The two key reports in this series, Improving the New Veterans Charter: The ReportFootnote 12 and its accompanying Actuarial AnalysisFootnote 13, provided evidence-based analysis to show that the financial needs of many Veterans were not being met. The report made eight recommendations related to financial support for improvement, and the actuarial analysis provided demographic and financial data on the effects of the programs.

In June 2014, the OVO published a report that examined two NVC financial support benefits provided to the most severely impaired Veterans: Supporting Severely Impaired Veterans: A Report on the New Veterans Charter Permanent Impairment Allowance and Permanent Impairment Allowance Supplement.Footnote 14 This report made four recommendations to improve access to PIA and the PIA-S for Veterans who suffer from any service-related permanent and severe impairment that affects their employment and career progression opportunities, and their survivor.

In 2016, the OVO published Fair Compensation to Veterans and their Survivors for Pain and Suffering, which assessed the fairness of compensation provided under the NVCFootnote 15 for non-economic loss. The report provides details on the non-economic benefits provided by VAC to CAF members, Veterans, and their survivors to compensate for the effects of service-related disability and death. Also, it compares these benefits to what other Canadians would receive, either through federal and provincial/territorial programs, such as Worker’s Compensation Boards or through the Canadian courts for personal injury. This report makes three recommendations.

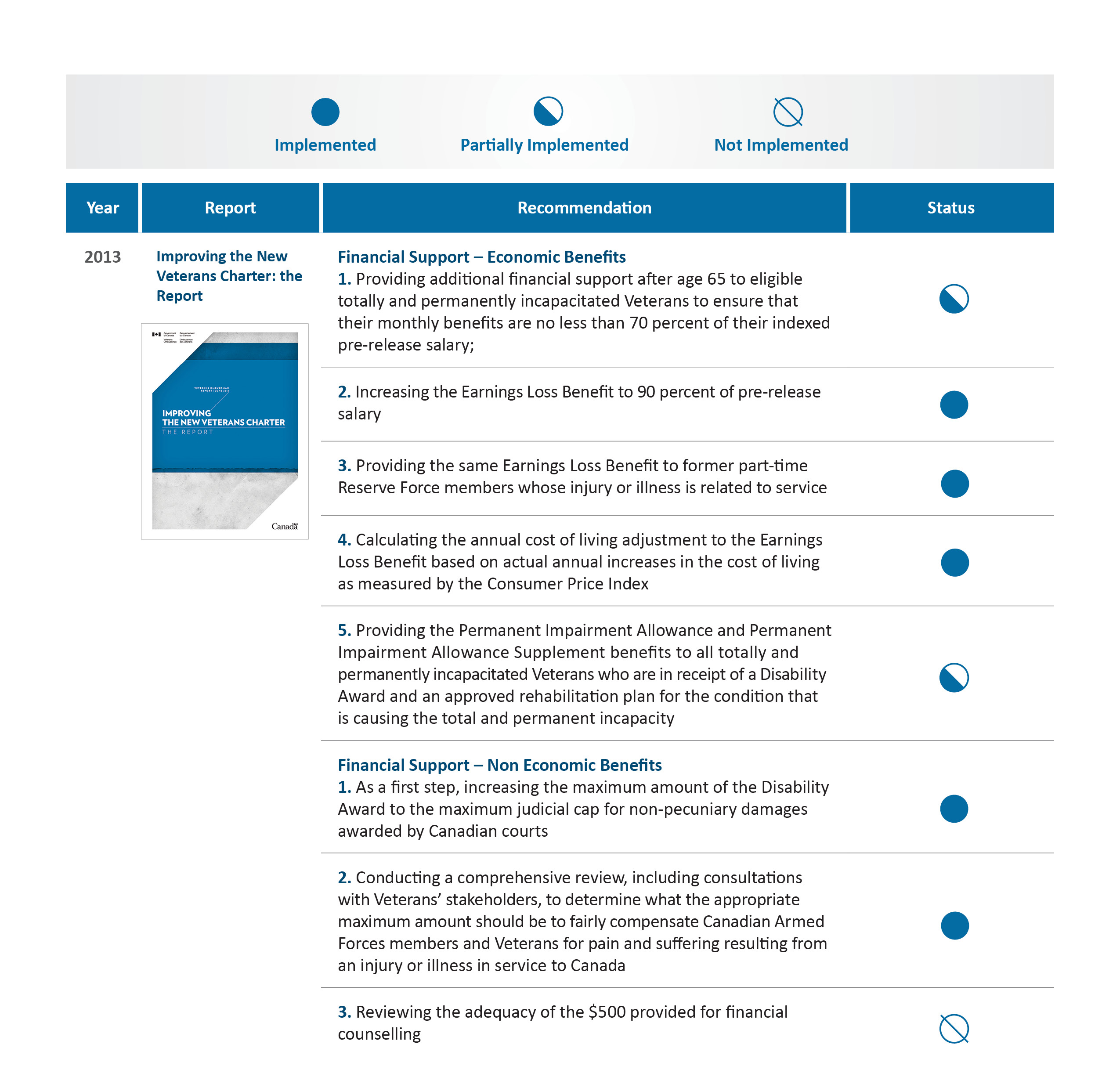

Image 1 outlines the status of the OVO recommendations related to NVC financial benefits.

Image 1 (Part 1) – Implementation Status of OVO Recommendations Related to NVC Financial Benefits - Table

| Year | Report | Recommendation | Status |

| 2013 | Improving the New Veterans Charter: The Report |

Financial Support - Economic Benefits 1. Providing additional financial support after age 65 to eligible totally and permanently incapacitated Veterans to ensure that their monthly benefits are no less than 70 percent of their indexed pre-release salary. |

Partially Implemented |

|

2. Increasing the Earnings Loss Benefit to 90 percent of pre-release salary. |

Implemented | ||

|

3. Providing the same Earnings Loss Benefit to former part-time Reserve Force members whose injury or illness is related to service. |

Implemented | ||

|

4. Calculating the annual cost of living adjustment to the Earnings Loss Benefit based on actual annual increases in the cost of living as measured by the Consumer Price Index. |

Implemented | ||

|

5. Providing the Permanent Impairment Allowance and Permanent Impairment Allowance Supplement benefits to all totally and permanently incapacitated Veterans who are in receipt of a Disability Award and an approved rehabilitation plan for the condition that is causing the total and permanent incapacity. |

Partially Implemented | ||

|

Financial Support – Non Economic Benefits 1. As a first step, increasing the maximum amount of the Disability Award to the maximum judicial cap for non-pecuniary damages awarded by Canadian courts. |

Implemented | ||

|

2. Conducting a comprehensive review, including consultations with Veterans’ stakeholders, to determine what the appropriate maximum amount should be to fairly compensate Canadian Armed Forces members and Veterans for pain and suffering resulting from an injury or illness in service to Canada. |

Implemented | ||

|

3. Reviewing the adequacy of the $500 provided for financial counselling. |

Not Implemented |

Image 1 (Part 2) – Implementation Status of OVO Recommendations Related to NVC Financial Benefits - Table

Evolution of Veterans' Financial Benefits - 2006 to present

In response to recommendations from the Veterans Ombudsman as well as Veterans, Veterans’ organizations and Parliamentarians, the first changes to the NVC took place in 2011 with the implementation of the Enhanced New Veterans Charter Act. In 2015, The Support for Veterans and Their Families Act brought further improvements, and in 2016, An Act to Amend the Canadian Forces Members and Veterans Re-establishment and Compensation Act was implemented which included additional improvements. The VAC websiteFootnote 16 provides additional information on the changes made in each iteration. The following is a summary of these improvements.

Enhanced New Veterans Charter Act (2011)

- improved ELB by establishing a minimum pre-tax income of $40,000 a year for all ill or injured Veterans in the rehabilitation program or, if they are unable to be suitably and gainfully employed again, until age 65;

- improved access to the PIA and the Exceptional Incapacity Allowance (EIA) for seriously injured Veterans;

- introduced a monthly $1,000 supplement to the PIA, payable for life to help the most seriously ill or injured Veterans who are unable to be suitably, gainfully employed; and

- provided flexible payment options for receiving a Disability Award.

Amendments to the Canadian Forces Members and Veterans Re-establishment and Compensation Act (2015)

- introduced the Critical Injury Benefit (CIB)Footnote 17 benefit, a non-taxable lump-sum award of $70,000 (indexed annually - the 2017 rate is $71,831.76), provided to CAF members and Veterans who, after March 31, 2006, sustained a service-related severe and traumatic injury or developed an acute disease caused by a sudden and single incident which resulted in an immediate and severe impairment and interference in quality of life;

- introduced the Retirement Income Security Benefit (RISB),Footnote 18 a monthly taxable benefit that begins at age 65 and tops up an eligible Veteran’s total annual income to at least 70 percent of what they received in financial benefits from VAC before age 65. The RISB is also available to Veterans eligible for SISIP LTD benefits who are totally disabled and are entitled to the Disability Award or Disability Pension. Survivors may also be eligible for RISB in certain cases;

- introduced the Family Caregiver Relief Benefit (FCRB),Footnote 19 an annual tax-free grant of $7,238, to allow an informal caregiver to take time off and recharge, or attend to their own health and well-being, while the Veteran's needs are still being provided for in his or her absence;

- expanded eligibility to the PIA. The definition of severe and permanent impairment was broadened (severe and permanent limitation in mobility or self-care) so that more permanently impaired Veterans can access the PIA; and

- expanded ELB to part-time Reservists to ensure they receive the same minimum income support payment as full-time Regular Force Veterans.

Amendments to the Canadian Forces Members and Veterans Re-establishment and Compensation Act (2016)

- increased the Disability Award and Death Benefit. These benefits will increase to a maximum of $360,000 starting in 2017 and will be indexed in accordance with changes to Consumer Price Index. Based on this increase, Veterans who received a Disability Award between April 1, 2006, and March 31, 2017 will receive an additional payment. This payment represents the total difference between the Disability Award amounts previously paid and what would have been paid if a higher rate had existed between April 1, 2006 and March 31, 2017;

- increased ELB from 75 to 90 percent of gross pre-release military salary for ill or injured Veterans, participating in VAC’s rehabilitation or vocational assistance program, or who cannot engage in suitable and gainful employment. Veterans covered under the Service Income Security Insurance Plan Long Term Disability (SISIP LTD) program may have their income replacement topped up provided that they apply and are determined eligible for VAC's Rehabilitation Services and Vocational Assistance Program and the ELB. The indexation of ELB is no longer capped at 2 percent and will keep pace with inflation. The calculation of the minimum benefit is now based on a senior Private’s salary instead of a basic Corporal’s salary; and

- expanded access to the three grade levels of PIA by introducing an individual assessment which will measure the impact a service-related impairment has on a Veteran’s career advancement opportunities, and will consider years of service. The benefit will be renamed to the Career Impact Allowance (CIA) to better reflect the intent of the program.

Image 2 shows the evolution of Veterans financial benefits.

Image 2 - Evolution of Veterans Financial BenefitsFootnote 20

| Pre-NVC | NVC 2006 | NVC 2011 | NVC 2015 | NVC 2016 | Number of RecipientsFootnote 21 |

|---|---|---|---|---|---|

| SISIP LTD - 75% of gross pre-release salary (2% cap per year) | This is a CAF benefit and is still available post NVC | Information not available on number of recipients | |||

| Disability Pension | 69,739 | ||||

| Exceptional Incapacity Allowance | 1,491 | ||||

| Attendance Allowance | 7,096 | ||||

| War Veterans Allowance | 404 | ||||

| ELB - 75% of gross pre-release salary with min. salary provision of senior private (2% cap per year) | ELB - 75% of gross pre-release salary with min. salary provision increased to basic corporal (2% cap per year) | ELB - All Reserve Force Veterans who are eligible for ELB receive a min. salary provision of basic corporal. The same min. amount a Regular Force Veteran would receive | ELB - 90% of gross pre-release salary with min. salary provision of senior private and 2% cap removed | 5,746 | |

| Disability Award / Death Benefit -$250,000 max indexed to inflation | Disability Award - provided choice of lump sum or annual payments or combination | Disability Award / Death Benefit -increased to max $360,000 | Disability Award 55,698 Death Benefit 431 |

||

| PIA | PIA - provided access to certain Veterans in receipt of a Disability Pension | PIA - increased access by broadening the definition of severe and permanent impairment | PIA renamed to CIA | 3,743 | |

| PIA-S introduced | 2,482 | ||||

| CIB introduced | 117 (cumulative) | ||||

| FCRB introduced | 178 | ||||

| Supplementary Retirement Benefit | 82 (cumulative) | ||||

| Canadian Forces Income Support | 55 | ||||

| RISB introduced | 43Footnote 22 |

Actuarial Analysis

The 2013 report, Improving the New Veterans Charter: The Report, was accompanied by Improving the New Veterans Charter: The Actuarial Analysis, in which the OVO examined how the NVC financial benefits impacted the most seriously ill and injured Veterans and their families. This group of Veterans was deemed to be most at financial risk.Footnote 23

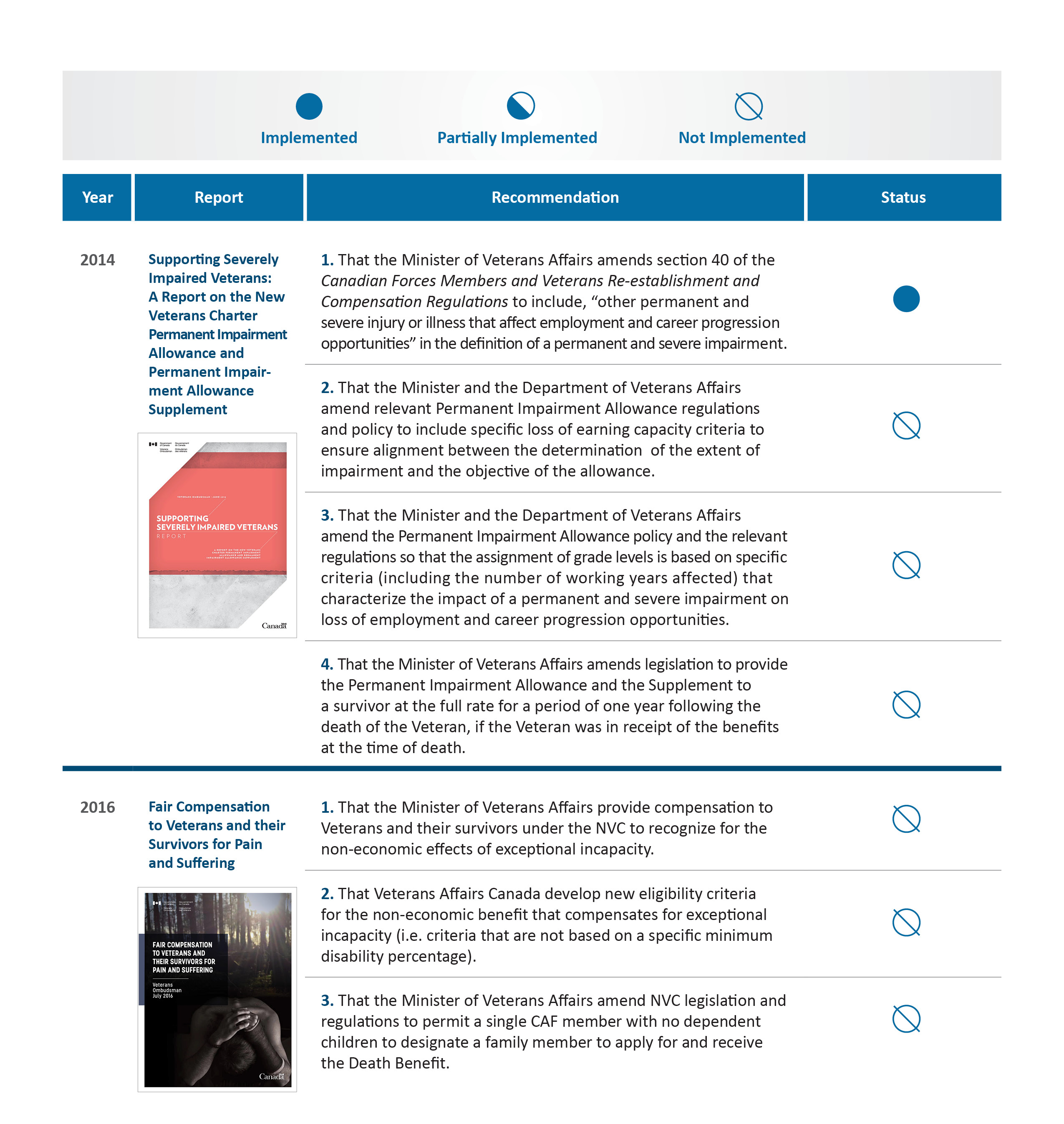

Veterans Affairs Canada Clients

Image 3 provides a summary of the number and percentage of CAF Veterans receiving VAC financial benefits and their level of disability. The majority of CAF Veterans are not receiving benefits from VAC, and VAC clients represent only 14 percent of the total Veteran population. VAC CAF clients that have a disability assessment of less than 33 percent represents approximately 72 percent of VAC’s client population. Image 3 also highlights that those Veterans deemed TPI represents four percent of VAC clients. The 2013 actuarial analysis did not include Veterans who were not TPI - the largest VAC client group. This analysis includes two scenarios of Veterans who are not TPI, as well as a survivor scenario to better understand the impact of NVC financial benefits on a broader representation of VAC clients.

Image 3 - VAC CAF Clients – March 2016 - Table

| CAF Veteran Population | VAC CAF Clients with a DP &/or DA | VAC CAF Clients with < 33% Disability | VAC CAF Clients with > 33% Disability | VAC CAF TPI Clients | VAC CAF TPI Clients with PIA or EIA |

| 600,400 | 86,148 | 62,189 | 23,959 | 3,596 | 2,704 (2,537 PIA +167 EIA) |

Scenario Descriptions

The eight scenarios considered in this analysis represent a variety of ranks, years of service, levels of disability and resulting financial benefit eligibility; however, they do not cover every circumstance. Image 4 provides a brief description of each scenario.

Image 4 - Scenario Descriptions

| Scenario | Description | Years of Service |

|---|---|---|

| TPI Veterans | ||

| 1 | 24-year old Corporal with 80 percent disability | 4 |

| 2 | 47-year old Major with 100 percent disability | 29 |

| 3 | 30-year old Captain with 40 percent disability | 10 |

| 4 | 35-year old Sergeant with 95 percent disability | 15 |

| 5 | 40-year old Corporal with 50 percent disability | 5 |

| Non-TPI Veterans | ||

| 6 | 44-year old Sergeant with 50 percent disability | 24 |

| 7 | 45-year old Captain with 25 percent disability | 25 |

| Survivor | ||

| 8 | 41-year old survivor of CAF member | 21 |

Overview of Scenario Analysis – Totally and Permanently Incapacitated

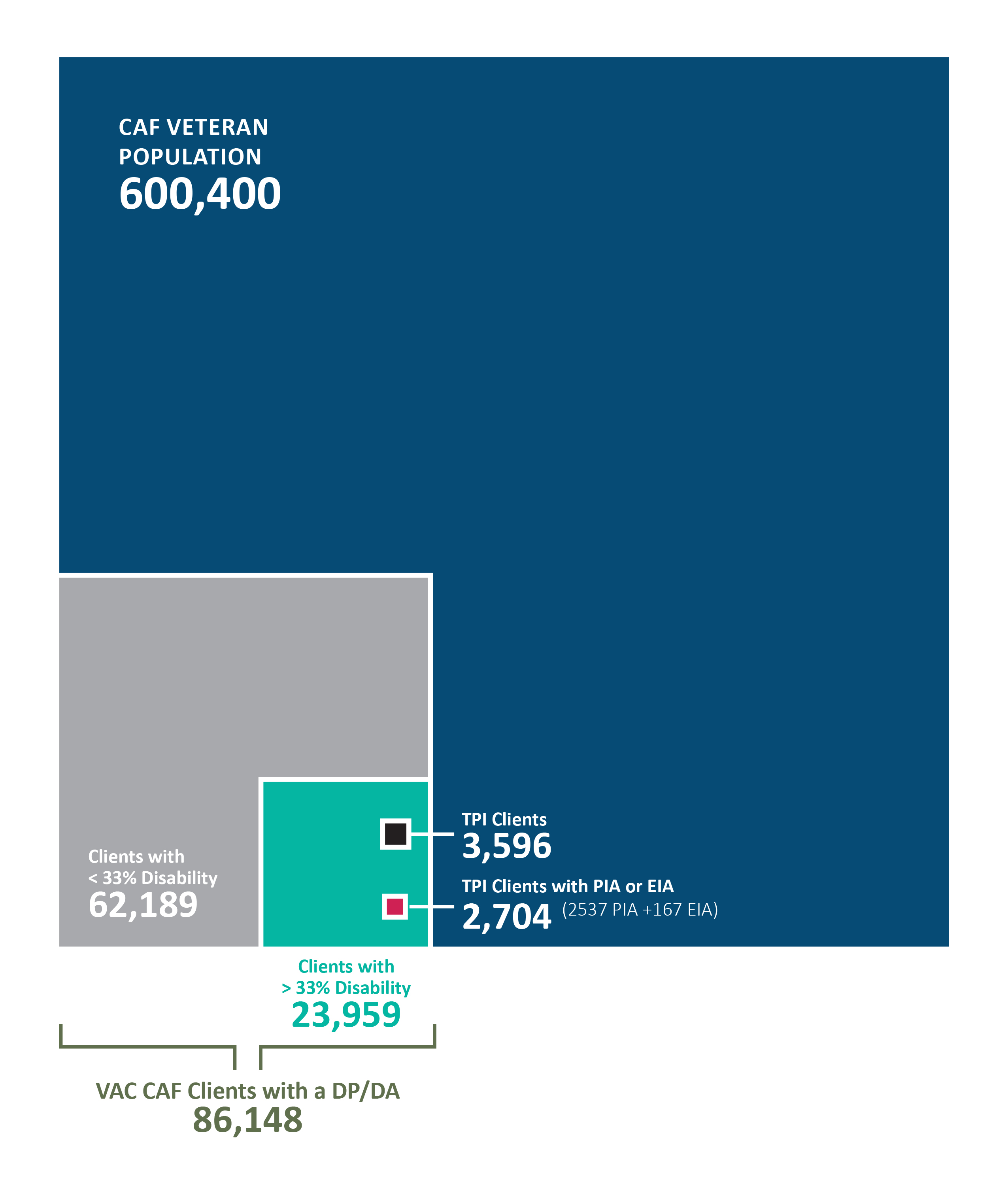

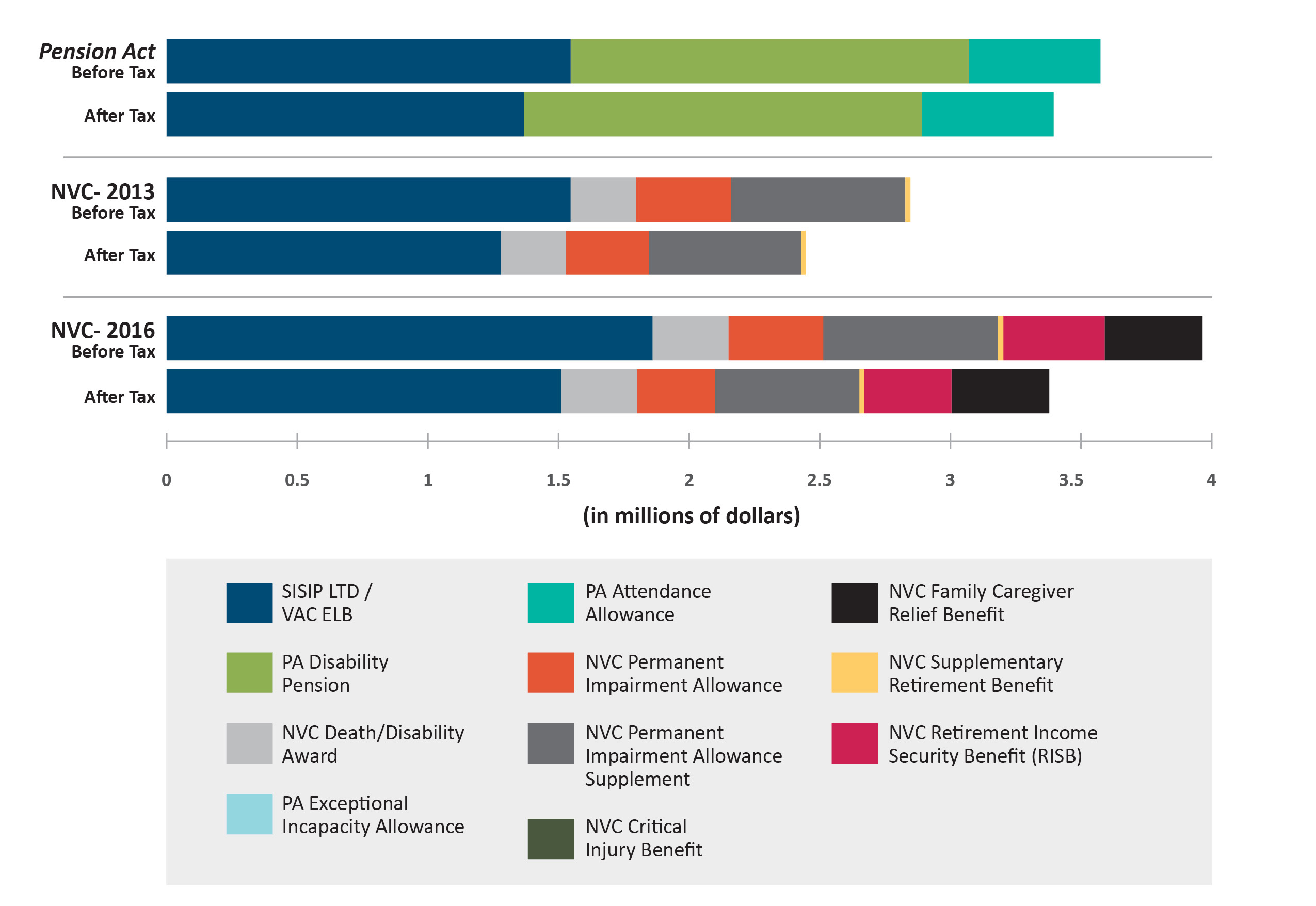

As an update to the 2013 analysis, image 5 provides a comparison of the lifetime compensation received under the NVC in 2013 to the NVC in 2016, as well as to the Pension Act for each of the five TPI scenarios.

Image 5 – Summary Comparison of 2013 to 2016 five TPI Scenarios after tax, 2016 dollars - Table

| Pension Act | NVC 2013 | NVC 2016 | |

| Caporal, Male, Single, 4 years of service | $3,366,579 | $2,423,171 | $3,310,239 |

| Major, Female, Married, 29 years of service | $3,523,052 | $1,692,124 | $2,292,551 |

| Captain, Male, Married, 10 years of service | $2,732,643 | $2,193,854 | $3,222,261 |

| Sergeant, Male, Married, 15 years of service | $3,299,424 | $1,816,033 | $2,592,688 |

| Corporal, Female, Married, 5 years of service | $1,908,271 | $1,045,654 | $1,736,619 |

Since 2013, the improvements to the NVC have had the following overall effects for Veterans:

- The amount of lifetime compensation some Veterans who are TPI receive has increased since 2013. Increasing ELB to 90 percent has had the greatest impact on lifetime compensation by affecting the largest number of Veterans; however, in only one scenario does the NVC financial benefits provide more lifetime compensation than what was achieved under the Pension Act.

- Multiple benefits create complexity. To achieve the increase in lifetime compensation under the 2016 NVC, four new benefits and eight enhancements were implemented. Each new benefit has different eligibility criteria, a separate application process, a different dollar value and different appeal rights. As a result, communicating and administering the intricacies and interrelationships of these benefits to Veterans and their families is challenging.

- It is not clear whether the NVC financial benefit programs are meeting Veteran’s needs. Many of the financial benefit programs do not have an easily understood and veteran-centric policy rationale and measurable benchmark. How does PIA Grade 3, the lowest level, at $599.96 per month, compensate for career progression and lost job opportunity for a Corporal earning $50,000 per year, with four years of service and who is no longer able to work? No assessment has been undertaken to determine if PIA is meeting Veteran’s needs.

Scenario Analysis – Veterans Who Are Totally and Permanently Incapacitated

The following images illustrate the results of the actuarial analysis of the NVC improvements for each of the scenarios included in the 2013 report.

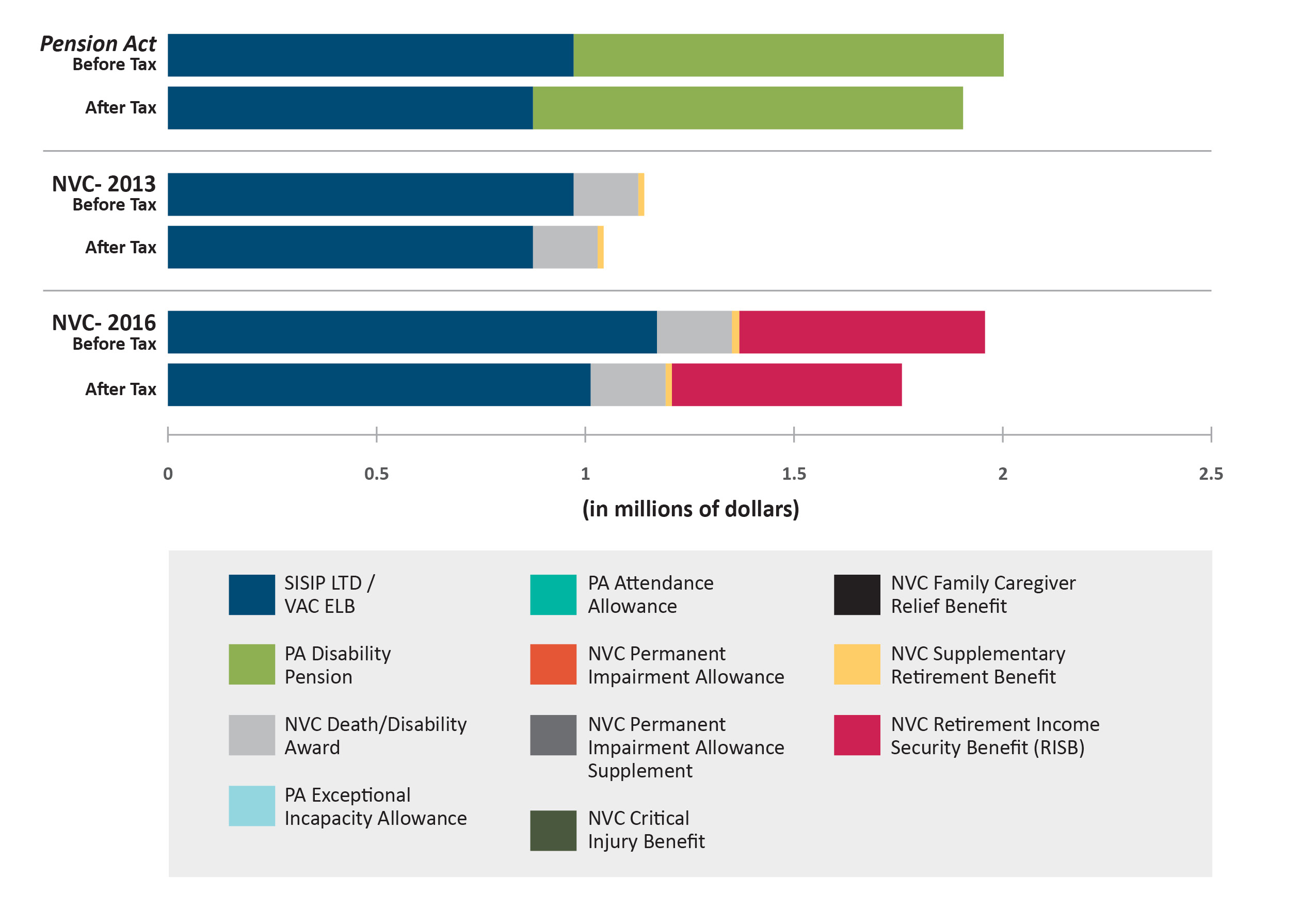

Scenario 1: Corporal, Age 24, with 80 Percent Disability and 4 Years of Service

This scenario represents a single, 24-year-old, male Veteran who is TPI, with an assessed disability level of 80 percent, and who was medically released at the rank of Corporal (salary of $55,464), with four years of service. He has access to Grade 3 PIA and PIA-S. As he only has four years of service, he would not receive an immediate CAF Annuity.

Image 6 – Scenario 1 - Table

| Pension Act | NVC 2013 | NVC 2016 | ||||

| Benefit Name | Before Tax | After Tax | Before Tax | After Tax | Before Tax | After Tax |

| SISIP LTD / VAC ELB | 1,533,033 | 1,355,527 | 1,533,033 | 1,267,118 | 1,843,782 | 1,496,669 |

| PA Disability Pension | 1,511,059 | 1,511,059 | 0 | 0 | 0 | 0 |

| PA Exceptional Incapacity Allowance | 0 | 0 | 0 | 0 | 0 | 0 |

| PA Attendance Allowance | 499,993 | 499,993 | 0 | 0 | 0 | 0 |

| NVC Death/Disability Award | 0 | 0 | 248,303 | 248,303 | 248,303 | 248,303 |

| NVC Critical Injury Benefit | 0 | 0 | 0 | 0 | 0 | 0 |

| NVC Permanent Impairment Allowance | 0 | 0 | 360,038 | 314,243 | 360,038 | 297,427 |

| NVC Permanent Impairment Allowance Supplement | 0 | 0 | 661,948 | 577,752 | 661,948 | 546,835 |

| NVC Supplementary Retirement Benefit | 0 | 0 | 17,911 | 15,755 | 21,542 | 17,288 |

| NVC Retirement Income Security Benefit (RISB) | 0 | 0 | 0 | 0 | 384,779 | 332,284 |

| NVC Family Caregiver Relief Benefit | 0 | 0 | 0 | 0 | 371,433 | 371,433 |

| Total | $3,544,084 | $3,366,579 | $2,821,233 | $2,423,171 | $3,891,826 | $3,310,239 |

Findings:

The new benefits and improvements since 2013 have had a major impact on increasing lifetime compensation (37 percent after tax increase over 2013). This is due to the introduction of the FCRB, the RISB, and the ELB increase to 90 percent. The impact, however, of SRB and CIB is minimal on lifetime compensation (when combined they make up less than three percent of lifetime compensation).

Despite these improvements to the NVC, the Pension Act provides slightly more lifetime compensation (2 percent greater after tax than NVC). In this scenario the impact of the PIA and the PIA-S is significant, as these benefits provide 26 percent of the lifetime 2016 NVC totals.

Scenario 2: Major, Age 47, with 100 Percent Disability and 29 Years of Service

This scenario represents a 47-year-old, female Veteran, who is TPI, with an assessed disability level of 100 percent, married with one dependent child, who was medically released at the rank of Major (salary of $110,640), with 29 years of service. This is a seriously disabled Veteran with access to Grade 1 PIA, the PIA-S, and an immediate, unreduced CAF Annuity.

Image 7 – Scenario 2 - Table

| Pension Act | NVC 2013 | NVC 2016 | ||||

| Benefit Name | Before Tax | After Tax | Before Tax | After Tax | Before Tax | After Tax |

| SISIP LTD / VAC ELB | 304,454 | 303,753 | 304,454 | 276,181 | 589,880 | 484,125 |

| PA Disability Pension | 1,690,208 | 1,690,208 | 0 | 0 | 0 | 0 |

| PA Exceptional Incapacity Allowance | 679,608 | 679,608 | 0 | 0 | 0 | 0 |

| PA Attendance Allowance | 849,483 | 849,483 | 0 | 0 | 0 | 0 |

| NVC Death/Disability Award | 0 | 0 | 310,379 | 310,379 | 360,000 | 360,000 |

| NVC Critical Injury Benefit | 0 | 0 | 0 | 0 | 70,840 | 70,840 |

| NVC Permanent Impairment Allowance | 0 | 0 | 765,950 | 682,709 | 765,950 | 668,935 |

| NVC Permanent Impairment Allowance Supplement | 0 | 0 | 469,414 | 418,400 | 469,414 | 409,958 |

| NVC Supplementary Retirement Benefit | 0 | 0 | 4,931 | 4,455 | 9,554 | 8,478 |

| NVC Retirement Income Security Benefit (RISB) | 0 | 0 | 0 | 0 | 27,414 | 26,817 |

| NVC Family Caregiver Relief Benefit | 0 | 0 | 0 | 0 | 263,398 | 263,398 |

| Total | $3,523,753 | $3,523,052 | $1,855,128 | $1,692,124 | $2,556,450 | $2,292,551 |

Findings:

In this scenario, the new benefits and improvements since 2013 have had a major impact on increasing lifetime compensation (35 percent after tax increase over 2013). This is due to the introduction of the FCRB, the CIB and the ELB increase to 90 percent. Because of the offset of the CAF Annuity, there is only a small effect of RISB on the total lifetime compensation. Even though the CAF Annuity amount has not been quantified and included in this analysis, it makes a significant contribution to the financial status of the Veteran post release.

Using the 2016 NVC benefits, the PIA and the PIA-S comprise 47 percent of lifetime compensation. Despite these improvements to the NVC, the Pension Act provides significantly more lifetime compensation (54 percent more after tax than NVC) due to receiving the EIA and the Attendance Allowance at the highest rates. Note that this scenario represents the maximum a Veteran could receive.

Scenario 3: Captain, Age 30, with 40 Percent Disability and 10 Years of Service

This scenario represents a married 30-year-old male Veteran, who is TPI, with an assessed disability level of 40 percent, with one dependent child, who was medically released at the rank of Captain (salary of $81,276), with 10 years of service. He receives Grade 3 PIA, the PIA-S, and a small but immediate, unreduced CAF Annuity.

Image 8 – Scenario 3 - Table

| Pension Act | NVC 2013 | NVC 2016 | ||||

| Benefit Name | Before Tax | After Tax | Before Tax | After Tax | Before Tax | After Tax |

| SISIP LTD / VAC ELB | 1,499,314 | 1,319,413 | 1,499,314 | 1,235,456 | 1,893,871 | 1,521,304 |

| PA Disability Pension | 964,357 | 964,357 | 0 | 0 | 0 | 0 |

| PA Exceptional Incapacity Allowance | 0 | 0 | 0 | 0 | 0 | 0 |

| PA Attendance Allowance | 448,873 | 448,873 | 0 | 0 | 0 | 0 |

| NVC Death/Disability Award | 0 | 0 | 124,151 | 124,151 | 124,151 | 124,151 |

| NVC Critical Injury Benefit | 0 | 0 | 0 | 0 | 0 | 0 |

| NVC Permanent Impairment Allowance | 0 | 0 | 327,580 | 287,585 | 327,580 | 270,414 |

| NVC Permanent Impairment Allowance Supplement | 0 | 0 | 602,271 | 528,739 | 602,271 | 497,169 |

| NVC Supplementary Retirement Benefit | 0 | 0 | 20,090 | 17,923 | 25,377 | 20,553 |

| NVC Retirement Income Security Benefit (RISB) | 0 | 0 | 0 | 0 | 505,602 | 450,723 |

| NVC Family Caregiver Relief Benefit | 0 | 0 | 0 | 0 | 337,947 | 337,947 |

| Total | $2,912,544 | $2,732,643 | $2,573,407 | $2,193,854 | $3,816,800 | $3,222,261 |

Findings:

Similar to the previous scenarios, the new benefits and improvements since 2013 have had a major impact on increasing lifetime compensation (47 percent after tax increase over 2013). This is due to the introduction of the FCRB, the RISB, and the ELB increase to 90 percent.

The PIA and the PIA-S account for 25 percent of lifetime compensation. Overall, with all the NVC improvements, the NVC provides more lifetime compensation (18 percent more after tax than the Pension Act), for this scenario.

Scenario 4: Sergeant with 95 Percent Disability and 15 Years of Service

This scenario represents a married 35-year-old male Veteran, who is TPI, with an assessed disability level of 95 percent, with one dependent child, who was medically released from the CAF at the rank of Sergeant (salary of $63,720), with 15 years of service. This Veteran has access to Grade 3 PIA, the PIA-S and a modest, but immediate, unreduced CAF Annuity.

Image 9 – Scenario 4 - Table

| Pension Act | NVC 2013 | NVC 2016 | ||||

| Benefit Name | Before Tax | After Tax | Before Tax | After Tax | Before Tax | After Tax |

| SISIP LTD / VAC ELB | 855,487 | 807,820 | 855,487 | 736,903 | 1,128,515 | 943,433 |

| PA Disability Pension | 2,085,809 | 2,085,809 | 0 | 0 | 0 | 0 |

| PA Exceptional Incapacity Allowance | 0 | 0 | 0 | 0 | 0 | 0 |

| PA Attendance Allowance | 405,795 | 405,795 | 0 | 0 | 0 | 0 |

| NVC Death/Disability Award | 0 | 0 | 294,860 | 294,860 | 294,860 | 294,860 |

| NVC Critical Injury Benefit | 0 | 0 | 0 | 0 | 70,840 | 70,840 |

| NVC Permanent Impairment Allowance | 0 | 0 | 299,483 | 272,336 | 299,483 | 260,291 |

| NVC Permanent Impairment Allowance Supplement | 0 | 0 | 550,615 | 500,702 | 550,615 | 478,558 |

| NVC Supplementary Retirement Benefit | 0 | 0 | 12,106 | 11,232 | 15,970 | 13,839 |

| NVC Retirement Income Security Benefit (RISB) | 0 | 0 | 0 | 0 | 235,043 | 221,905 |

| NVC Family Caregiver Relief Benefit | 0 | 0 | 0 | 0 | 308,962 | 308,962 |

| Total | $3,347,092 | $3,299,424 | $2,012,551 | $1,816,033 | $2,904,287 | $2,592,688 |

Findings:

Similar to scenarios 1 and 3, the new benefits and improvements since 2013 have had a major impact on increasing lifetime compensation (43 percent after tax increase over 2013). This is due to the introduction of the FCRB, the RISB, the CIB and the ELB increase to 90 percent; however, the impact of the SRB (1 percent) and the CIB (2 percent) is minimal on lifetime compensation.

The PIA and the PIA-S make up 28 percent of lifetime compensation. Despite the improvements to the NVC, the Pension Act provides more lifetime compensation (21 percent more after tax than NVC).

Scenario 5: Corporal, Age 40, with 50 Percent Disability and 5 Years of Service

This scenario represents a married 40-year-old female Veteran, who is TPI, with an assessed disability level of 50 percent, with one dependent child, who was medically released at the rank of Corporal (salary of $56,286), with five years of service. Although this Veteran is TPI, she is not eligible for the PIA or PIA-S as she does meet the VAC definition of severely disabled. Also, with only five years of service, she would not receive an immediate CAF Annuity.

Image 10 – Scenario 5 - Table

| Pension Act | NVC 2013 | NVC 2016 | ||||

| Benefit Name | Before Tax | After Tax | Before Tax | After Tax | Before Tax | After Tax |

| SISIP LTD / VAC ELB | 973,363 | 875,923 | 973,363 | 875,923 | 1,173,369 | 1,014,222 |

| PA Disability Pension | 1,032,348 | 1,032,348 | 0 | 0 | 0 | 0 |

| PA Exceptional Incapacity Allowance | 0 | 0 | 0 | 0 | 0 | 0 |

| PA Attendance Allowance | 0 | 0 | 0 | 0 | 0 | 0 |

| NVC Death/Disability Award | 0 | 0 | 155,189 | 155,189 | 155,189 | 155,189 |

| NVC Critical Injury Benefit | 0 | 0 | 0 | 0 | 0 | 0 |

| NVC Permanent Impairment Allowance | 0 | 0 | 0 | 0 | 0 | 0 |

| NVC Permanent Impairment Allowance Supplement | 0 | 0 | 0 | 0 | 0 | 0 |

| NVC Supplementary Retirement Benefit | 0 | 0 | 14,584 | 14,542 | 17,580 | 15,193 |

| NVC Retirement Income Security Benefit (RISB) | 0 | 0 | 0 | 0 | 589,822 | 552,015 |

| NVC Family Caregiver Relief Benefit | 0 | 0 | 0 | 0 | 0 | 0 |

| Total | $2,005,711 | $1,908,271 | $1,143,136 | $1,045,654 | $1,935,961 | $1,736,619 |

Findings:

In this scenario, the new benefits and improvements since 2013 have had a major impact on increasing lifetime compensation (66 percent after tax increase over 2013). The introduction of the RISB has had a major impact and represents 32 percent of the 2016 NVC lifetime total compensation.

Despite the improvements to the NVC, the Pension Act provides slightly more lifetime compensation (9 percent more after tax than NVC).

Summary of the Effect of the Improvements to the NVC Veterans Who Are Totally and Permanently Incapacitated

From 2013 to 2016, the improvements to the NVC have been focused and incremental. Their overall effect has been to increase the lifetime compensation for Veterans who are TPI and in receipt of NVC benefits:

- For all Veterans in the rehabilitation program and survivors, the ELB increase to 90 percent of pre-release salary has universal application. The increase in compensation as a result of the higher ELB rate impacts 5,746Footnote 25 Veterans and survivors;

- For those who are TPI and seriously disabled Veterans, the FCRB increases lifetime compensation. However, this impacts only 178Footnote 26 Veterans;

- The RISB has had a significant impact for those Veterans who are TPI and have either a small number of pensionable years of service or no CAF Annuity. The number of RISB recipients in 2016 was 43Footnote 27, representing a small number of the total 3,596Footnote 28 Veterans who are TPI;

- The CIB has had a limited effect in increasing the overall lifetime compensation, as it provides a one-time payment and only 117Footnote 29 Veterans received this benefit. Only twoFootnote 30 CAF members per year are forecasted to receive the CIB; and

- For the most part, the Pension Act continues to provide greater lifetime compensation in the scenarios which the Veteran has a higher disability assessment.

Scenario Analysis – Veterans Who Are Not Totally and Permanently Incapacitated

In this report, two new scenarios were added to show the effects of the recent changes to the NVC on Veterans who are not TPI. This is the largest group of VAC CAF clients (96 percent) as shown in Image 3.

The following images illustrate the results of the actuarial analysis of the NVC improvements since 2013 for these two scenarios.

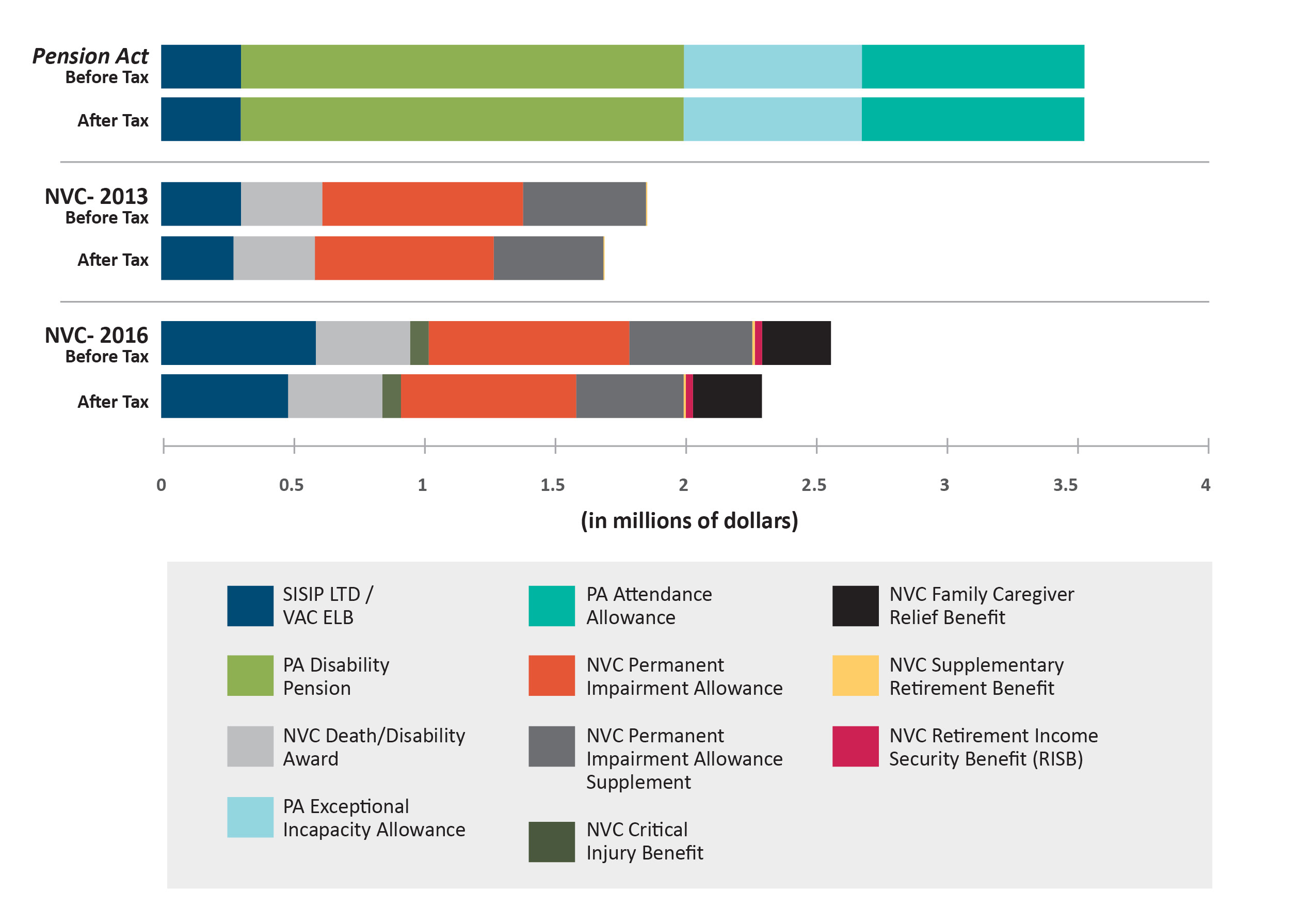

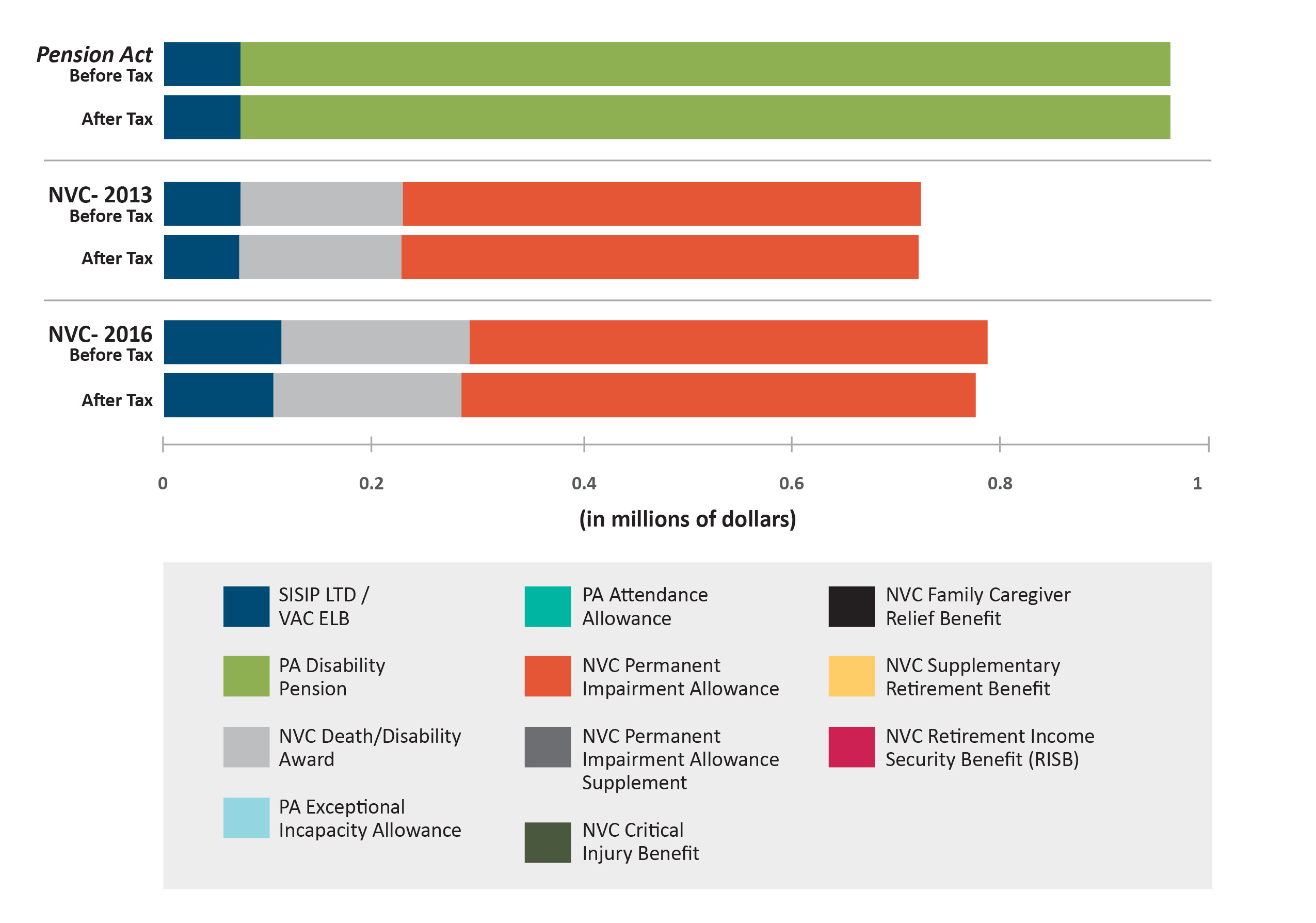

Scenario 6: Sergeant, Age 44, with 50 Percent Disability and 24 Years of Service

This scenario represents a 44-year old, male Veteran, with an assessed disability of 50 percent, who was medically released at the rank of Sergeant (salary of $63,720), with 24 years of service. This Veteran would still be able to work. The VAC benefits provided include temporary ELB during the rehabilitation process and PIA at the lowest grade level, for lost job opportunities as a result of a severe impairment. He is also is in receipt of an immediate, unreduced CAF Annuity.

Image 11 – Scenario 6 - Table

| Pension Act | NVC 2013 | NVC 2016 | ||||

| Benefit Name | Before Tax | After Tax | Before Tax | After Tax | Before Tax | After Tax |

| SISIP LTD / VAC ELB | 72,951 | 72,951 | 72,951 | 71,696 | 112,033 | 104,414 |

| PA Disability Pension | 889,721 | 889,721 | 0 | 0 | 0 | 0 |

| PA Exceptional Incapacity Allowance | 0 | 0 | 0 | 0 | 0 | 0 |

| PA Attendance Allowance | 0 | 0 | 0 | 0 | 0 | 0 |

| NVC Death/Disability Award | 0 | 0 | 155,189 | 155,189 | 180,000 | 180,000 |

| NVC Critical Injury Benefit | 0 | 0 | 0 | 0 | 0 | 0 |

| NVC Permanent Impairment Allowance | 0 | 0 | 495,726 | 494,765 | 495,726 | 491,934 |

| NVC Permanent Impairment Allowance Supplement | 0 | 0 | 0 | 0 | 0 | 0 |

| NVC Supplementary Retirement Benefit | 0 | 0 | 0 | 0 | 0 | 0 |

| NVC Retirement Income Security Benefit (RISB) | 0 | 0 | 0 | 0 | 0 | 0 |

| NVC Family Caregiver Relief Benefit | 0 | 0 | 0 | 0 | 255,706 | 255,706 |

| Total | $962,672 | $962,672 | $723,867 | $721,650 | $787,759 | $776,348 |

Findings:

In this scenario, the only improvement since 2013 that is applicable is the ELB increase to 90 percent while participating in the vocational rehabilitation program. As a result, the impact on the overall lifetime compensation is minimal. However, PIA provides a significant contribution to the lifetime compensation, making up 65 percent of lifetime compensation.

Despite the improvements to the NVC, the Pension Act provides slightly more lifetime compensation (4 percent more after tax than NVC).

Not shown on the image is that the Veteran is in receipt of the CAF Annuity and is able to earn at least 66 2/3 percent of his pre-release salary. Also, even though the CAF Annuity amount has not been quantified and included in this analysis, it makes a significant contribution to the financial status of the Veteran post release.

Some Veterans have an impairment that affects their earning capacity but they do not have a severe impairment that would entitle them to PIA. In this case, there is no lifetime compensation (PIA) provided for loss of job opportunities and career progression. Removing PIA from the above image reduces the lifetime compensation provided under the NVC significantly when compared to the Pension Act. In both cases, they have a diminished earning capacity, have been medically released and no longer have a military career.

Should a Veteran with a moderate impairment, impacting his ability to earn, receive some level of compensation to recognize this impact? For example, if this Veteran was earning $75,000 on release and now can only work at a job that pays $50,000, is there an obligation to top up the salary? If the Veteran finds a job that pays $100,000, should the government continue to compensate for lost job opportunities and career progression? These questions suggest that the needs of Veterans who are not TPI are complex and the support provided to them should be clearly defined.

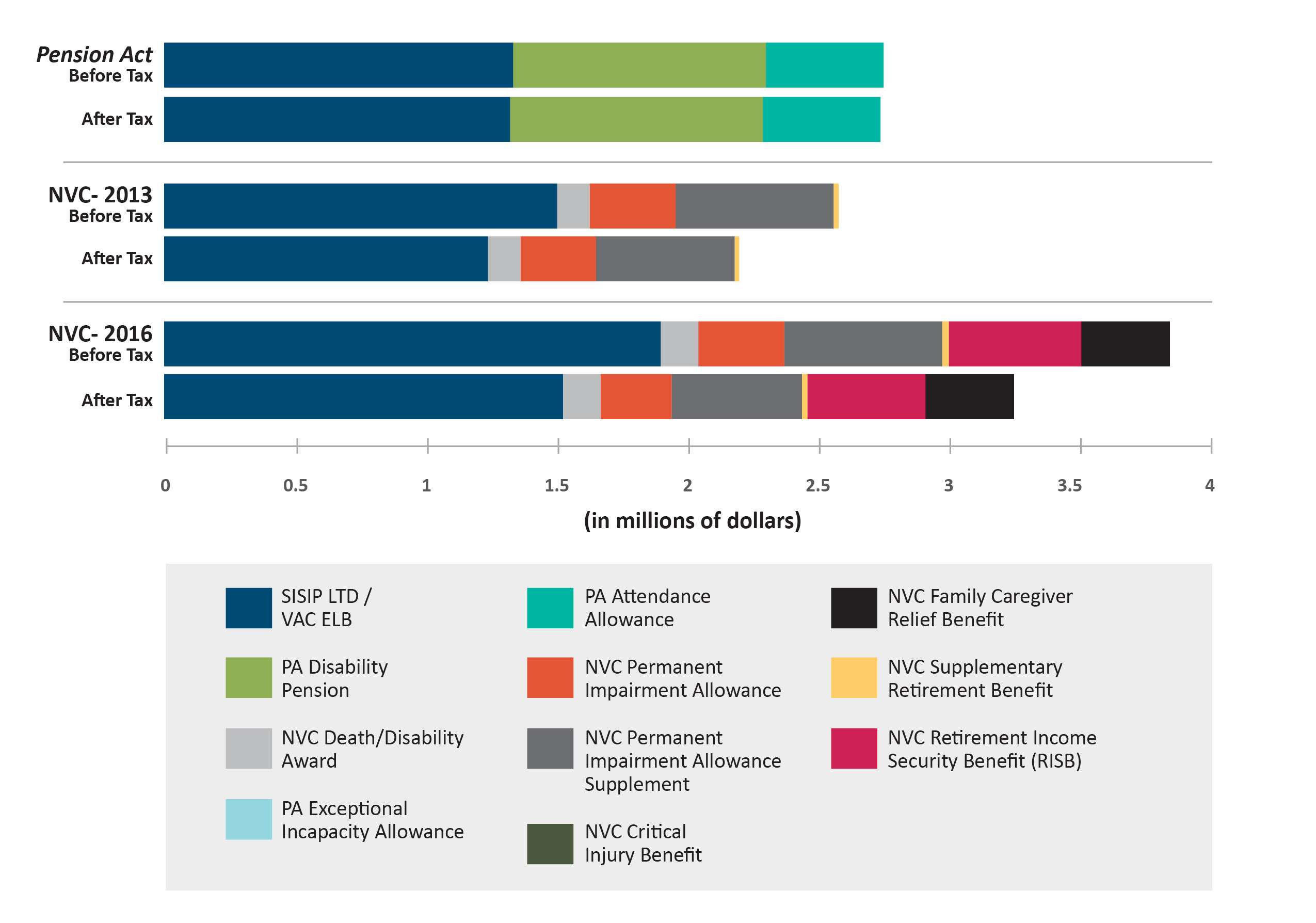

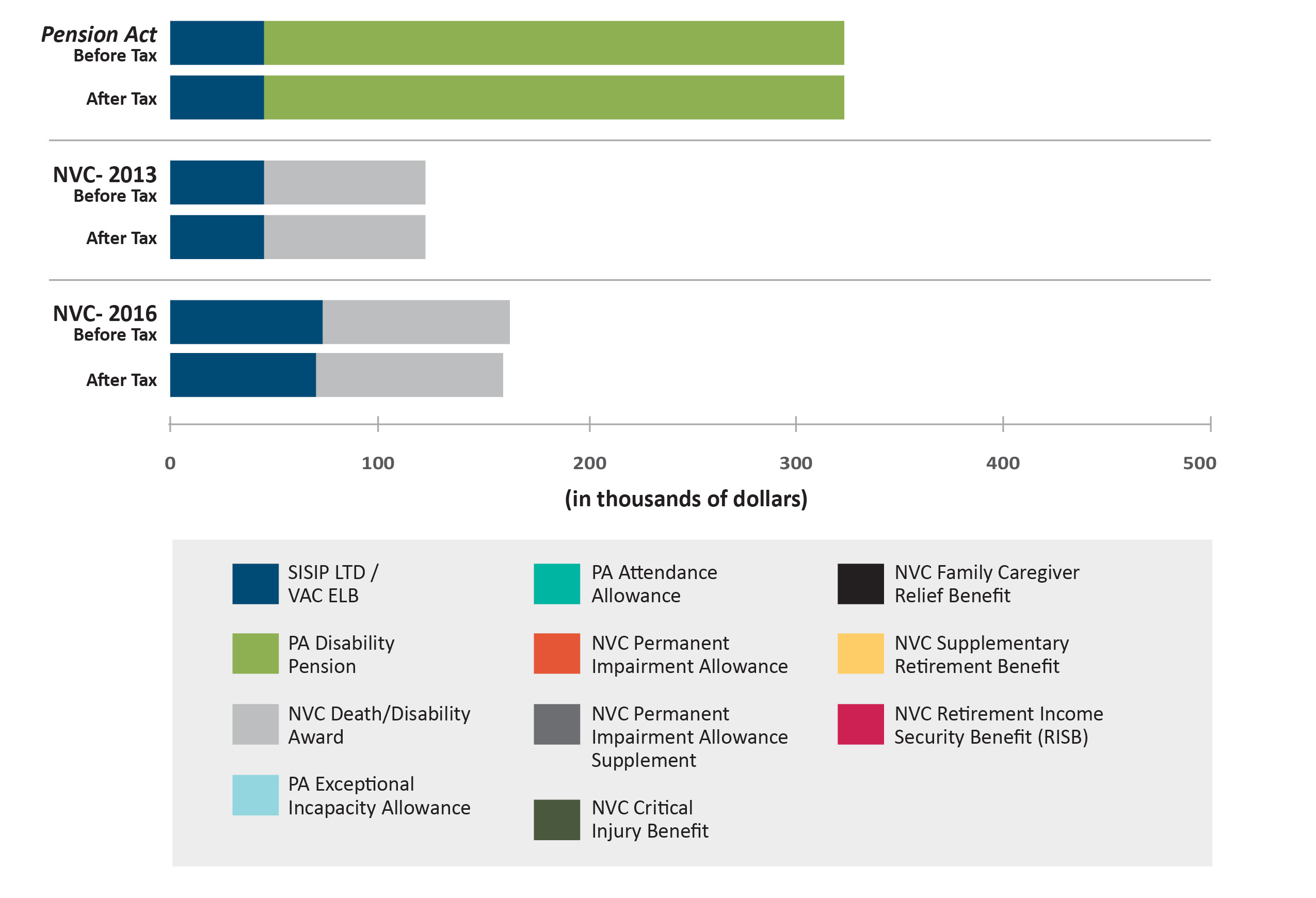

Scenario 7: Captain, Age 45, with 25 Percent Disability and 25 Years of Service

This scenario represents a 45-year old, male Veteran, with an assessed disability of 25 percent, who was medically released at the rank of Captain (salary of $81,276), with 25 years of service and is still able to work. Like the preceding scenario, the Veteran received retraining with income replacement (ELB) for the duration of the rehabilitation process. He is also in receipt of an immediate, unreduced CAF Annuity.

Image 12 – Scenario 7 - Table

| Pension Act | NVC 2013 | NVC 2016 | ||||

| Benefit Name | Before Tax | After Tax | Before Tax | After Tax | Before Tax | After Tax |

| SISIP LTD / VAC ELB | 45,103 | 45,103 | 45,103 | 45,103 | 73,293 | 70,088 |

| PA Disability Pension | 279,040 | 279,040 | 0 | 0 | 0 | 0 |

| PA Exceptional Incapacity Allowance | 0 | 0 | 0 | 0 | 0 | 0 |

| PA Attendance Allowance | 0 | 0 | 0 | 0 | 0 | 0 |

| NVC Death/Disability Award | 0 | 0 | 77,844 | 77,844 | 90,000 | 90,000 |

| NVC Critical Injury Benefit | 0 | 0 | 0 | 0 | 0 | 0 |

| NVC Permanent Impairment Allowance | 0 | 0 | 0 | 0 | 0 | 0 |

| NVC Permanent Impairment Allowance Supplement | 0 | 0 | 0 | 0 | 0 | 0 |

| NVC Supplementary Retirement Benefit | 0 | 0 | 0 | 0 | 0 | 0 |

| NVC Retirement Income Security Benefit (RISB) | 0 | 0 | 0 | 0 | 0 | 0 |

| NVC Family Caregiver Relief Benefit | 0 | 0 | 0 | 0 | 0 | 0 |

| Total | $324,143 | $324,143 | $122,947 | $122,947 | $163,293 | $160,088 |

Findings:

In this scenario, the lifetime compensation provided under the 2016 NVC is greater (18 percent) than what would have been provided in 2013 but the Pension Act still provides more lifetime compensation (50 percent more after tax than NVC).

In addition to the benefits presented in the image, the Veteran would be in receipt of a CAF Annuity and would be able to earn at least 66 2/3 percent of his pre-release salary. Even though the CAF Annuity amount has not been quantified and included in this analysis, it makes a significant contribution to the financial status of the Veteran post release.

Almost 75 percent of Veterans in receipt of VAC benefits fall into this category. If a Veteran was medically released with a service-related medical condition, is there any obligation to provide ongoing financial support once the Veteran is re-trained and is capable of working?

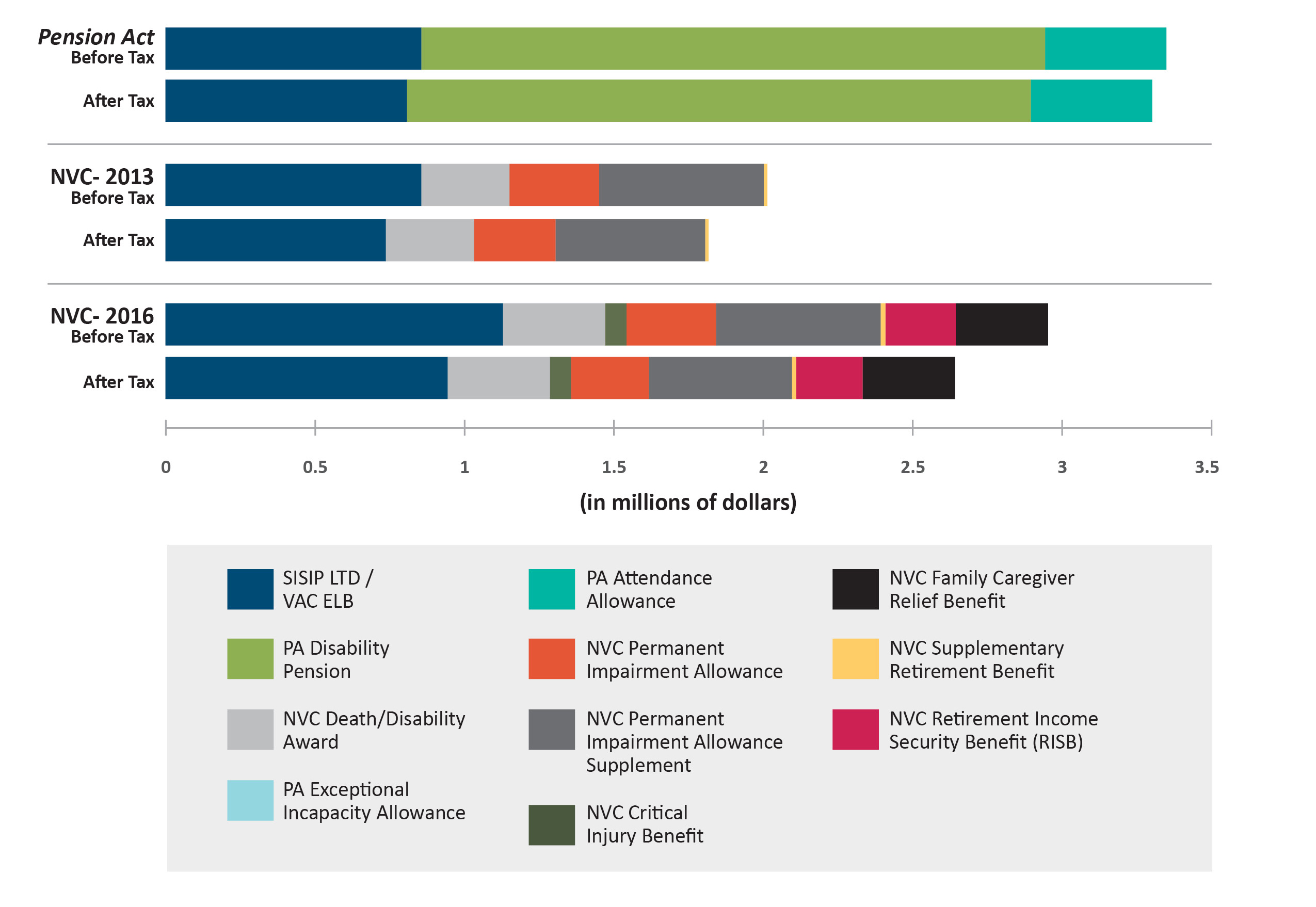

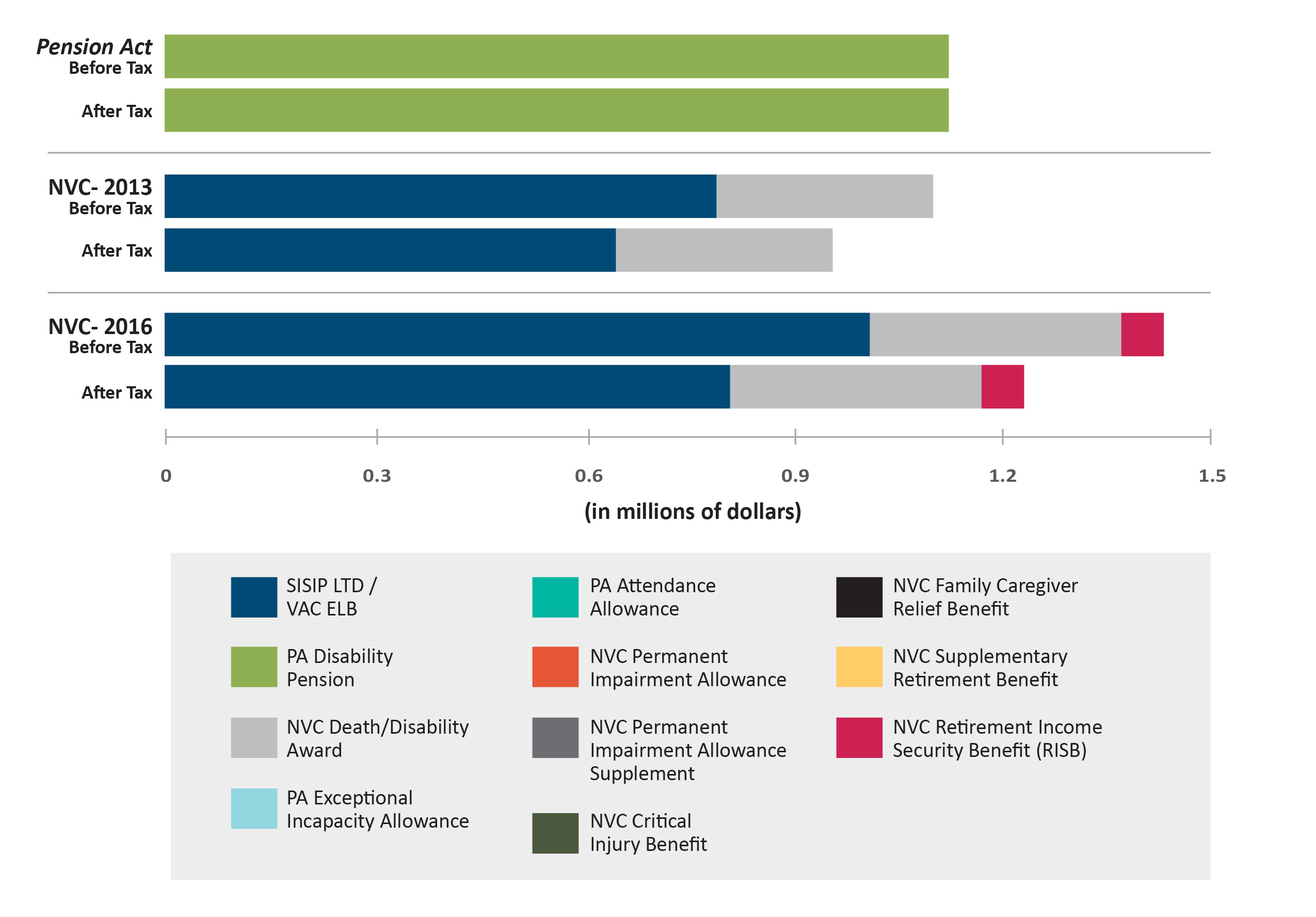

Scenario 8 - Survivor

This scenario represents the survivor of a Veteran with a service-related death at age 41, after 21 years of service. The survivor would receive an immediate, reduced survivor annuity from the CAF, which is deducted from both SISIP LTD, VAC ELB and RISB.

Image 13 – Scenario 8 - Table

| Pension Act | NVC 2013 | NVC 2016 | ||||

| Benefit Name | Before Tax | After Tax | Before Tax | After Tax | Before Tax | After Tax |

| SISIP LTD / VAC ELB | 0 | 0 | 790,418 | 646,317 | 1,009,979 | 809,805 |

| PA Disability Pension | 1,123,128 | 1,123,128 | 0 | 0 | 0 | 0 |

| PA Exceptional Incapacity Allowance | 0 | 0 | 0 | 0 | 0 | 0 |

| PA Attendance Allowance | 0 | 0 | 0 | 0 | 0 | 0 |

| NVC Death/Disability Award | 0 | 0 | 310,379 | 310,379 | 360,000 | 360,000 |

| NVC Critical Injury Benefit | 0 | 0 | 0 | 0 | 0 | 0 |

| NVC Permanent Impairment Allowance | 0 | 0 | 0 | 0 | 0 | 0 |

| NVC Permanent Impairment Allowance Supplement | 0 | 0 | 0 | 0 | 0 | 0 |

| NVC Supplementary Retirement Benefit | 0 | 0 | 0 | 0 | 0 | 0 |

| NVC Retirement Income Security Benefit (RISB) | 0 | 0 | 0 | 0 | 0 | 0 |

| NVC Family Caregiver Relief Benefit | 0 | 0 | 0 | 0 | 0 | 0 |

| Total | $1,123,128 | $1,123,128 | $1,100,797 | $956,696 | $1,431,079 | $1,230,906 |

Findings:

In this scenario, the lifetime compensation under the 2016 NVC is 23 percent greater after tax than in 2013, as a result of the ELB increase to 90 percent of pre-release salary and the RISB. The impact of the RISB is limited as the survivor is in receipt of a CAF Annuity which VAC uses as an offset to the RISB.

In general, service-related death survivors receive more in terms of lifetime compensation under the NVC than under the Pension Act (5 percent more after tax). This is mainly because these survivors receive ELB until the member would have reached age 65, regardless if the survivor remarries or earns additional income. However, if you compare the VAC financial benefits received post age 65, the Pension Act provides more financial support during this time.

Lifetime Totals Versus Annual Totals

It is important to examine both lifetime and annual financial totals because when you receive compensation is as important as how much you receive in most cases.

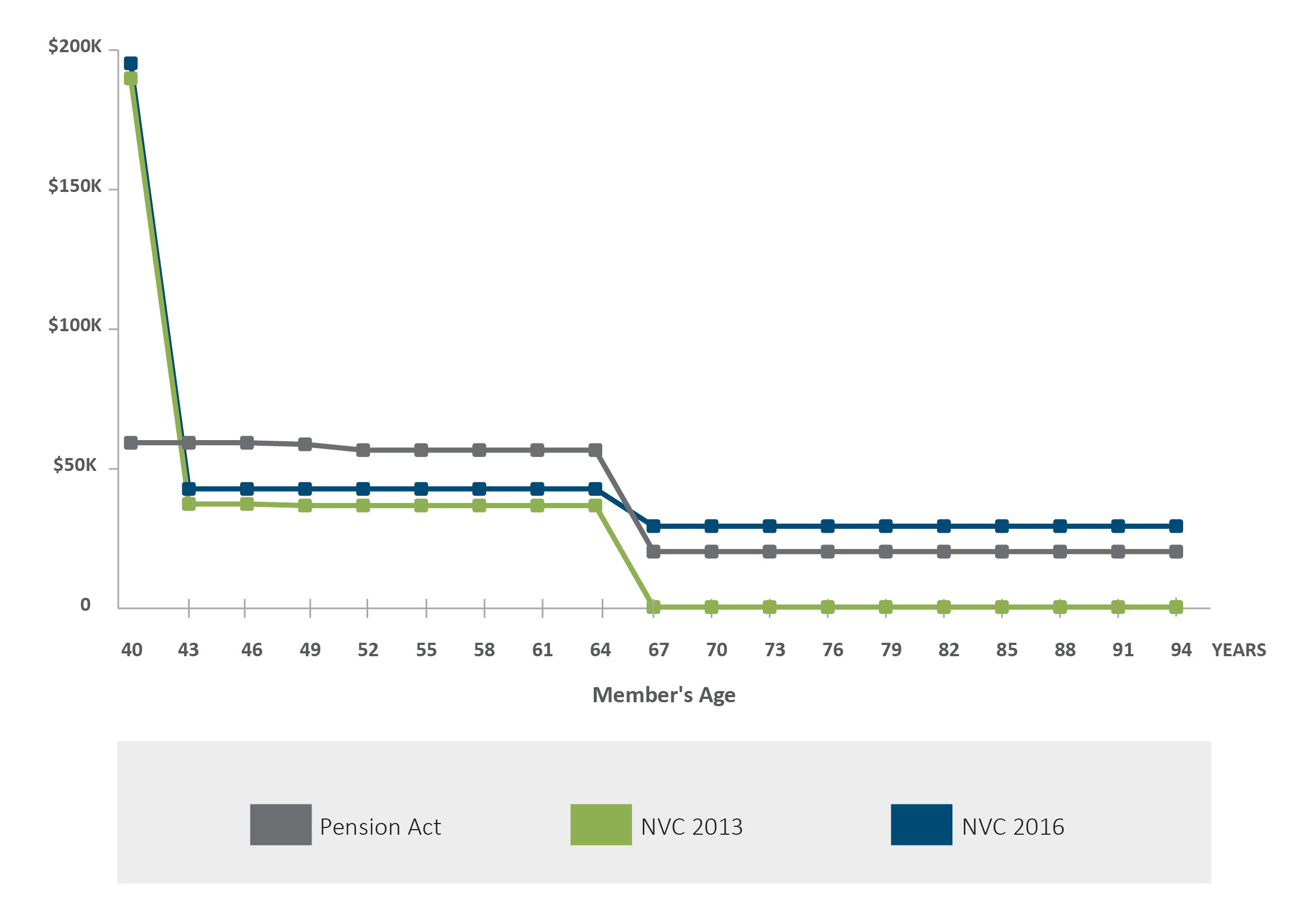

While the lifetime total compensation may be adequate, there may be times in the Veteran’s life when the compensation does not meet the Veteran’s financial needs. The following image depicts when benefits are paid to a Veteran and clearly illustrates that annual payments vary over time. In this example, the drop in annual compensation at age 65 and the impact of the implementation of RISB in 2016 is evident.

Image 14 – Lifetime Compensation vs Annual Compensation for Scenario 5 (Corporal, Age 40, with 50 Percent Disability and 5 Years of Service) - Table

Summary of Key Findings

- Four new benefits and eight enhancements to the NVC were implemented, resulting in additional complexity. Communicating and administering the intricacies and interrelationships of these benefits to Veterans and their families has been challenging.

- The increase to the ELB has had the most significant effect on NVC recipients in that it increases lifetime compensation for the greatest number of Veterans including those who are TPI, not TPI and survivors.

- The PIA and PIA Supplement contribute significantly to the lifetime compensation for Veterans who are TPI.

- New benefits such as the FCRB, the CIB and the RISB, while improving the financial situation for some Veterans, have a limited impact on the broader Veteran population, as so few Veterans are eligible for these benefits.

- It is unclear whether the needs of Veterans who are not TPI are being met.

- While lifetime compensation to survivors has increased more under the NVC than under the Pension Act (5 percent more after tax), compensation after age 65 has not been studied to determine if the annual dollar values are meeting the financial needs of survivors.

- Both lifetime and annual compensation totals are important. When you receive the compensation is as important as how much you receive. While the value of the lifetime total may be adequate, depending on when the Veteran receives these payments, there may be times when compensation does not fully meet the Veteran’s, or his/her family’s financial needs.

Recommendations

This report illustrates that VAC has made a number of improvements to the NVC suite of financial benefits since the OVO’s 2013 Actuarial Report. While there has been a resulting increase to lifetime compensation for all scenarios, there remain areas requiring further review and improvements. The following recommendations are submitted for immediate action:

- Recommendation 1: That the Minister of Veterans Affairs, by 1 April 2019, consolidate financial benefits to reduce complexity and better address the financial needs of Veterans and survivors.

- Recommendation 2: That VAC assess the level of financial support it provides to Veterans who are not TPI to ensure that their financial needs are being met and publish the results of that assessment by 1 April 2018.

- Recommendation 3: That VAC assess the level of financial support it provides to survivors to ensure that their lifelong financial needs are being met and publish the results of that assessment by 1 April 2018.

- Recommendation 4: That VAC review when financial benefits are being delivered to Veterans and their survivors to ensure that their financial needs are being met and publish by 1 April 2018 the benchmarks used to measure that financial support.

Conclusion

This report reviews, from an actuarial perspective, the impact of the changes made to the NVC financial benefits since the 2013 OVO Report: Improving the New Veterans Charter: The Report and its accompanying Actuarial Analysis. Since 2013, these changes have increased the lifetime compensation for many Veterans in receipt of benefits under the NVC for service-related illness or injury.

This report also shows that further NVC improvements are needed to streamline benefits and reduce complexity, as well as to ensure that the financial needs of Veterans who are not TPI and survivors of Veterans are being met.

Implementing the recommendations made in this report will make a difference in ensuring that ill or injured Veterans and their families receive the lifetime financial compensation they need and deserve as a result of their sacrifice and service to Canada.