Table of Contents

- Message from the Veterans Ombudsman

- The Mandate of the Veterans Ombudsman

- Report Summary

- Introduction

- Methodology

- Financial Support

- Vocational Rehabilitation and Assistance Support

- Family Support

- Conclusions

- Recommendations

- Appendix 1 – Reports and Audits Recommending Improvements to the New Veterans Charter

- Appendix 2 – Identifying the At Risk Totally and Permanently Incapacitated Veterans Cohort

- Appendix 3 – Improving Financial Support After Age 65

- Appendix 4 – Increasing the Earnings Loss Benefit to 90 Percent of Pre-Release Salary

- Appendix 5 – Providing the Permanent Impairment Allowance to All Eligible Totally and Permanently Incapacitated Veterans

- Appendix 6 – Increasing the Disability Award Maximum to $350,000

- Footnotes

Message from the Veterans Ombudsman

I am pleased to offer you this report as the third part of the Office of the Veterans Ombudsman’s four-part publication series Improving the New Veterans Charter: the Parliamentary Review. The report is a follow-up to the review paper, released on April 4, 2013, and is the culmination of an extensive research effort and Canada-wide consultation with Veterans and Veterans’ organizations.

The focus of this report is on the economic benefits of the New Veterans Charter, as opposed to the non-economic benefits. This is because the first goal of any compensation analysis of the New Veterans Charter should be to determine whether the economic needs of Veterans and their families are being met, and then to examine whether compensation for pain and suffering is adequate.

With this focus, and building on the foundation set out in the review paper, the report puts forward evidenced-based recommendations that address shortcomings in three New Veterans Charter program areas: financial, vocational rehabilitation and assistance, and family support. Importantly, for the first time, the Office of the Veterans Ombudsman is supporting its recommendations with an actuarial analysis that provides a detailed examination of the effects of the New Veterans Charter financial programs in support of Veterans and their families.

Through this fall’s parliamentary committee review, the Government of Canada has the opportunity to broaden the parliamentary examination of the New Veterans Charter and address these shortcomings in its programs, benefits and services. By such action, it can demonstrate to Veterans and their families, as well as to all Canadians, that the New Veterans Charter is indeed a “living” charter and that its improvement will remain an enduring priority.

Prime Minister Stephen Harper said at the launch of the New Veterans Charter on April 6, 2006,

“In future, when our servicemen and women leave our military family, they can rest assured the Government will help them and their families’ transition to civilian life. Our troops’ commitment and service to Canada entitles them to the very best treatment possible. This Charter is but a first step towards according Canadian veterans the respect and support they deserve.”

I encourage the Government of Canada to implement this report’s recommendations promptly. I encourage it also to formalize an ongoing two-year parliamentary review of the New Veterans Charter, so that the Prime Minister’s promise to Veterans is kept.Footnote 1

Guy Parent

Veterans Ombudsman

The Mandate of the Veterans Ombudsman

The Office of the Veterans Ombudsman, created by Order in Council (P.C. 207-530, April 3, 2007), works to ensure that Veterans, serving members of the Canadian Forces and the Royal Canadian Mounted Police, and other clients of Veterans Affairs Canada are treated respectfully, in accordance with the Veterans Bill of Rights, and receive the services and benefits that they require in a fair, timely and efficient manner.

The Office addresses complaints, emerging and systemic issues related to programs and services provided or administered by Veterans Affairs Canada, as well as systemic issues related to the Veterans Review and Appeal Board.

The Veterans Ombudsman is an independent and impartial officer who is committed to ensuring that Veterans and other clients of Veterans Affairs Canada are treated fairly. The Ombudsman measures fairness in terms of adequacy (Are the right programs and services in place to meet the needs?), sufficiency (Are the right programs and services sufficiently resourced?), and accessibility (Are eligibility criteria creating unfair barriers, and can the benefits and services provided by Veterans Affairs Canada be accessed quickly and easily?).

In accordance with the Veterans Bill of Rights, Veterans and all other clients of Veterans Affairs have the right to:

- Be treated with respect, dignity, fairness and courtesy.

- Take part in discussions that involve them and their family.

- Have someone with them for support when they deal with Veterans Affairs.

- Receive clear, easy-to-understand information about programs and services, in English or French, as set out in the Official Languages Act.

- Have their privacy protected as set out in the Privacy Act.

- Receive benefits and services as set out in published service standards and to know their appeal rights.

They have the right to make a complaint and have the matter looked into if they feel that any of their rights have not been upheld.

Report Summary

This report is the third part of the Office of the Veterans Ombudsman’s four-part publication series Improving the New Veterans Charter: the Parliamentary Review. It presents options and recommendations to address the shortcomings in the three New Veterans Charter program areas examined in the review paper, released on April 4, 2013. Additionally, it is important to note that it is supported by an actuarial analysis, which forms the fourth part of the publication series. The actuarial analysis provides a detailed examination of the effects of the New Veterans Charter’s financial programs that support Canadian Forces Veterans.

The key message of this report is that improvements are required to specific New Veterans Charter programs to help Veterans and their families successfully transition to civilian life. The most urgent shortcomings to address are those that affect the economic financial support provided to Veterans, especially totally and permanently incapacitated Veterans who are vulnerable financially. In addition, non-economic compensation for pain and suffering should at least match the level of compensation awarded to other Canadians by courts in Canada. It is simply not acceptable to let Veterans who have sacrificed the most for their country—those who are totally and permanently incapacitated— live their lives with unmet financial needs.

The New Veterans Charter program areas related to economic financial support with the most urgent shortcomings to address, especially for Veterans who are the most vulnerable financially, are:

- The insufficiency of the economic financial support provided after the age of 65 to at risk totally and permanently incapacitated Veterans.

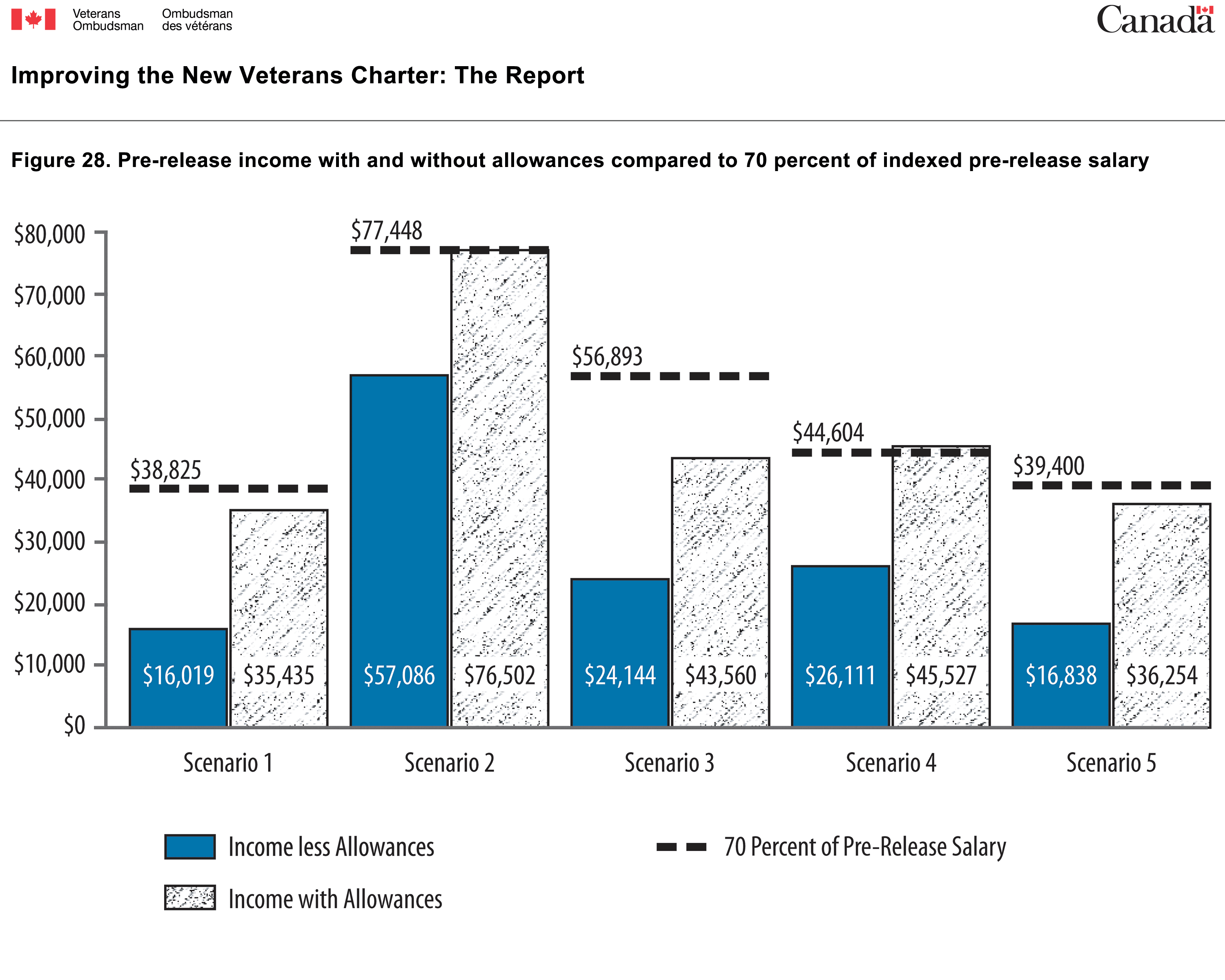

Over 400 Veterans are at risk of living their retirement years with insufficient income to sustain their pre-age 65 standard of living. Five options are analysed in this report to provide Veterans with 70 percent of their indexed pre-release salary after age 65. This rate is a well-recognized benchmark to maintain the same standard of living during retirement as that enjoyed during working years.

- The inadequacy of the Earnings Loss Benefit to support Veterans who are transitioning from a military to a civilian career.

The benefit should be increased from 75 percent to 90 percent of pre-release salary to provide 100 percent of net pre-release salary. In addition, the Earnings Loss Benefit provided to Veterans who served as part-time Reserve Force members, and whose injury or illness is related to service, should be the same as that provided to Veterans who served on a full-time basis. Finally, annual adjustments to the benefit should be based on actual annual increases in the cost of living as measured by the Consumer Price Index.

- The accessibility to the Permanent Impairment Allowance and the Permanent Impairment Allowance Supplement.

Fifty-three percent of Veterans who are assessed to be totally and permanently incapacitated, and who are unable to engage in suitable gainful employment, are not awarded these benefits, which are designed to compensate severely and permanently impaired Veterans for a lack of career opportunity and progression. Veterans Affairs Canada should conduct a review of the totally and permanently incapacitated Veteran cohort to confirm whether more Veterans should have access to the benefits.

The report also addresses briefly the non-economic benefit designed to compensate for pain and suffering—the Disability Award. Other than annual indexing, it has not been increased, since the benefit came into effect in 2006.

The report recommends that as a first step, the maximum amount of the Disability Award should be increased to at least match the current judicial cap for pain and suffering resulting from injury (non-pecuniary damages) awarded by Canadian courts, which is at $342,000.Footnote 2 Following this, more research and consultation can be undertaken to determine what the appropriate maximum amount should be to fairly compensate Canadian Forces members and Veterans for pain and suffering resulting from an injury or illness in service to Canada.

The second New Veterans Charter program area of concern for transitioning Veterans is vocational rehabilitation and assistance support. The specific shortcomings are:

- The practice of building on a Veteran’s existing skills, experience and training limits education upgrade and employment options, including access to postsecondary university education programs.

- The tuition reimbursement limit is insufficient to support participation in a full four‑year university degree program at most Canadian universities.Footnote 3

- There is inadequate performance measurement to track whether Veterans find employment following completion of a vocational rehabilitation plan and whether they stay employed.

- The effectiveness of providing two similar government vocational rehabilitation programs to Veterans is not clear.Footnote 4

Veterans Affairs Canada’s approach to vocational rehabilitation and assistance support needs to be adjusted. At present, it focuses on the Veteran’s current qualifications and on limiting vocational rehabilitation and income support expenditures. This focus needs to be redirected to one that considers vocational rehabilitation and assistance support as an investment in Veterans to prepare them to realize their full potential in a competitive work environment where skills training and higher education are an increasingly common requirement to satisfy labour market demands.

Also, Veterans Affairs Canada should explore additional partnership opportunities to help place Veterans in good paying jobs. As well, the Department needs to improve the performance measurement of the vocational rehabilitation and assistance support it provides to Veterans in order to confirm if it is successfully transitioning Veterans to civilian life. Finally, Veterans Affairs Canada, in collaboration with the Department of National Defence, should launch an independent review of the dual Service Income Security Insurance Plan ( SISIP ) Financial Services and Veterans Affairs Canada’s income support and vocational rehabilitation programs to determine whether they are effective.

The third New Veterans Charter program area that requires improvement is support to families. Past reports from expert advisory groups and parliamentary committees, as well as Veterans Affairs Canada’s own internal evaluations, recommended that more should be done to address the unmet needs of families, especially those who care for Veterans with severe and complex disabilities. This report recommends a number of measures that could significantly enhance the support provided to families such as, but not limited to, improved counselling, information and outreach, extended access to Military Family Resource Centers, and improved financial assistance.

Introduction

The parliamentary committee review of the enhancements to the Canadian Forces Members and Veterans Re-establishment and Compensation Act,Footnote 5 commonly known as the New Veterans Charter, is to be undertaken in the fall of 2013.Footnote 6 It is an important opportunity for the Government of Canada, Veterans and their families, Veterans organizations and Canadians to broaden the parliamentary examination of the New Veterans CharterFootnote 7 and seek solutions to its shortcomings.

To support the upcoming parliamentary committee review, the Office of the Veterans Ombudsman has prepared a four-part publication series entitled Improving the New Veterans Charter: the Parliamentary Review. The first part, released on April 4, 2013, is a review that provides a factual reference point for three New Veterans Charter program areas that are of most concern to Veterans transitioning from military to civilian life and their families, namely, financial, vocational rehabilitation and assistanceFootnote 8 and family support. The second in the series, entitled Investing in Veterans Vocational Training, provided research, analysis, and recommendations specific to the vocational rehabilitation and assistance provided under the Department's Rehabilitation Program.

This report is the third part of the publication series. It presents evidence-based options and recommendations to address the shortcomings in the three New Veterans Charter program areas identified in the review paper. Importantly, it is supported by an actuarial analysis, which provides a detailed examination of the effects of the New Veterans Charter’s financial programs that support Canadian Forces Veterans.

It is important to note at the outset that there are two components to the financial benefits provided to Veterans under the New Veterans Charter: economic financial support and non-economic compensation. These are separate and distinct benefits, and they are designed to achieve different outcomes. Therefore, identified shortcomings of New Veterans Charter’s financial benefits need to be addressed separately.

The focus of this report is on the New Veterans Charter’s economic financial support benefits. These need to be dealt with first. Only then can there be the analytical clarity required to address the main non-economic compensation benefit—the Disability AwardFootnote 9—which is the most frequently debated benefit by Veterans and Veteran advocacy groups.

In this report, therefore, the Disability Award is only discussed briefly and the spotlight is firmly kept on the focus of the report: the need to address shortcomings in economic financial support benefits, especially for those Veterans who are most vulnerable financially.

Of all the New Veterans Charter’s economic financial support benefits, the four most at issue are the:

- Supplementary Retirement Benefit,

- Earnings Loss Benefit,

- Permanent Impairment Allowance, and,

- Permanent Impairment Allowance Supplement.

Economic financial support is inadequate for transitioning Veterans, and especially for certain totally and permanently incapacitated Veterans after age 65. Urgent action is required to address the shortcomings identified in this report.

The economic support provided to Veterans must be sufficient to enable them to meet their needs during their transition to civilian life, or until end of life if required, with minimal reduction in the standard of living that they had before their military careers ended unexpectedly and prematurely because of injury or illness.

In addition, the amount of non-economic compensation provided in recognition for the pain and suffering resulting from a service-related injury or illness has not kept pace with original benchmarks. This compensation needs to be increased at least to match the level of compensation awarded to other Canadians by courts in Canada.

Addressing these shortcomings must be the first priority. Once economic financial security is achieved, then broader consultation can follow to determine what the appropriate maximum amount should be to compensate fairly Canadian Forces members and Veterans for pain and suffering resulting from an injury or illness in service to Canada.

The second area of concern for transitioning Veterans is vocational rehabilitation and assistance support, which is analysed in the Ombudsman's August 2013 report entitled Investing in Veterans Vocational Training. The current support limits access to postsecondary education programsFootnote 10 and constrains civilian employment opportunities. In addition, the fact that two government programs (from Veterans Affairs Canada and SISIP Financial Services) provide similar income support and vocational rehabilitation to Veterans can be confusing, and it is unclear whether this dual program construct is effective. Improvements need to be made to the vocational rehabilitation and assistance support provided to transitioning Veterans by increasing the flexibility to meet their needs; developing more partnerships to enhance job placement opportunities; improving performance measurement of program outcomes; and, reviewing the effectiveness of the dual program construct.

Thirdly, past reports from expert advisory groups, parliamentary committees and internal departmental audits recommended that more must be done to address the unmet needs of families, especially those who care for Veterans with severe and complex disabilities. This report recommends a number of simple and inexpensive measures to better equip families to support disabled Veterans and to facilitate their transition to community supports.

By addressing the shortcomings identified in this report, the Government of Canada will make a significant difference for injured and ill Veterans and their families. It will also send a strong message that it is steadfast in its resolve to uphold the founding principle of the New Veterans Charter, that it is a “living” Charter that will be continually improved to meet the unmet and evolving needs of Veterans and their families.

Methodology

The methodology used in this report includes:

- A review of the New Veterans Charter financial, vocational rehabilitation and assistance, and family support program legislation and regulations and Veterans Affairs Canada directives, guidelines and business practices;

- A review of past expert advisory groups, parliamentary committee and Auditor General reports and internal Veterans Affairs Canada audits and evaluations related to New Veterans Charter programs, services and benefits;

- A literature review and analysis of other federal and provincial government support programs for disabled workers;

- An analysis of statistical information provided by Veterans Affairs Canada, the Department of National Defence, and SISIP Financial Services;

- A review of foreign Veterans support programs;

- An analysis of the Pension Act and New Veterans Charter financial benefits;

- ModellingFootnote 11 and cost analysis of options to address New Veterans Charter financial support shortcomings;

- Consultations with Veterans, the Veterans Ombudsman Advisory Council, and Veterans stakeholder organizations; and,

- Consultations with Veterans Affairs Canada and Department of National Defence/Canadian Forces staff who deal with policy development and the care and management of ill and injured Canadian Forces members, Veterans and their families.

The reader will note that there are certain similarities between the recommendations made in this report and recommendations from past Veterans advisory committee and parliamentary committee reports and internal Veterans Affairs Canada audits. The reports and audits are listed in Appendix 1. Two of these reports, in particular, made 20 recommendations to improve the three program areas examined in this report:

- The New Veterans Charter Advisory Group report, The “Living Charter” in Action, October 2009;Footnote 12 and

- The House of Commons Standing Committee on Veterans Affairs report, A Timely Tune-Up for The Living New Veterans Charter, June 2010.Footnote 13

Many of the recommendations presented to Veterans Affairs Canada and Parliament in these two reports have not been implemented. Shortcomings with the New Veterans Charter that were brought forward in these reports remain unaddressed today and continue to affect Veterans and their families.

Financial Support

Purpose of the New Veterans Charter Financial Support Benefits

The New Veterans Charter’s financial support benefits that can be provided to eligible Canadian Forces members, Veterans, spouses and survivors are complex, often inter-related, and not always well understood or appreciated. Before presenting options to address specific shortcomings, the following provides a brief overview of the purpose of the financial support benefits.

The objective of the New Veterans Charter is to help Veterans rebuild their lives and to restore, to the greatest extent possible, their financial independence, health and quality of life. The Charter was designed to provide an integrated suite of benefits and needs‑based programs, supported by case management,Footnote 14 to assist Canadian Forces members, Veterans and their families successfully transition from a military career, with its support, to civilian life.

The New Veterans Charter financial support programs provide for both non‑economic and economic impacts of a disability or death. The two non-economic compensation benefits are the Disability Award and the Death Benefit. The financial benefits that provide economic support are the Earnings Loss Benefit, Supplementary Retirement Benefit, Permanent Impairment Allowance and Permanent Impairment Allowance Supplement, and Canadian Forces Income Support.Footnote 15

Non-economic Compensation Benefits

Disability Award:The Disability Award recognizes the sacrifices made by Canadian Forces members and Veterans and compensates them, and in some cases their surviving spouses/common-law partners and surviving dependent children, for non-economic impacts, such as pain and suffering, physical and psychological loss and the impact of a service-related disability on their quality of life. The Disability Award provides the option of immediate financial compensation and is intended to offer a sense of closure that, when combined with other New Veterans Charter programs, can help Veterans move on and focus on a new life and career path. The amount of the Disability Award is based on the degree of disability and the relationship between the disability and the applicant’s service.

Unlike the Disability Pension provided under the Pension Act, the Disability Award is not the only gateway to other Veterans Affairs Canada programs, benefits and services. This design feature is the cornerstone of the New Veterans Charter because a Veteran can now access rehabilitation services, other financial benefits, health benefits and career transition support, without first having to establish entitlement to a Disability Award. These other benefits complement the Disability Award to help the Veteran successfully transition to civilian life.

Death Benefit: The Death Benefit recognizes and compensates a surviving spouse, common-law partner and/or dependent children for the non-economic impacts of the service-related death of a Canadian Forces member. The benefit compensates for the loss of guidance, care and companionship, and is provided in addition to other economic support benefits.

Economic Support Benefits

Earnings Loss Benefit: The purpose of the Earnings Loss Benefit is to provide a Veteran who is participating in the Rehabilitation Services and Vocational Program with income replacement allowing them to focus on their rehabilitation goals. The benefit can be extended to age 65 for Veterans who are deemed to be totally and permanently incapacitated and are unable to engage in suitable gainful employment.Footnote 16 The benefit is also payable to survivors until the Veteran would have turned 65 to ensure that the spouse and dependent children are supported in a similar manner to that if the Veteran had lived.

Supplementary Retirement Benefit: The Supplementary Retirement Benefit may be paid at age 65 to a totally and permanently incapacitated Veteran who is no longer entitled to the Extended Earnings Loss Benefit or before age 65 if the totally and permanently incapacitated Veteran becomes able to engage in suitable gainful employment. The purpose of the benefit is to compensate the Veteran for the lost opportunity to contribute to a retirement pension plan because of his or her inability to work as a result of a career-ending or service-related disability. The benefit may also be paid to eligible survivors.

Permanent Impairment Allowance/Supplement:The Permanent Impairment Allowance recognizes the effects that a permanent severe impairment resulting primarily from service can have on a Veteran’s employment potential and career advancement opportunities. The allowance is payable in three grade levels to a Veteran who suffers from a permanent and severe impairment for which rehabilitation services have been approved and for which the Veteran has received a disability benefit.

The Permanent Impairment Allowance Supplement is an additional monthly amount that compensates the totally and permanently incapacitated Veteran for his or her inability to perform any occupation that is considered to be suitable gainful employment. In order to be eligible to receive the supplement, the Veteran must be in receipt of the Permanent Impairment Allowance in any of the three grade levels.

Canadian Forces Income Support: The Canadian Forces Income Support benefit may be available to Canadian Forces Veterans who have successfully completed a rehabilitation program, are no longer eligible for the Earnings Loss Benefit, and are capable of working, but are not yet employed. The benefit is income tested against total household income. The benefit may also be payable to the Veteran at age 65 or to the Veteran’s survivor and orphans in certain circumstances.

Options to Address Shortcomings

Since 2006, Canadian Forces members, Veterans and their survivors have been compensated and supported through New Veterans Charter financial benefit programs. These are provided in parallel to the financial benefits provided to eligible Canadian Forces members, Veterans and their survivors under the Pension Act. In numerous instances, Canadian Forces members and Veterans are in receipt of both Pension Act and New Veterans Charter financial benefits. For example, in March 2013, 12,829 Canadian Forces members and Veterans were in receipt of both a Pension Act Disability Pension and a New Veterans Charter Disability Award. Also, of the 3,198 Veterans in receipt of the New Veterans Charter Earnings Loss Benefit, 1,874 (or 59 percent) were Pension Act or dual Pension Act/New Veterans Charter clients.Footnote 17

Considering that financial benefits are currently provided by two different regimes, it is not surprising that recipients often compare the value of New Veterans Charter benefits to those of the Pension Act. Too frequently, comparisons are made only between the Pension Act monthly Disability Pension and the New Veterans Charter lump sum Disability Award without considering other financial benefits that are provided under the New Veterans Charter.

That being said, there are undeniable differences between the value of financial benefits provided under the Pension Act and the New Veterans Charter. The differences are explained in detail in the Office of the Veterans Ombudsman’s Actuarial Analysis. The two primary reasons for these differences are:

- The value of monthly financial benefits payable for life under the Pension Act is generally greater than the value of lump sum financial benefits payable under the New Veterans Charter; and,

- Most financial benefits payable under the Pension Act are not taxable whereas, for the most part, benefits provided under the New Veterans Charter are taxable.

Finally, to further illustrate the differences between the two financial benefit regimes, the following figure provides a simple depiction of eligibility for the main financial benefits provided under the Pension Act and the New Veterans Charter.

Figure 1. Eligibility for Pension Act and New Veterans Charter Financial Benefits

| Financial Benefit | Pension Act (Second World War / Korean War Veterans) | Pension Act(Canadian Forces Veterans post-1947, but not Korea) | Pension Act (Survivor) | New Veterans Charter (Canadian Forces Veteran) | New Veterans Charter (Survivor) |

|---|---|---|---|---|---|

| Disability Award | x [1] | x | x | ||

| Disability Pension | x | x | x | ||

| Earnings Loss Benefit | x [1] | x | x | ||

| Exceptional Incapacity Allowance | x | x | |||

| Attendance Allowance | x | x | |||

| Permanent Impairment Allowance/Supplement | x [1] | x | |||

| Supplementary Retirement Benefit | x [1] | x | x | ||

| Canadian Forces Income Support | x [1] | x | x | ||

| War Veterans Allowance | x | x | |||

| Clothing Allowance | x | x | x | ||

| Prisoner of War Compensation | x | x | |||

| Detention Benefit | x [1] | x | |||

| Survivor Pension | x | ||||

| Death Benefit | x |

[1] New Veterans Charter benefits for which Pension Act clients may be eligible

The Veterans Ombudsman acknowledges that different financial benefits provided under different legislative regimes may result in different monetary amounts. However, it is not the objective of this report to recommend financial parity between the benefit regimes. Rather, the intended effect of the recommendations presented herein is to improve New Veterans Charter economic supports and non-economic compensation to ensure that:

- Economic support is sufficient to enable Veterans to meet their needs during transition to civilian life, or until end of life, if required, with minimal reduction in the standard of living that they had before their military careers ended unexpectedly and prematurely because of injury or illness; and,

- Canadian Forces Veterans receive non-economic compensation for pain and suffering resulting from a service-related injury or illness that is at least equivalent to the maximum amount (currently $342,000) that is awarded to Canadians by Canadian courts for pain and suffering.

The next sections of this report will review the shortcomings with the New Veterans Charter financial support benefits and provide options to address the shortcomings. The options are analyzed in detail in the appendices to this report using the following five scenarios:Footnote 18

Scenario 1– A totally and permanently incapacitated single 24-year-old male Veteran with an assessed disability level of 80 percent, who was medically released from the Canadian Forces at the rank of Corporal (salary of $55,464) with four years of service.

This scenario represents a young Veteran with a high level of disability who has access to the Permanent Impairment Allowance and Supplement, and has very little pensionable service.

Scenario 2 – A totally and permanently incapacitated 47-year-old female Veteran with an assessed disability level of 100 percent, married with one dependent child, who was medically released from the Canadian Forces at the rank of Major (salary of $110,640) with 29 years of service.

This scenario represents an older Veteran with a very serious disability who has access to the Permanent Impairment Allowance and Supplement, and a high number of years of pensionable service.

Scenario 3 – A totally and permanently incapacitated 30-year-old male Veteran with an assessed disability level of 40 percent, married with one dependent child, who was medically released from the Canadian Forces at the rank of Captain (salary of $81,276) with 10 years of service.

This scenario represents a young Veteran with a moderate level of disability who has access to the Permanent Impairment Allowance and Supplement, a small but immediate unreduced Canadian Forces annuity, and who cannot return to work because of the nature of his disability.

Scenario 4 – A totally and permanently incapacitated 35-year-old male Veteran with an assessed disability level of 95 percent, married with one dependent child, who was medically released from the Canadian Forces at the rank of Sergeant (salary of $63,720) with 15 years of service.

This scenario represents a Veteran with a very high level of disability who has access to the Permanent Impairment Allowance and Supplement, a modest but immediate unreduced Canadian Forces annuity, and who cannot work because of the seriousness of his disability.

Scenario 5– A totally and permanently incapacitated 40-year-old female Veteran with an assessed disability level of 50 percent, married with one dependent child, who was medically released from the Canadian Forces at the rank of Corporal (salary of $56,286) with five years of service.

This scenario represents a moderately disabled Veteran who joined the Canadian Forces later in life, who is not eligible for the Permanent Impairment Allowance and Supplement, and who has few years of pensionable service.

After Age 65 Financial Support

The insufficiency of financial support provided after the age of 65 for certain at-riskFootnote 19 totally and permanently incapacitated Veterans is the most urgent New Veterans Charter shortcoming to address.

The Supplementary Retirement Benefit is a benefit provided to eligible totally and permanently incapacitated Veterans, normally after the age of 65. The benefit can be provided before the age of 65 if the Veteran returns to work. The benefit is a taxable lump sum based on two percent of the total amount of the Earnings Loss Benefit that would have been payable to the eligible Veteran if no offsets (deductions) from prescribed sources were considered.Footnote 20

Since the coming into force of the New Veterans Charter, there have been very few recipients of the Supplementary Retirement Benefit. This is because few Veterans who may be eligible for the benefit have reached the age of 65. Veterans Affairs Canada reports that between October 2007 and August 2012 there were 15 recipients of the benefit. The average amount of the lump sum payment over this five year period was $1,927, and the largest single payment was $5,969.Footnote 21

The Supplementary Retirement Benefit lump sum amount provided at age 65 is insufficient to compensate for the termination of the monthly Extended Earnings Loss Benefit. This deficiency is a particular problem for certain totally and permanently incapacitated Veterans who are not in receipt of New Veterans Charter or Pension Act allowancesFootnote 22 and who have little or no Canadian Forces Pension. Who these Veterans are and what can be done to address the shortcoming is explained below, with detailed analysis provided in Appendices 2 and 3.

The termination of the Extended Earnings Loss Benefit and the insufficiency of after age 65 financial support also affect surviving spouses. Currently, financial benefits that are payable to a Veteran after-age 65, such as the Permanent Impairment Allowance and Permanent Impairment Allowance Supplement, cease when the Veteran dies. This could leave surviving spouses with little income to support themselves. Therefore, any solution implemented by Veterans Affairs Canada to address the insufficiency of financial benefits after age 65 for Veterans needs to consider the surviving spouse.

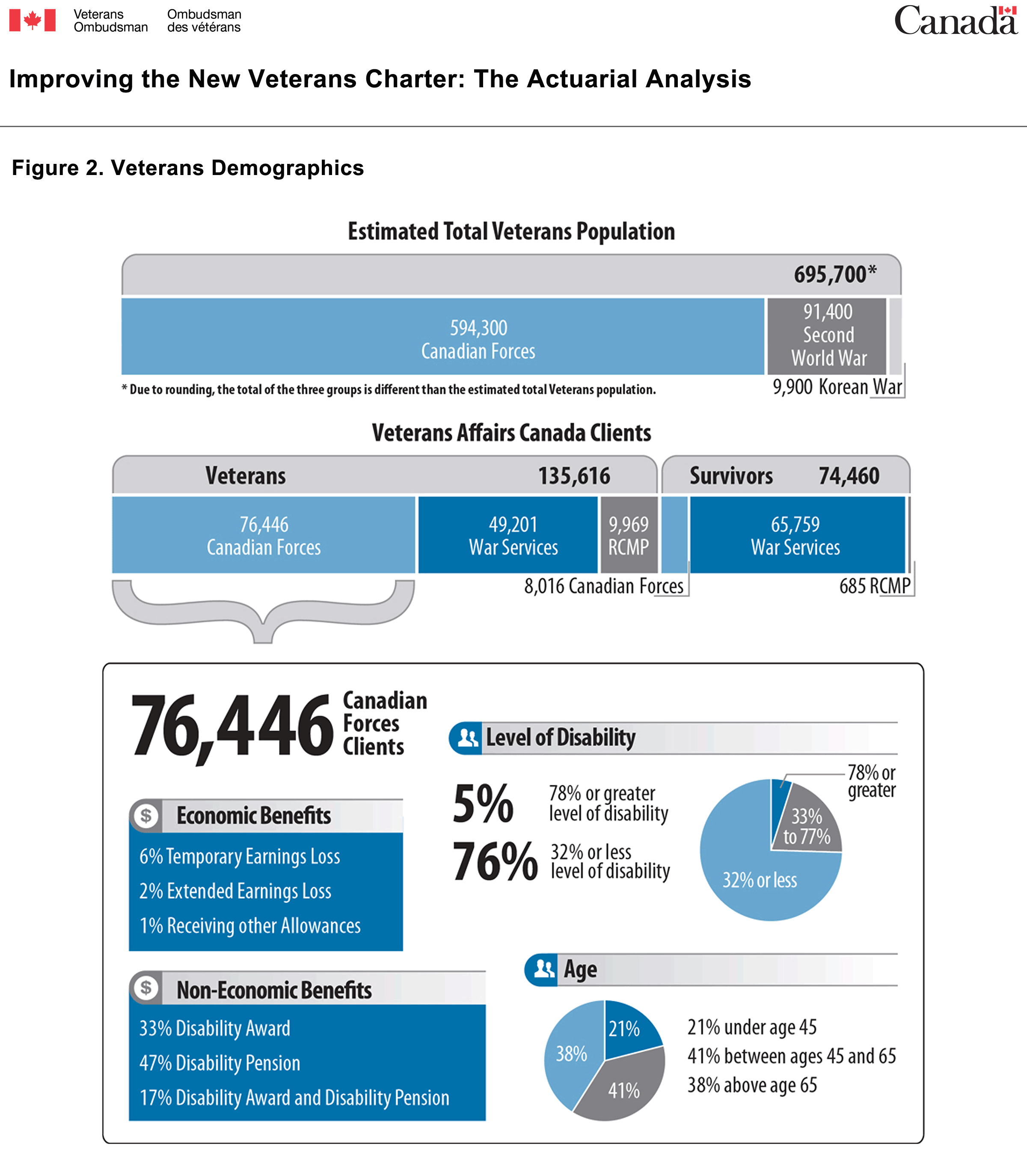

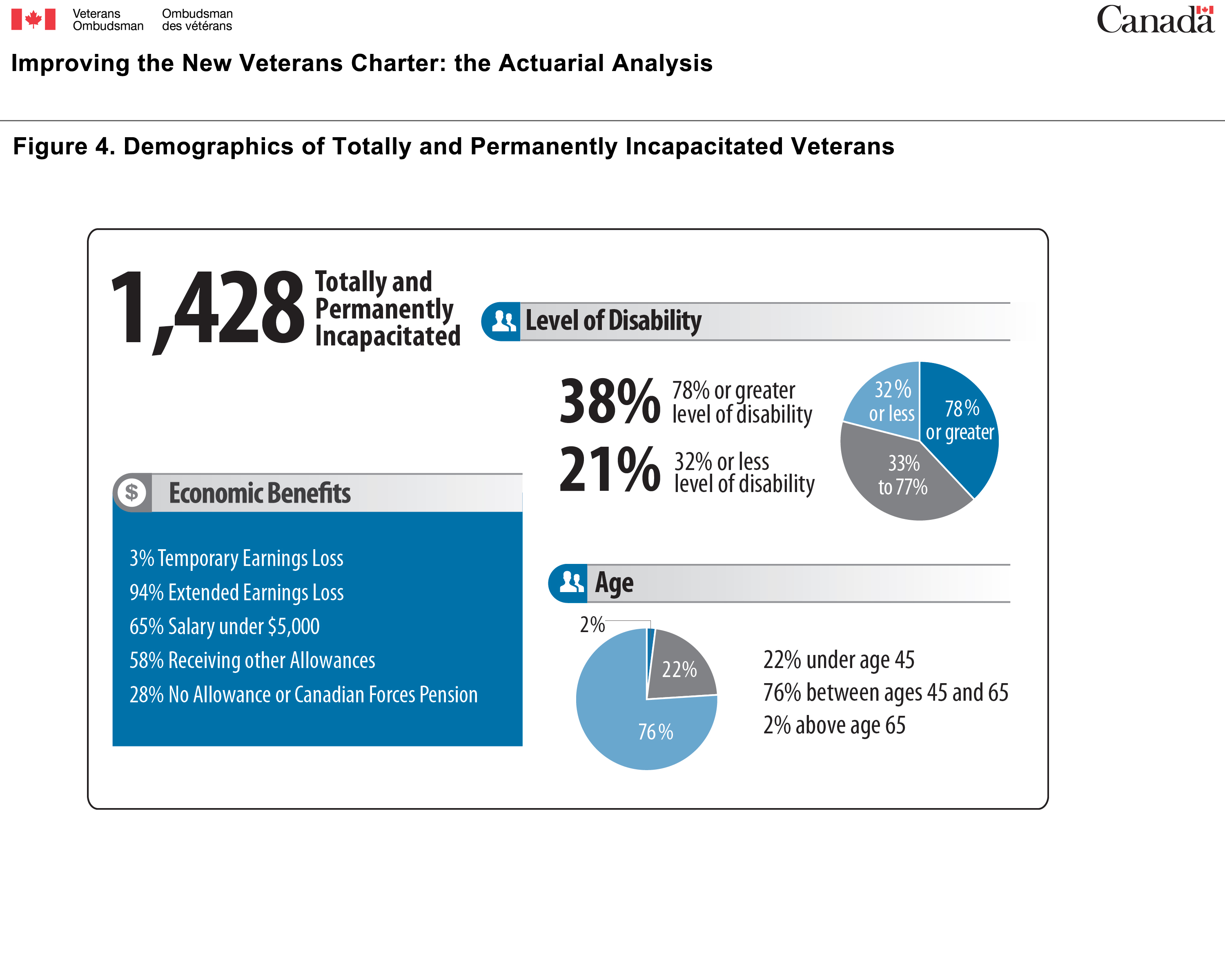

Demographics of the Totally and Permanently Incapacitated Veteran Cohort

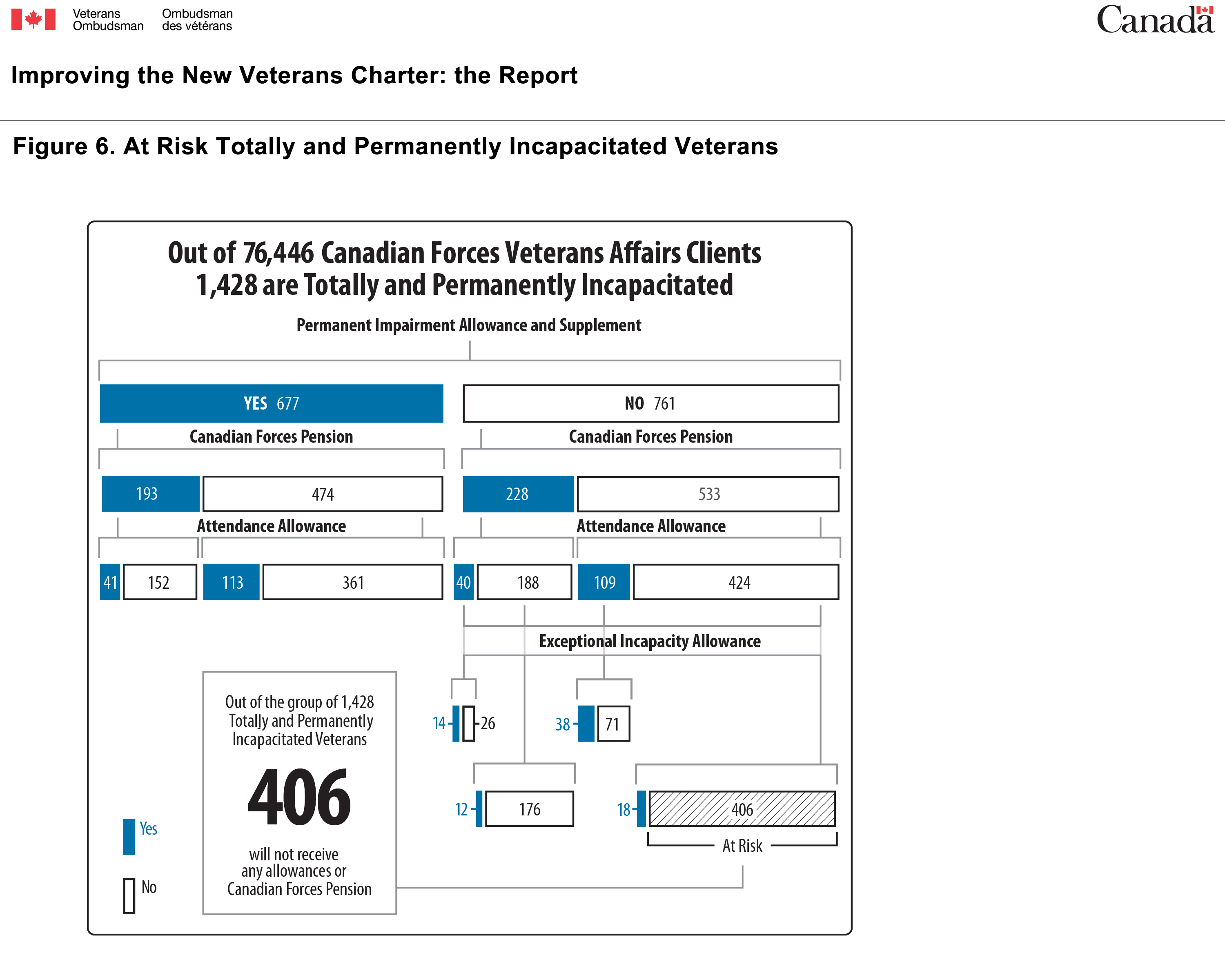

As of March 2013, approximately 1,428 Veterans (out of 76,446 Canadian Forces Veteran clients) were assessed by Veterans Affairs Canada to be totally and permanently incapacitated. Six hundred and seventy-four (674) of these Veterans were in receipt of the New Veterans Charter Extended Earnings Loss Benefit, which is provided until age 65 to Veterans who are, and remain, totally and permanently incapacitated and who are unable to engage in suitable gainful employment.Footnote 23

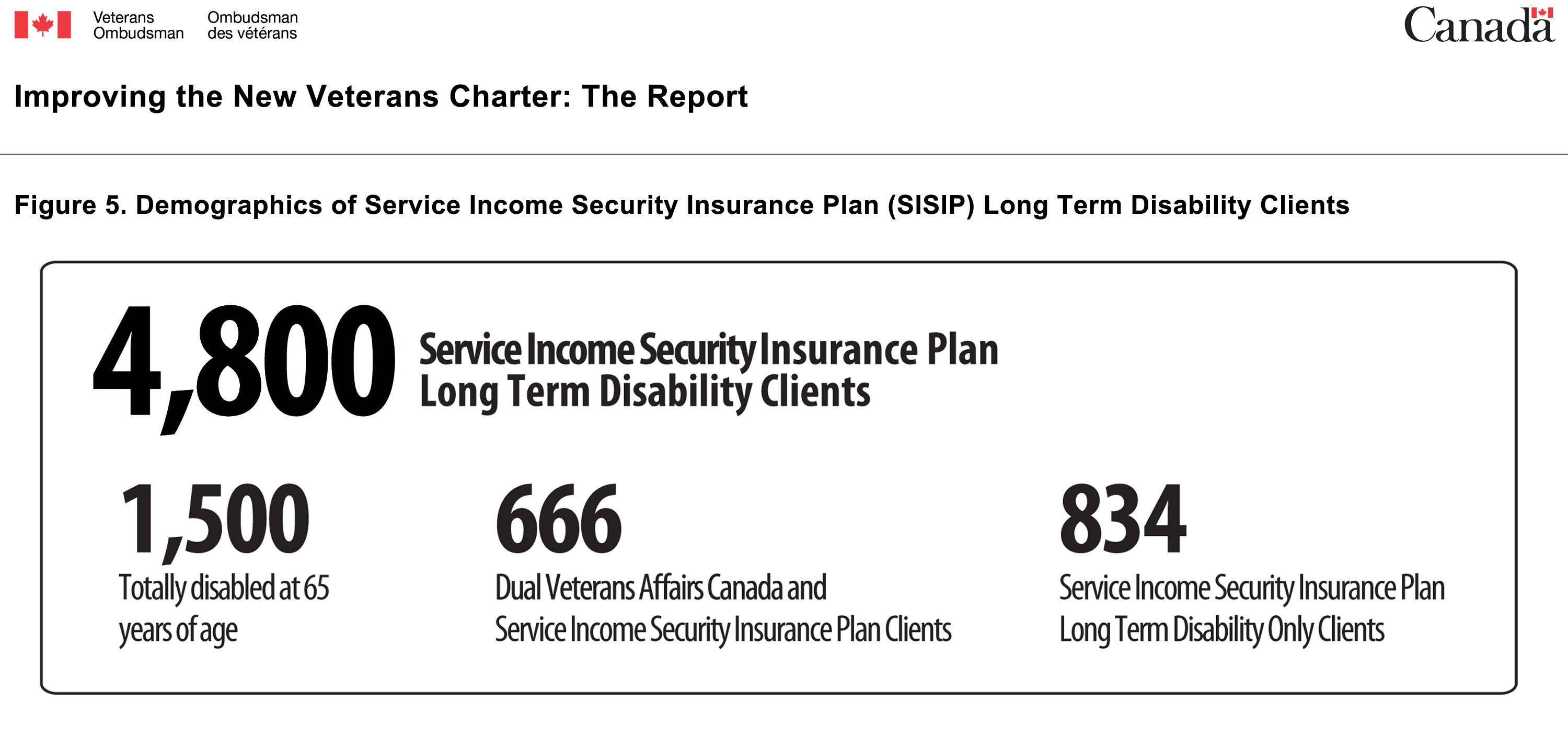

An additional 666 totally and permanently incapacitated Veterans were Veterans Affairs Canada clients, but were eligible to receive the SISIP Long Term Disability Plan income replacement benefit.Footnote 24

The Office of the Veterans Ombudsman conducted a comprehensive analysis of the statistics provided by Veterans Affairs Canada on the totally and permanently incapacitated Veteran cohort. The analysis is presented in Appendix 2.

The key finding from the analysis is that there are over 400Footnote 25 totally and permanently incapacitated Veterans Affairs Canada Veteran clients who are not in receipt of the New Veterans Charter Permanent Impairment Allowance/Supplement or the Pension Act Attendance Allowance or Exceptional Incapacity Allowance, and who have very little to no Canadian Forces Pension. When these Veterans lose their Veterans Affairs Canada Extended Earnings Loss Benefit at age 65, they will experience a significant reduction in monthly income support. These most vulnerable, seriously disabled Veterans are at risk of living their retirement years with insufficient income to sustain their pre-age 65 standard of living. In fact, some Veterans are at risk of living their retirement years below the poverty level.Footnote 26

These are not the only at-risk Veterans. SISIP Financial Services reports that there are approximately 1,500 SISIP Long Term Disability Plan Veteran clients considered to be totally disabled and who are expected to remain totally disabled until age 65, at which time their income replacement benefit will also cease.Footnote 27 As noted earlier, Veterans Affairs Canada statistics indicate that approximately 666 SISIP Long Term Disability Plan Veteran clients are also Veterans Affairs Canada totally and permanently incapacitated clients. This leaves approximately 834 totally disabled SISIP clients who are not counted in Veterans Affairs Canada’s statistics and whose financial situation after age 65 is unclear. A number of these SISIP Long Term Disability Plan totally disabled Veteran clients may also be at risk of living their retirement years with insufficient income to sustain a pre-age 65 standard of living.

Typical Financial Support Benefits Provided to a Totally and Permanently Incapacitated Veteran Before and After Age 65

The following describes the typical financial support benefits that could be provided under the New Veterans Charter and other government programs to a totally and permanently incapacitated Veteran who was released at the Corporal basic pay rate after four years of service (Scenario 1). While the whole-of-governmentFootnote 28 financial support benefits provided in this scenario are typical of those that could be provided to a Veteran under the New Veterans Charter, specific benefit amounts will vary depending on a number of factors, such as:

- Whether the Veteran meets benefit eligibility criteria;

- The assessed level and service relationship of the disability;

- The degree of impairment;

- The number of years of pensionable Canadian Forces service and amount of pre-release salary; and,

- The contributions made to Government of Canada benefit plans.

Before Age 65 Financial Support

Until this totally and permanently incapacitated Veteran reaches the age of 65, he or she could receive the following monthly New Veterans Charter economic support benefits and other government benefits:Footnote 29

- A taxable monthly Extended Earnings Loss Benefit (or SISIP Long Term Disability Plan income replacement benefit) of 75 percent of pre-release salary ($3,467 per month)Footnote 30, less offsets from prescribed sources of income.

- A taxable Permanent Impairment Allowance that ranges from $569.76 to $1,709.27 per month, depending on the assessed grade level.

- A taxable Permanent Impairment Allowance Supplement of $1,047.53 per month.

- A taxable Canada Pension Plan disability benefit, on average up to $841.95 per month,Footnote 31 provided that eligibility and contributory period requirements are met. Note that this amount is reduced (offset) from the Extended Earnings Loss Benefit amount above.

- A taxable deferred Canadian Forces pension at age 60 of approximately $3,200 per year, which is reduced to approximately $2,200 per year when the Veteran begins receiving a Canada Pension Plan pension at age 65. If the Veteran becomes entitled to the Canada Pension Plan disability benefit, he or she will receive an immediate annuity of approximately $2,200 per year or $185 per month.Footnote 32 To note, this amount is also offset from the Extended Earnings Loss Benefit amount above.

In summary, the Scenario 1 totally and permanently incapacitated Veteran could receive until age 65 up to approximately $6,200 per month in taxable financial support benefits. However, considering that almost 90 percent of Permanent Impairment Allowance recipients are awarded the lowest grade level (3), the Veteran’s monthly taxable financial support benefits until age 65 are more likely to total approximately $5,000 per month.Footnote 33

Furthermore, considering that 53 percent of totally and permanently impaired Veterans are not awarded a Permanent Impairment Allowance or Supplement,Footnote 34 taxable monthly financial support benefits for these Veterans could be as low as approximately $3,500 per month.Footnote 35

The amount of economic financial support provided to Veterans before the age of 65 is highly variable, depending on eligibility for allowances. The amount of economic financial support is significantly reduced after age 65.

After Age 65 Financial Support

At age 65, the Veteran will retain the deferred Canadian Forces pension he or she began receiving at age 60 or earlier, if the Canada Pension Plan ( CPP ) disability benefit was approved. If eligible to receive the Permanent Impairment Allowance and Supplement benefits, the Veteran will continue to receive these for life. The Veteran will also be entitled to other Government of Canada benefits such as the Old Age Security pension and the Canada Pension Plan retirement pension (in lieu of the CPP disability benefit which ceases at age 65).Footnote 36 Finally, the Veteran may be eligible for the Guaranteed Income Supplement if the value of his or her and his or her spouse’s annual income, not including the Old Age Security pension and Guaranteed Income Supplement, is less than $16,559 for a single individual or a combined annual income of $21,887.99 for a couple. Footnote 37

The average amounts of the other Government of Canada benefits, less the Guaranteed Income Supplement, are as follows:

- Canada Pension Plan retirement pension: an average benefit of $534.65 per month,Footnote 38 and,

- Old Age Security pension: a maximum benefit of $546.07 per month.Footnote 39

Also at age 65, the Veteran’s Extended Earnings Loss Benefit ceases and he or she receives the Supplementary Retirement Benefit, a taxable lump sum amount. The amount of the lump sum is dependent on the Veteran’s pre-release salary and the number of years the Veteran was in receipt of the Extended Earnings Loss Benefit. For example, a Veteran who receives 40 years of Extended Earnings Loss Benefit based on a Corporal basic pay grade could receive (in 40 years from now) a taxable lump sum Supplementary Retirement Benefit of approximately $52,000. This amount is insufficient income support to sustain a Veteran during the remaining years of his life.Footnote 40

In summary, and as illustrated in the adjacent example, at age 65, this sample Veteran would receive a one-time lump sum Supplementary Retirement Benefit amount based on the amount and years of Extended Earnings Loss Benefit received, but would experience a reduction in taxable monthly economic support benefits (from all government sources) from approximately $5,000 per month to approximately $2,900 per month. The amount of after age 65 monthly benefits could be even lower for totally and permanently incapacitated Veterans who do not satisfy the eligibility requirements for Veterans Affairs Canada allowances and who have less Canadian Forces Pension.Footnote 41

Comparison of before and after age 65 monthly financial benefits for Scenario 1

Economic support benefits/superannuation received until age 65:

- Extended Earnings Loss Benefit: $2,325 includes offset for Canada Pension Plan and annuity)

- Permanent Impairment Allowance (Grade 3): $569.76

- Permanent Impairment Allowance Supplement: $1,047.53

- Canada Pension Plan disability benefit (offset from Earnings Loss Benefit): $841.95 (average)

- Deferred annuity at age 60 or when approved for Canada Pension Plan disability benefit (offset from Earnings Loss Benefit): $185 (approximately)

Total before age 65 monthly benefits: $4,969.24 ($3,350 if not in receipt of Permanent Impairment Allowance/Permanent Impairment Allowance Supplement)

Economic support benefits/superannuation received after age 65:

- Supplementary Retirement Benefit: lump sum depending on amount of Extended Earnings Loss Benefit received

- Permanent Impairment Allowance: $569.76

- Permanent Impairment Allowance Supplement: $1,047.53

- Canada Pension Plan retirement benefit: $528.49 (average)

- Old Age Security benefit: $546.07 (average)

- Deferred annuity: $185 (approximately)

Total after age 65 monthly benefits: $2,876.85 + Supplementary Retirement Benefit (Lower monthly amount if not in receipt of Permanent Impairment Allowance/Permanent Impairment Allowance Supplement)

Establishing a Reasonable Level of Financial Support After Age 65

A 2009 report that summarized the research prepared for the Research Working Group on Retirement Income Adequacy for Federal‐Provincial‐Territorial Ministers of Finance, states:

“…It has typically been suggested that retirement income, including pensions, RRSP or RRIF withdrawals and other sources of income, should be 70 percent of working income….”Footnote 42

Other studies and opinions by various financial advisors and experts in the field of retirement planning have been published on the subject of the adequacy of retirement income. Conclusions are generally in line with the view expressed above. Public sector pension plans, including the Canadian Forces Pension Plan, accept this 70 percent replacement ratio and have designed their plans around it. Retirement planners use this number to help Canadians prepare their retirement plans. Also, the federal government uses the 70 percent income target in its communications; for example, the online Service Canada personal retirement calculator identifies 70 percent as the desired income replacement rate.Footnote 43

It is reasonable, therefore, to establish the minimum after-age 65 monthly financial support from all government sources that should be provided to totally and permanently incapacitated Veterans at 70 percent of their indexed pre-release salary. This level of support would allow the most vulnerable Veterans whose military careers were cut short because of severe disability and who were unable to engage in suitable gainful employment to maintain the same standard of living they had before their medical release from the Canadian Forces.

This 70 percent ratio is usually based on sources of income from government plans (Canada/Quebec Pension Plan, Old Age Security, Veterans benefits, etc.), employment-related pension plans (such as the Canadian Forces Pension Plan) and personal savings. Because it is difficult to predict how much totally and permanently incapacitated Veterans who are unable to engage in suitable gainful employment will save for retirement, and considering that these Veterans may have little employment-related pension, 70 percent of indexed pre-release salary should be the minimum threshold level upon which to base after-age 65 financial support.

Options to Address the Insufficiency of Financial Support After Age 65

As discussed earlier, there are at least 15 totally and permanently incapacitated Veteran clients under the New Veterans Charter who have already reached the age of 65. Veterans Affairs Canada also advises that approximately 85 Veterans will be eligible for the after-age 65 Supplementary Retirement Benefit in the next five years.Footnote 44 In addition, SISIP Financial Services estimates that approximately 200 of its totally disabled Veteran clients will likely reach the age of 65 in the next five years.Footnote 45

Considering that the number of Veterans Affairs Canada totally and permanently incapacitated and SISIP Long Term Disability Plan totally disabled Veteran clients who will reach the age of 65 in the next five years is relatively low (approximately 285 Veterans) the Government can address the after-age 65 financial support shortcoming in an incremental fashion.

285 – Number of totally and permanently incapacitated Veterans Affairs Canada and totally disabled SISIP Long Term Disability Plan Veterans who will turn 65 in the next five years.

A number of potential options to address the after-age 65 benefit shortcomings were considered:Footnote 46

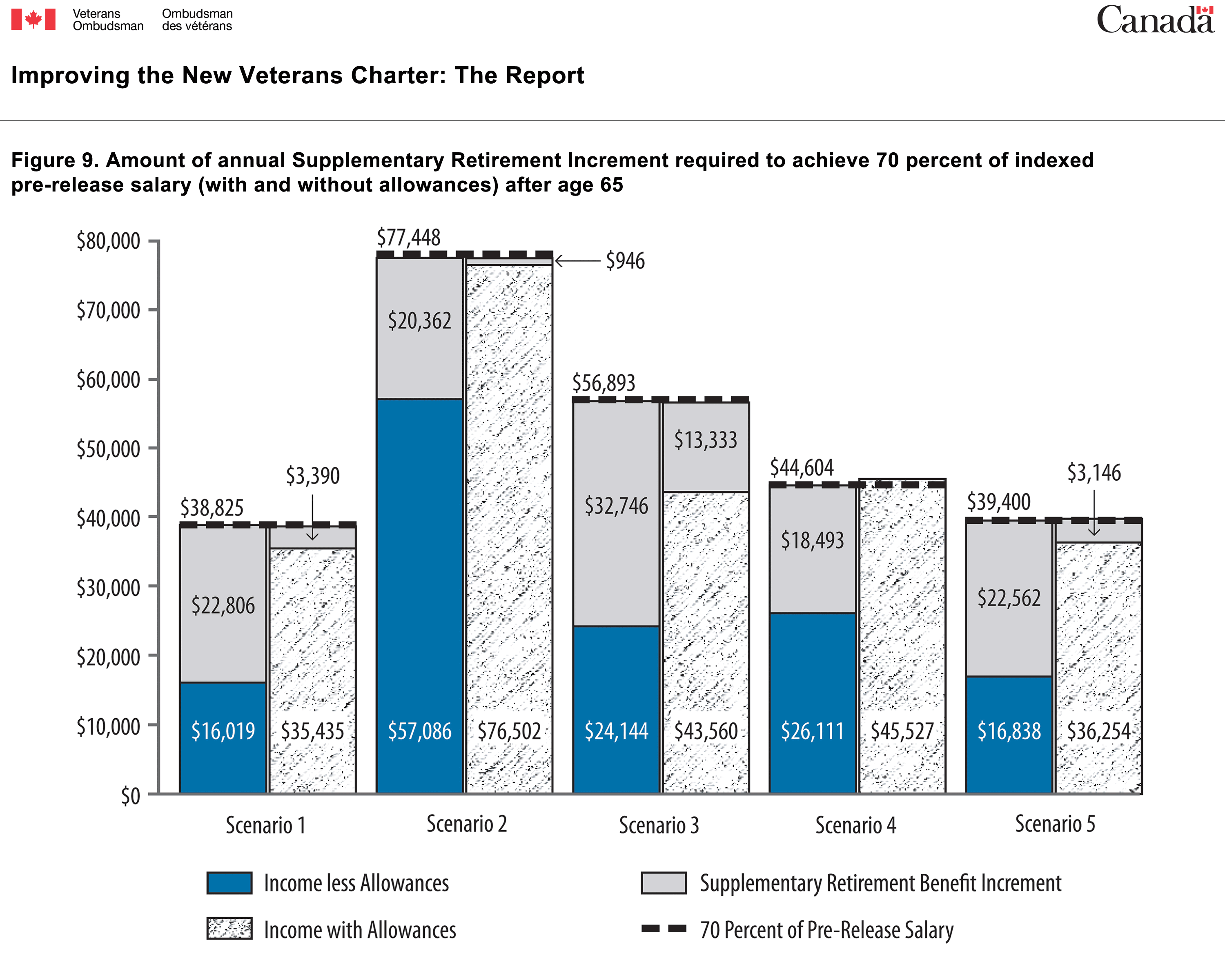

- Implement a new monthly Supplementary Retirement Increment Benefit for totally and permanently incapacitated Veterans to top up after- age 65 monthly support benefits and income from prescribed sources to 70 percent of the Veteran’s pre-release indexed Canadian Forces salary;

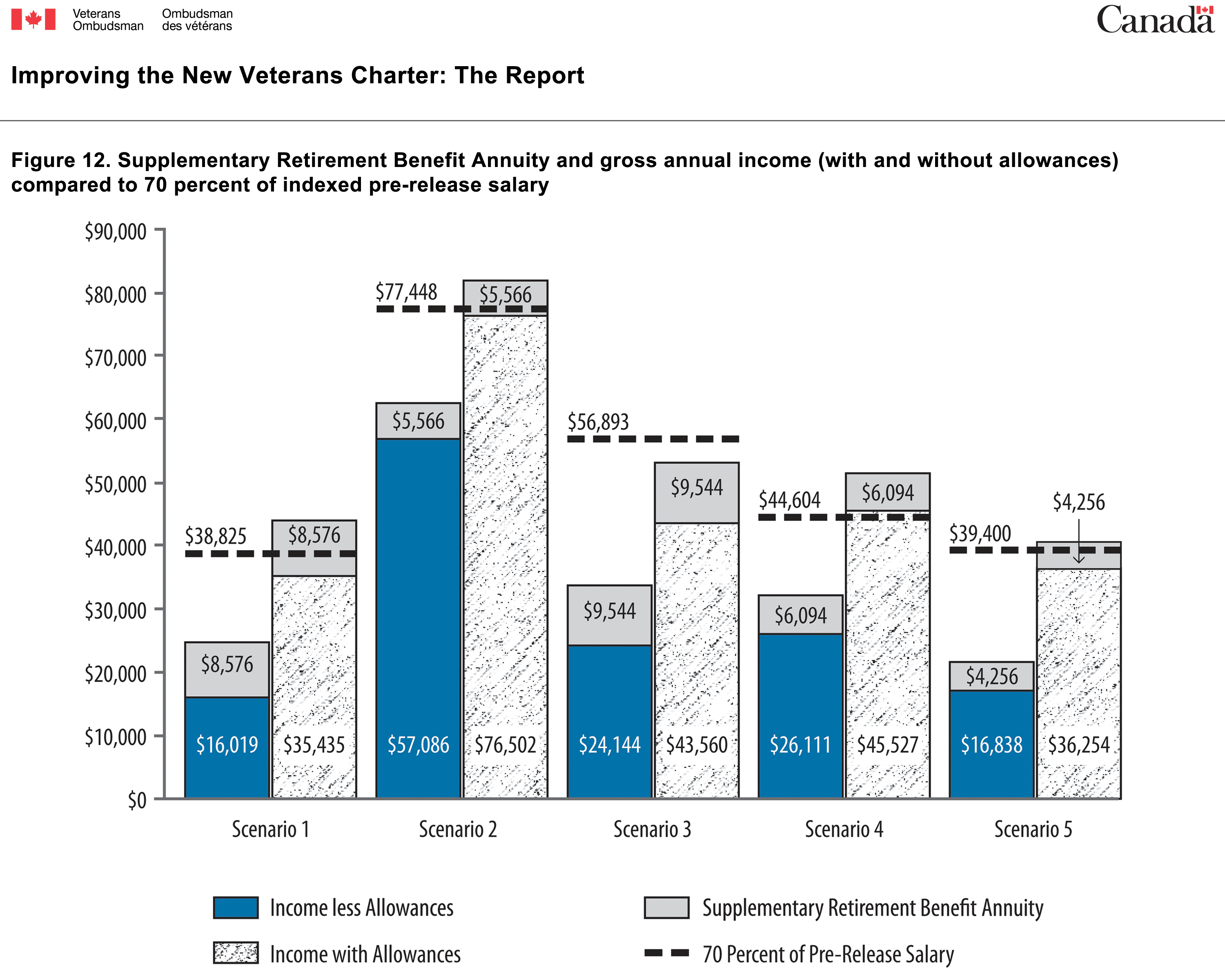

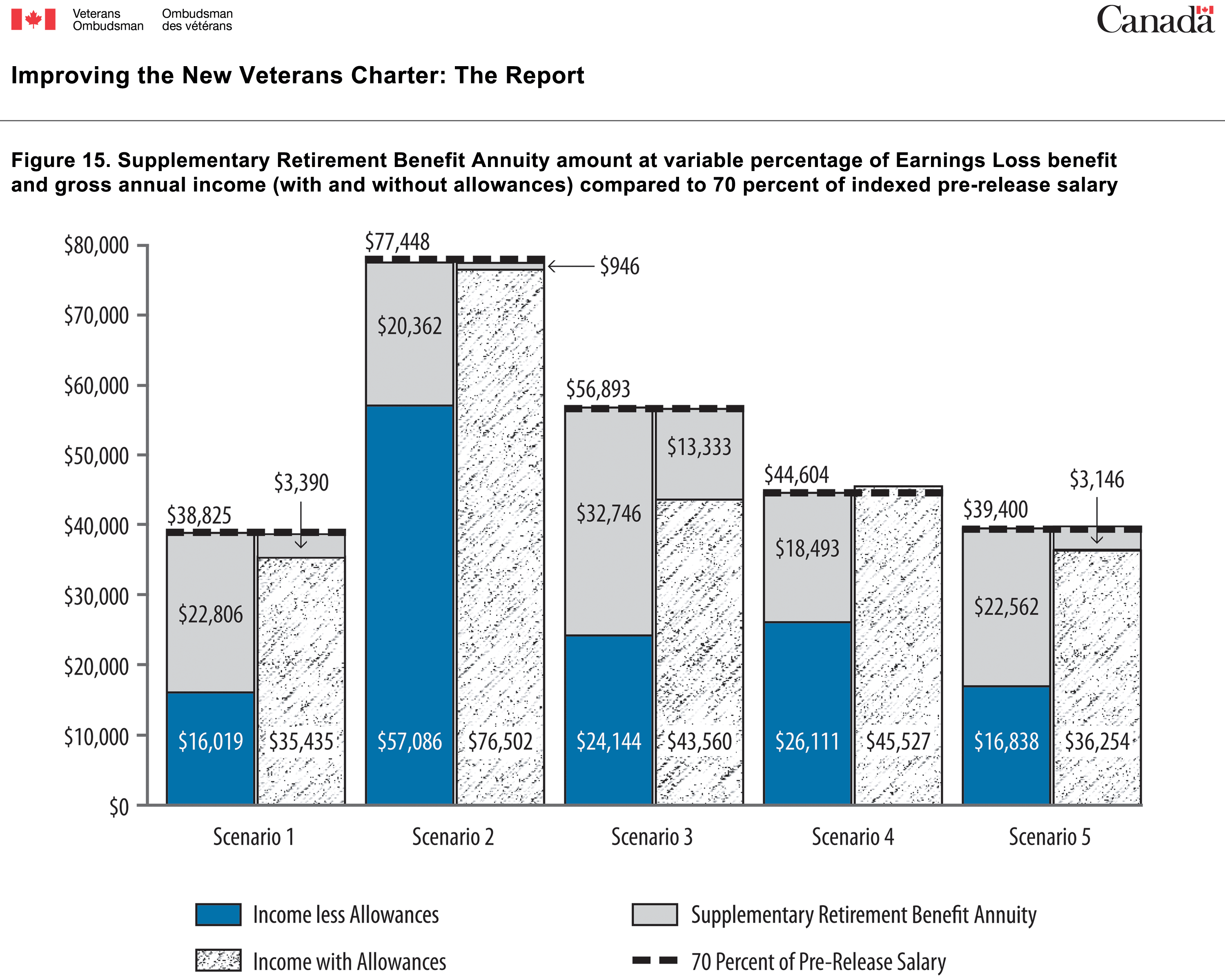

- Set aside and invest annuallyFootnote 47 five percent of the Earnings Loss Benefit and pay the invested amount to eligible totally and permanently incapacitated Veterans as a redesigned taxable monthly Supplementary Retirement Benefit Annuity at age 65;

- Set aside and invest annually a variable percentage of the Earnings Loss Benefit and pay the invested amount to eligible totally and permanently incapacitated Veterans as a redesigned taxable monthly Supplementary Retirement Benefit Annuity at age 65;

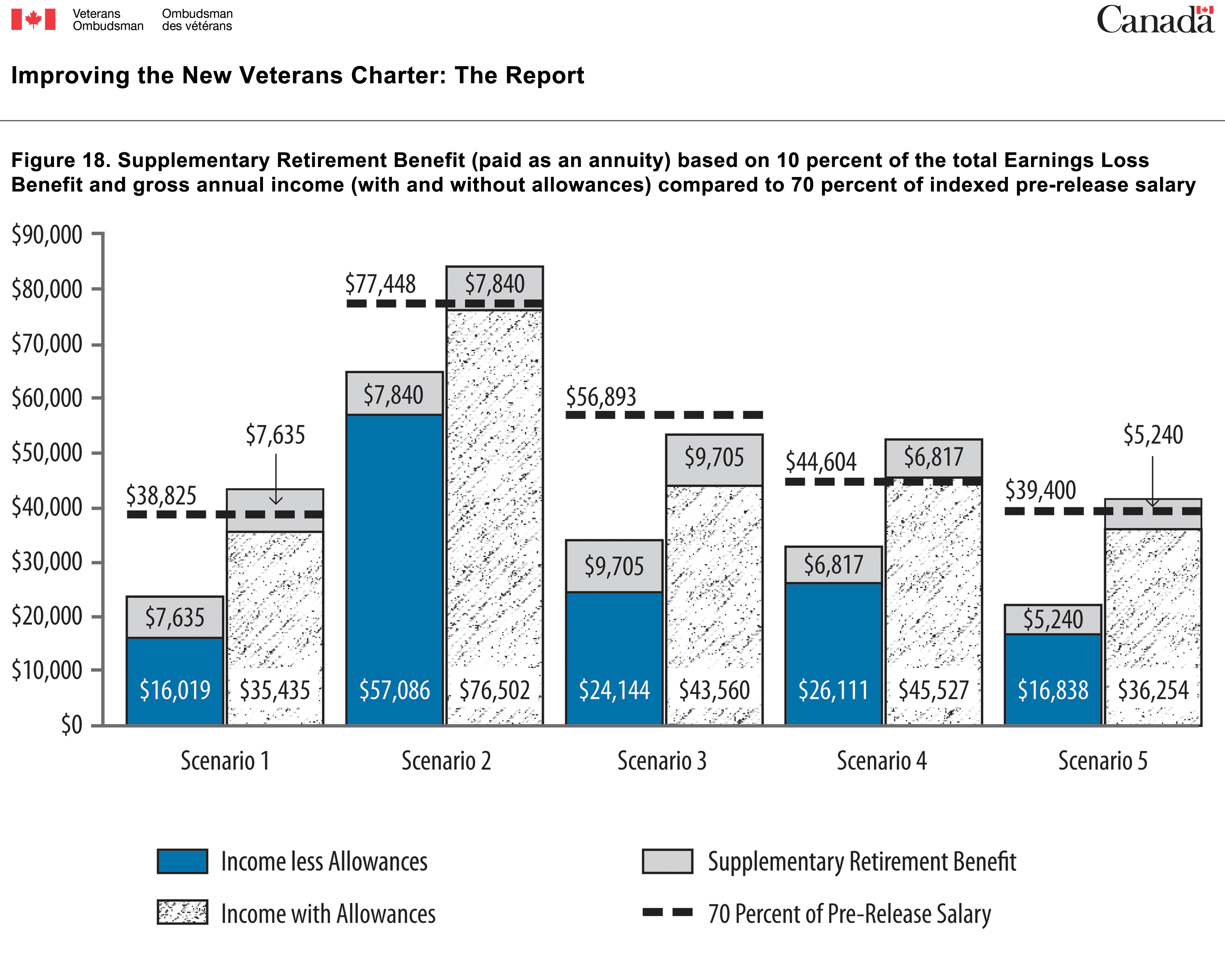

- Increase the amount of the Supplementary Retirement Benefit from two percent to 10 percent of the Earnings Loss Benefit, transfer the amount to a financial institution, and pay the amount as a monthly annuity at age 65;

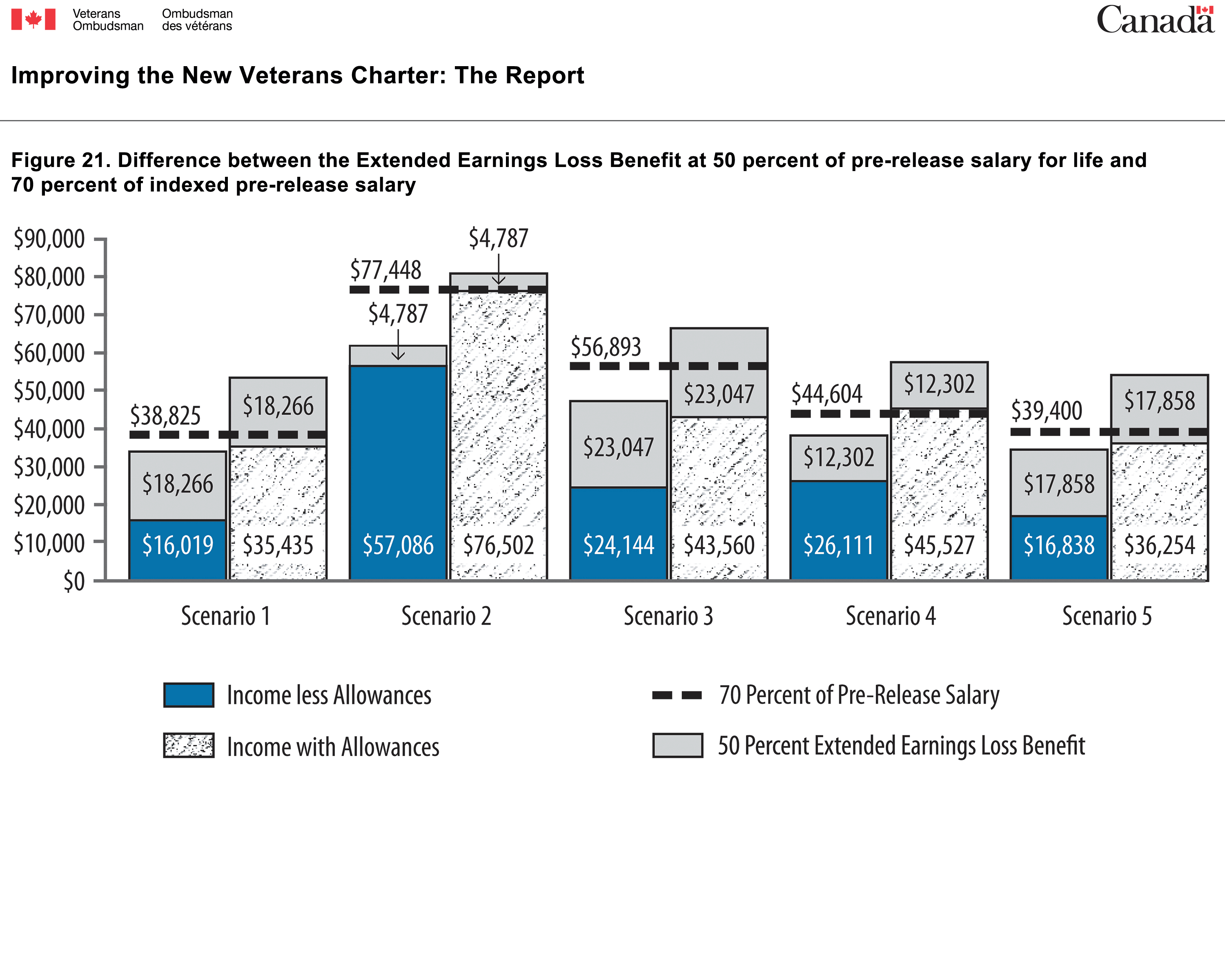

- Continue the Extended Earnings Loss Benefit after age 65 for life for totally and permanently incapacitated Veterans, at a reduced rate of 50 percent of pre-release salary.

These options are analyzed in detail in Appendix 3. Option 1 is the option that best addresses the after-age 65 shortcomings. It is described briefly below and further analyzed in Appendix 3.

Implement a New Monthly Supplementary Retirement Increment Benefit at Age 65 for Totally and Permanently Incapacitated Veterans

A new monthly taxable Supplementary Retirement Increment benefit could be provided at age 65 for life to eligible totally and permanently incapacitated Veterans whose total monthly financial benefits and income from prescribed sources are less than 70 percent of their pre-release indexed Canadian Forces salary. The prescribed sources could include monthly financial benefits provided under the New Veterans Charter, Pension Act and other government programs, and any reported income.Footnote 48

The new Supplementary Retirement Increment benefit would be provided to totally and permanently incapacitated Veterans at age 65, who were in receipt of the Extended Earnings Loss Benefit. The new benefit would also be provided to Veterans Affairs Canada clients, who were totally disabled SISIP Long Term Disability Plan clients in receipt of the income replacement benefit, and who were assessed by Veterans Affairs Canada to be totally and permanently incapacitated at age 65.Footnote 49

The amount of the increment would be based on an assessment of the value of the Veteran’s total monthly benefits and income from prescribed sources in relation to 70 percent of his or her indexed pre-release Canadian Forces salary. If the total monthly financial benefits and income are less than 70 percent of the Veteran’s indexed pre-release Canadian Forces salary, then a monthly increment would be provided for life to top up the Veteran’s financial benefits and income to the 70 percent threshold. The effect of the increment on vulnerable Veterans in the representative scenarios and the estimated cost are presented in Appendix 3.

This option would provide the most disadvantaged totally and permanently incapacitated Veterans—those with the greatest need for additional financial assistance—with sufficient after-age 65 financial support to allow them to sustain a standard of living based on 70 percent of their indexed pre-release salary. In addition, the new benefit would be given only to those with a need, which is consistent with one of the guiding principles of the New Veterans Charter.Footnote 50

Earnings Loss Benefit

Earnings Loss Benefit: A monthly taxable income replacement benefit offset by prescribed sources of income (such as the Canada/Quebec Pension Plan, Canadian Forces superannuation and other employment income) that ensures a Veterans’ income does not fall below 75 percent of his or her gross pre-release military salary. For the part-time reservist Veteran, the benefit is based on 75 percent of a deemed (standard amount) monthly salary of $2,700.

To summarize the information presented in the Veterans Ombudsman’s review paper Improving the New Veterans Charter: the Parliamentary Review, the following items are the main shortcomings of the Earnings Loss Benefit:

- An immediate reduction in income upon medical release from the Canadian Forces can be a barrier to transition to a new civilian life for Canadian Forces members whose military careers ended unexpectedly and prematurely due to injury or illness. The reduction in income can last a lifetime for seriously disabled Veterans who can no longer return to suitable and gainful employment.

- The Earnings Loss Benefit for a former part-time Reserve Force member is calculated on a much lower deemed salary (i.e. one standard amount) than the actual pre-release salary used to calculate the benefit for a former full-time Reserve Force or Regular Force member.

- The annual cost of living increase to the Earnings Loss Benefit is capped at two percent, even though the Consumer Price Index may be higher in a particular year.

Impact of the Reduction in Income after Release from the Canadian Forces

The practice of limiting the Earnings Loss Benefit to a rate of 75 percent of pre-release salary less offsets is based on Treasury Board policy for federal government disability insurance plans. While the rate is the same as the one used by the SISIP Long Term Disability Plan, it is different than the one used by the Public Service Disability Insurance Plan. It is also different than the various rates used by provincial Workers’ Compensation Boards to calculate income support benefits.Footnote 51

Regardless of this inconsistency in rates, the reality for many disabled Veterans is that they will experience a reduction in net pay when their Canadian Forces career is unexpectedly and prematurely terminated because of injury or illness. The termination of a military career and way of life is a difficult and stressful time for the Veteran; an unplanned reduction in income at release adds to the stress. The reduction in income has a greater impact on the disabled Veteran who is released at a lower rank and salary level, with no allowances from Veterans Affairs Canada and little or no superannuation annuity.

It should be emphasized that a member of the Canadian Forces who does not meet universality of service requirementsFootnote 52 cannot be accommodated in another Canadian Forces job at the same pay level, but it is not unusual for these service members who no longer meet universality of service requirements to want to remain in the Canadian Forces as long as possible. They want to retain their salary and financial security, continue to receive the medical care and support provided to them by the Canadian Forces and prolong their sense of belonging to the only organization for which they may have ever worked.

Veterans who do not have to worry about making ends meet during the post-Canadian Forces transition period are more likely to accept to start rehabilitation early and to focus on successful transition to civilian life. Financial security is key to successful vocational rehabilitation. In addition, early intervention is one of the guiding principles of the New Veterans Charter, and it is well documented that the sooner one starts vocational rehabilitation, the better their chances of successful transition to a new civilian career.

Furthermore, Veterans who can no longer work may face a lifetime of reduced quality of life because of their disability. Considering the sacrifices they have made for their country, they should not have to experience an additional reduction in quality of life because of a reduced standard of living.

There are a number of Veterans who may experience reduced income after their military careers are terminated because of injury or illness. Veterans Affairs Canada reports that as of March 2013, there were 3,198 Veterans in receipt of the New Veterans Charter Earnings Loss Benefit.Footnote 53 In addition to these Veterans, in November 2012 there were approximately 4,800 Veterans who were active SISIP Long Term Disability Plan clients.Footnote 54 The income replacement benefit provided to eligible Veterans under the SISIP Long Term Disability Plan is similar to the Earnings Loss Benefit provided by Veterans Affairs Canada.Footnote 55

Increasing the Earnings Loss Benefit

In its 2009 reportFootnote 56, the New Veterans Charter Advisory Group recommended that the Earnings Loss Benefit be provided at 100 percent of Canadian Forces earnings; this would make the income support payment fairer and give Veterans greater financial stability. The Advisory Group also recommended that the Extended Earnings Loss Benefit provided to totally and permanently incapacitated Veterans be based on probable career progression had the Veteran remained in the Canadian Forces.

The Veterans Ombudsman supports providing the Earnings Loss Benefit to eligible Veterans at a rate that allows them to maintain their net pre-release salary during transition from service in the Canadian Forces to a civilian job for those who can return to work, or until age 65 for those who can no longer work. However, the career progression component of income support should continue to be addressed through the Permanent Impairment Allowance and Permanent Impairment Allowance Supplement benefits, which are discussed in the next section.

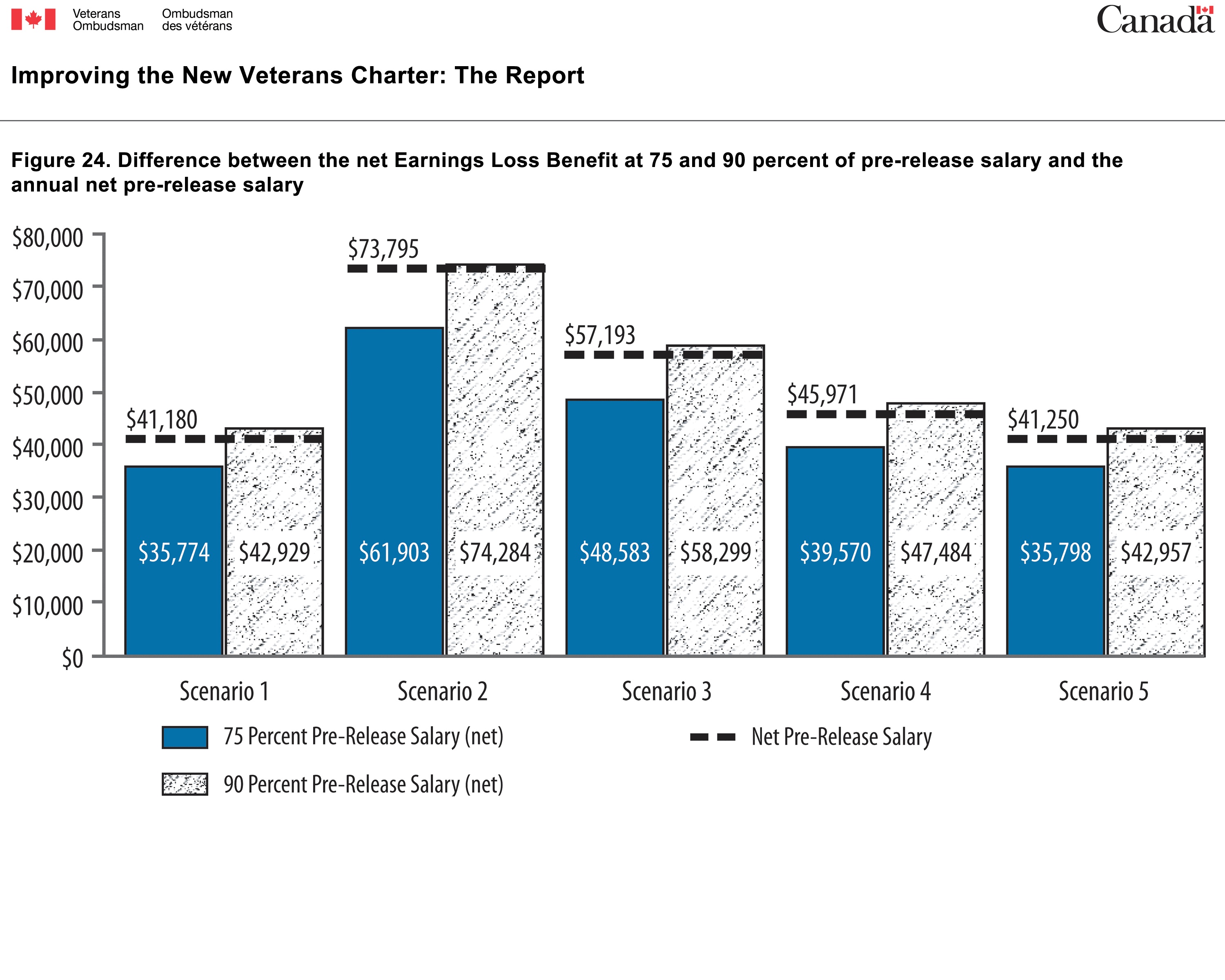

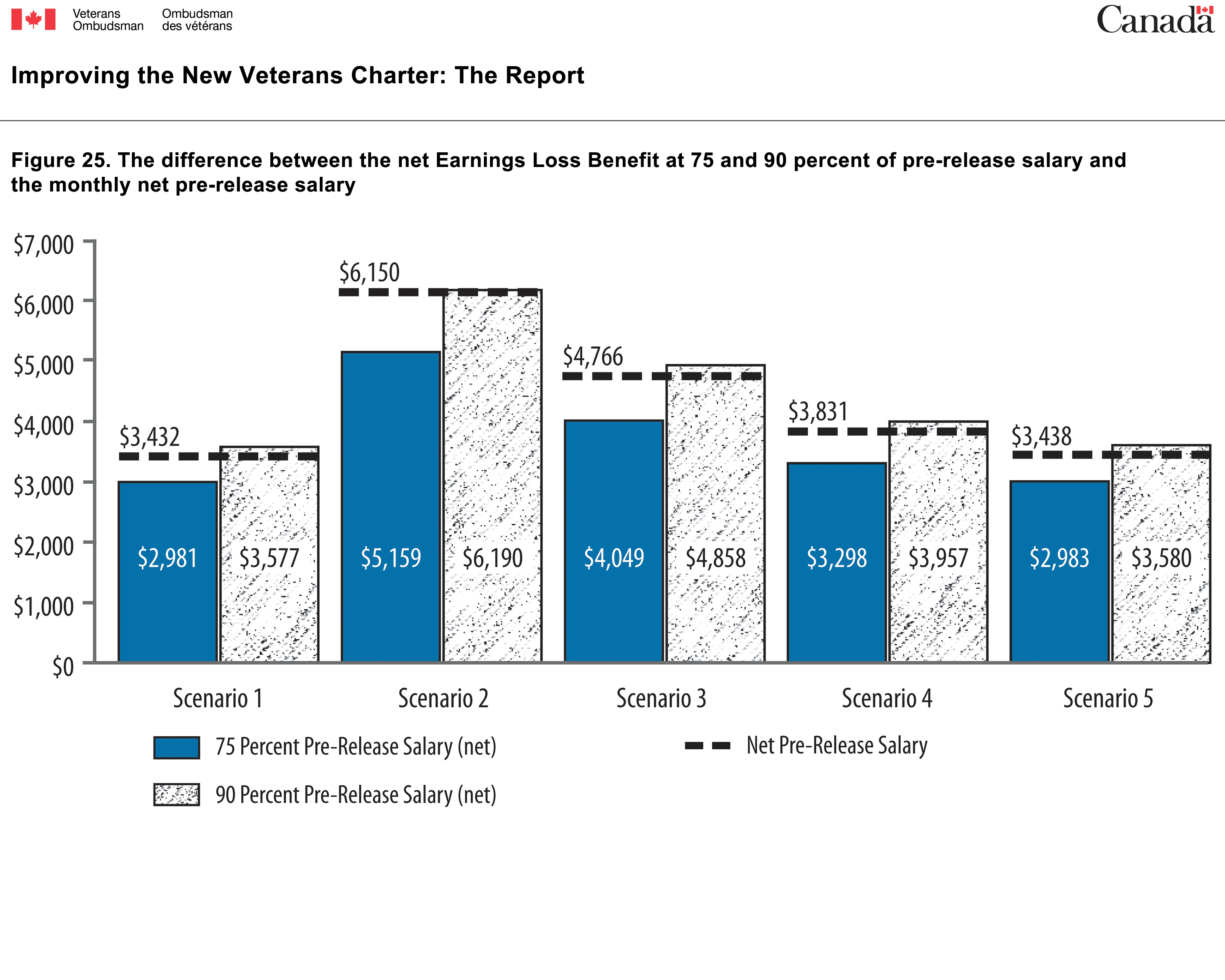

To achieve the desired effect with respect to the income support provided to Veterans, the Earnings Loss Benefit should be increased from the current 75 percent to 90 percent of the Veteran’s pre-release salary, less applicable offsets, such as superannuation, Canada/Quebec Pension Plan, employment income, etc. This percentage is the same as that used to calculate Workers’ Compensation Board income support benefits in six provinces.Footnote 57 Increasing the Earnings Loss Benefit to 90 percent of pre-release salary will provide the Veteran with 100 percent of his or her net pre-release salary. This is because while the Veteran is in receipt of the income support benefit, he or she no longer contributes to Employment Insurance, the Canada/Quebec Pension Plan, and Canadian Forces superannuation.Footnote 58 An example of the effect of such an increase is in the example presented earlier in this section.

The minimum salary used to calculate the Earnings Loss Benefit should remain at the Corporal basic pay level, as per the enhancement brought about in October 2011 through New Veterans Charter regulatory amendments related to Bill C-55.Footnote 59 The rationale for establishing this level of minimum salary remains reasonable.Footnote 60 In addition, the current offsets from the benefit should continue to apply as these too are reasonable, and the practice is consistent with the methodology used by federal disability insurance plans and provincial Workers’ Compensation Boards.

Provision of the increased Earnings Loss Benefit should continue to be conditional on active participation in a rehabilitation program, unless the Veteran is assessed to be totally and permanently incapacitated in spite of rehabilitation efforts. Finally, the benefit should cease when the Veteran is able to engage in suitable gainful employment.

There are three advantages to increasing the New Veterans Charter Earnings Loss Benefit (and the SISIP Long Term Disability Plan income replacement benefit) to 90 percent of the Veteran’s pre-release salary. First, by maintaining their pre-release net salary during transition from military to civilian life, Veterans should more readily accept their medical release from the Canadian Forces, start rehabilitation early and better concentrate on completing their rehabilitation plan—factors that are determinants of a successful transition. Second, the most seriously disabled Veterans will maintain their pre-release salary and standard of living until age 65, which will eliminate one of the stresses (financial), associated with the inability to work after termination of their military career. Third, this approach is consistent with how six provincial Workers’ Compensation Boards calculate the income support benefit provided to disabled workers.

The effect of increasing the Earnings Loss Benefit to 90 percent of pre-release salary and the estimated cost of implementing this measure are analysed in detail in Appendix 4.

Example of effect of increasing the Earnings Loss Benefit to 90 percent of pre-release salary (Scenario 1)

- Current salary of $4,622/month

- Canada Pension Plan, Employment Insurance and Canadian Forces Superannuation Act deductions of $632/month

- Tax rate of 14 percent (assumes Ontario-based Veteran)

- We calculate the pre-release net income as:

Gross salary – deductions x tax rate

For example: ($4,622 – $632) x .86 = $3,432/month - We calculate the net value of the Earnings Loss Benefit based on 90 percent of pre-release salary as:

Gross salary x 90 percent x tax rate (no Canada Pension Plan/Employment Insurance/ Canadian Forces Superannuation Act deductions)

For example: $4,622 x .90 x .86 = $3,577/month

Difference between net monthly pre-release salary and the net monthly Earnings Loss Benefit at 90 percent of pre-release salary: $145

Improving the Earnings Loss Benefit for Part-time ReservistsFootnote 61

The Earnings Loss Benefit provided to medically released part-time Reserve Force Veterans is based on 75 percent of a deemed salary (one standard amount) of $2,700 per month, while the benefit for full-time Reserve Force or Regular Force Veterans is based on 75 percent of their actual pre-release salary or a minimum salary of Corporal basic. This equates to an annual income support, before applicable offsets are deducted, of $24,300 for the part-time Reserve Force Veteran, regardless of rank, compared to a minimum annual income support of $41,600 for the full-time Veteran at the Corporal basic salary level. The difference between the two income support levels increases at higher rank and salary levels.

In September 2011, the Canadian Forces Chief of the Defence Staff communicated his vision for the Primary Reserve Force: Reservists are key to the ability of the Canadian Forces to meet Canada’s security and defence needs; and the contributions of part-time reservists to operations and to the connection with Canadians are important to the nation and to the communities in which they serve.Footnote 62

Considering the important role of all service personnel, all Veterans who sustain similar illnesses or injuries while serving their country should have access to the same benefits, regardless of the nature of their service and where and when they served. This is a matter of fairness and is consistent with the equitable medical care provided by the Canadian Forces to every reservist whose injury or illness is related to service. It is also consistent with the recent Government decision (December 2012) to provide the same compensation to all Canadian Forces members who suffer a service-related accidental dismemberment, regardless of service component, sub-component or class of Reserve Force service.Footnote 63

The Earnings Loss Benefit provided to part-time Reserve Force Veterans whose injury or illness is related to service should be based on the same salary level as that used to calculate the benefit for full-time Reserve Force and Regular Force Veterans. This will provide part-time Reserve Force Veterans with sufficient income to afford the basic necessities of lifeFootnote 64. This methodology should also apply to members of the Cadet Organizations Administration and Training Service and the Canadian Rangers who suffer service-related injuries or illnesses, because they too are members of the Canadian Forces.

It is simply inconsistent to provide injured or ill Veterans who served part-time in the Primary Reserve Force with the same rehabilitation services and vocational assistance as that provided to Veterans who served full-time in the Primary Reserve or Regular Forces, and then deny them the same income support benefit during the rehabilitation period. It is also unfair to restrict eligibility to the Earnings Loss Benefit for members of the Cadet Organizations Administration and Training Service and the Canadian Rangers to a service-related injury or illness suffered only while on Class C terms of service.Footnote 65 It is extremely unlikely that Canadian Forces members in these Reserve Force sub-components will ever serve on Class C terms of service. Therefore, the restriction essentially has the same effect as stating that members of these two sub-components of the Reserve Force are not entitled to the Earnings Loss Benefit.

The number of part-time Reserve Force Veterans in receipt of the New Veterans Charter Earnings Loss Benefit and the SISIP Long Term Disability Plan income replacement benefit is very low—less than 30 per year. Footnote 66 This is in contrast to the approximately 8,000 New Veterans Charter and SISIP Long Term Disability Plan Veteran clients who are eligible to receive income support. While the Canadian Forces does not track how many of these part-time Reserve Force Veterans were medically released for medical conditions related to service, it is reasonable to assume that some suffered a service-related injury or illness. Therefore, the incremental cost of providing the same income support to part-time Reserve Force Veterans as that provided to full-time Reserve Force and Regular Force Veterans will be a small fraction of the total cost of the Veterans Affairs Canada and SISIP Financial Services income support programs.

Amending the Methodology of the Annual Cost of Living Adjustment to the Earnings Loss Benefit

The practice of capping the annual cost of living adjustment to the New Veterans Charter Earnings Loss Benefit at two percent is based on the practice used by the SISIP Long Term Disability Plan. The latter does not specify why a two percent limit is imposed. Likewise, it is unclear why the Disability Insurance Plan for represented federal government employees limits annual increases to three percent.Footnote 67

The annual cost of living adjustment to the Earnings Loss Benefit should not be capped at an arbitrary percentage rate. Instead, adjustments should be based on actual annual increases in the cost of living as measured by the Consumer Price Index. This will allow the income support provided to Veterans to keep pace with increases in the cost of living.

Permanent Impairment Allowance/Supplement

Permanent Impairment Allowance:A monthly taxable benefit payable for life in three grade levels that compensates for the lack of career opportunities and progression.

Permanent Impairment Allowance Supplement: A monthly supplement that compensates for the inability to perform any occupation that is considered to be suitable gainful employment.

As indicated in the Veterans Ombudsman’s paper Improving the New Veterans Charter: the Parliamentary Review, access to the Permanent Impairment Allowance has improved since the enactment of Bill C-55. However, the statistics provided by Veterans Affairs Canada suggest that accessibility to the benefit may continue to be an issue, as described below.

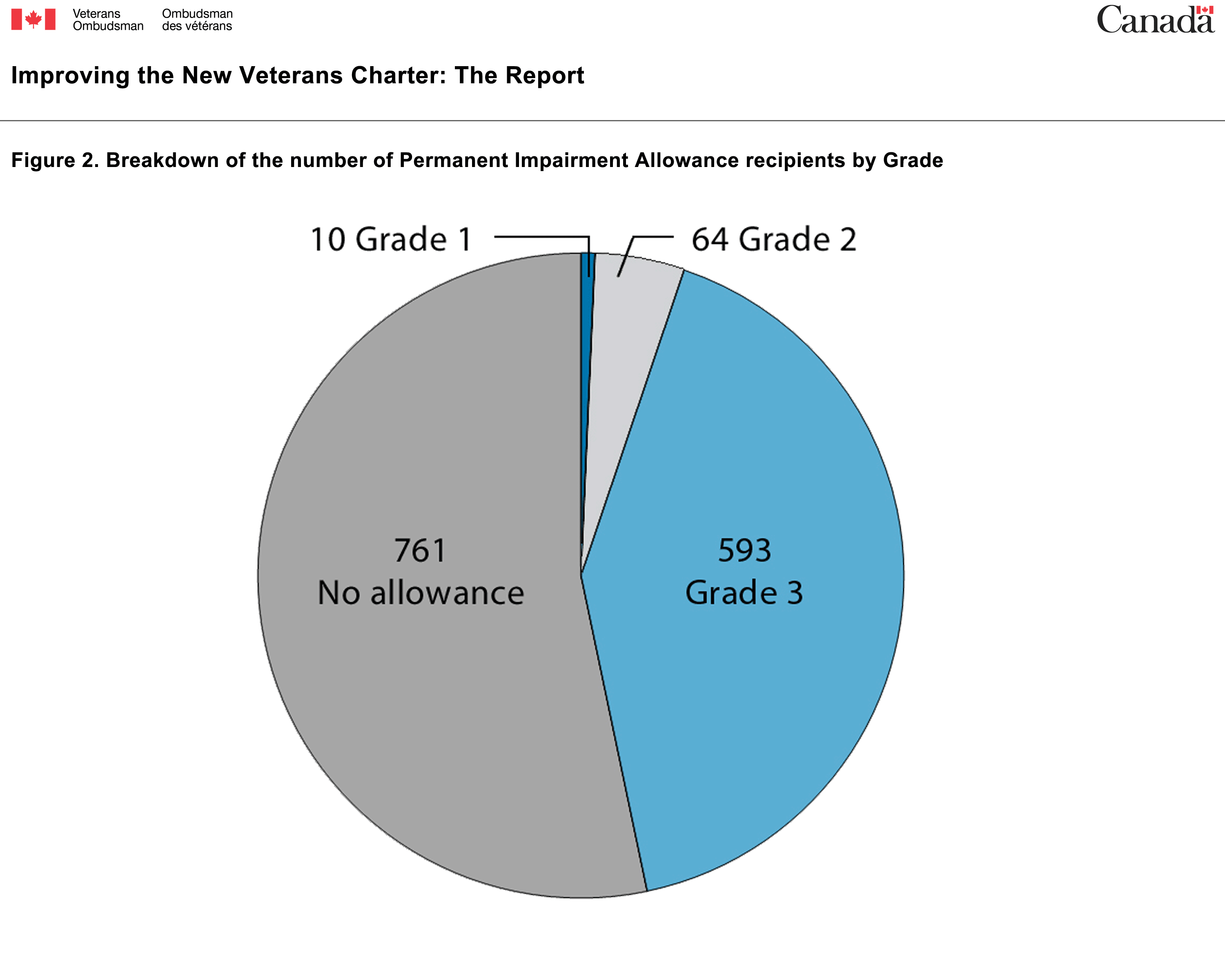

For example, and as shown in Figure 2,Footnote 68 almost 90 percent of Permanent Impairment Allowance recipients are awarded the lowest grade level. There is insufficient information to assess whether there is a valid reason for this situation or whether the eligibility criteria for the benefit are too stringent. Also, it is not clear why 761, or 53 percent, of Veterans who are assessed to be totally and permanently incapacitated and who suffer from a permanent physical or mental health problem that prevents them from engaging in suitable gainful employment are not awarded the benefit that is designed to compensate severely and permanently impaired Veterans for a lack of career opportunity and progression. By definition, a totally and permanently incapacitated Veteran is unable to engage in suitable gainful employment, yet most of these Veterans are not eligible for the very benefit that is designed to compensate them for the lack of career opportunities.

Figure 2. Breakdown of the number of Totally Permanently Incapacitated Veterans receiving the Permanent Impairment Allowance by Grade

Pie Chart - Breakdown of the number of Totally Permanently Incapacitated Veterans receiving the Permanent Impairment Allowance by Grade

- 10 veterans are receiving Grade 1

- 64 veterans are receiving Grade 2

- 593 veterans are receiving Grade 3

- 761 veterans receive no allowance

Also, from other statistics provided by Veterans Affairs Canada, it is not clear why approximately 40 percent of the close to 300 totally and permanently incapacitated Veterans who are assessed at a disability level of at least 98 percent, and who are presumably very seriously disabled, are not in receipt of the Permanent Impairment Allowance and Supplement. Finally, the fact that Veterans Affairs Canada does not track the reasons why applications for the Permanent Impairment Allowance and Supplement are denied hampers the ability to conduct a more comprehensive review of the accessibility to these benefits.

The analysis of the options to improve financial support after age 65 in Appendix 3 demonstrates that the financial situation of totally and permanently incapacitated Veterans after age 65 is significantly improved when they are in receipt of the Permanent Impairment Allowance and the Supplement. Therefore, Veterans Affairs Canada needs to conduct a review of this Veteran cohort that is not receiving the Permanent Impairment Allowance and Supplement. If the review indicates that totally and permanently incapacitated Veterans who are in receipt of a disability award and an approved rehabilitation plan for the condition that is causing the total and permanent incapacity are not receiving the allowance and supplement, then the benefits should be provided to them. The modelling and cost analysis of providing the Permanent Impairment Allowance and Permanent Impairment Allowance Supplement benefits to totally and permanently incapacitated Veterans are provided in Appendix 5.

This review by Veterans Affairs Canada would address the issue of accessibility to the benefits. The Office of the Veterans Ombudsman will conduct a separate review to determine whether the rates for the Permanent Impairment Allowance and Permanent Impairment Allowance Supplement are fair economic support for the lack of career progression and the impact on the totally and permanently incapacitated Veteran of the inability to engage in suitable gainful employment.

Disability Award

Disability Award: A tax-free lump sum, annual payment, or combination of both, that recognizes and compensates for non-economic impacts of a service-related disability such as pain and suffering, functional loss and the effects of a permanent impairment on one’s life.

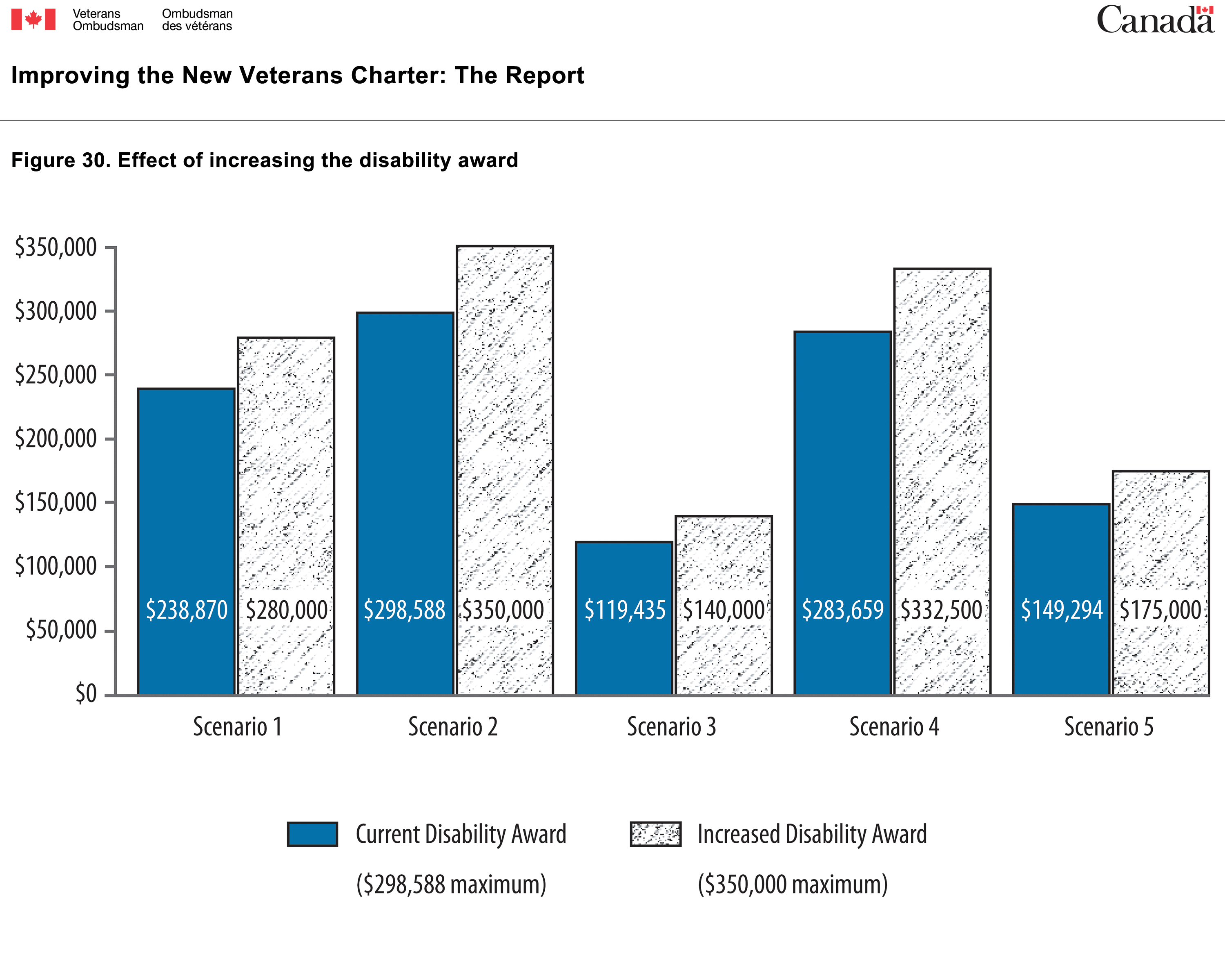

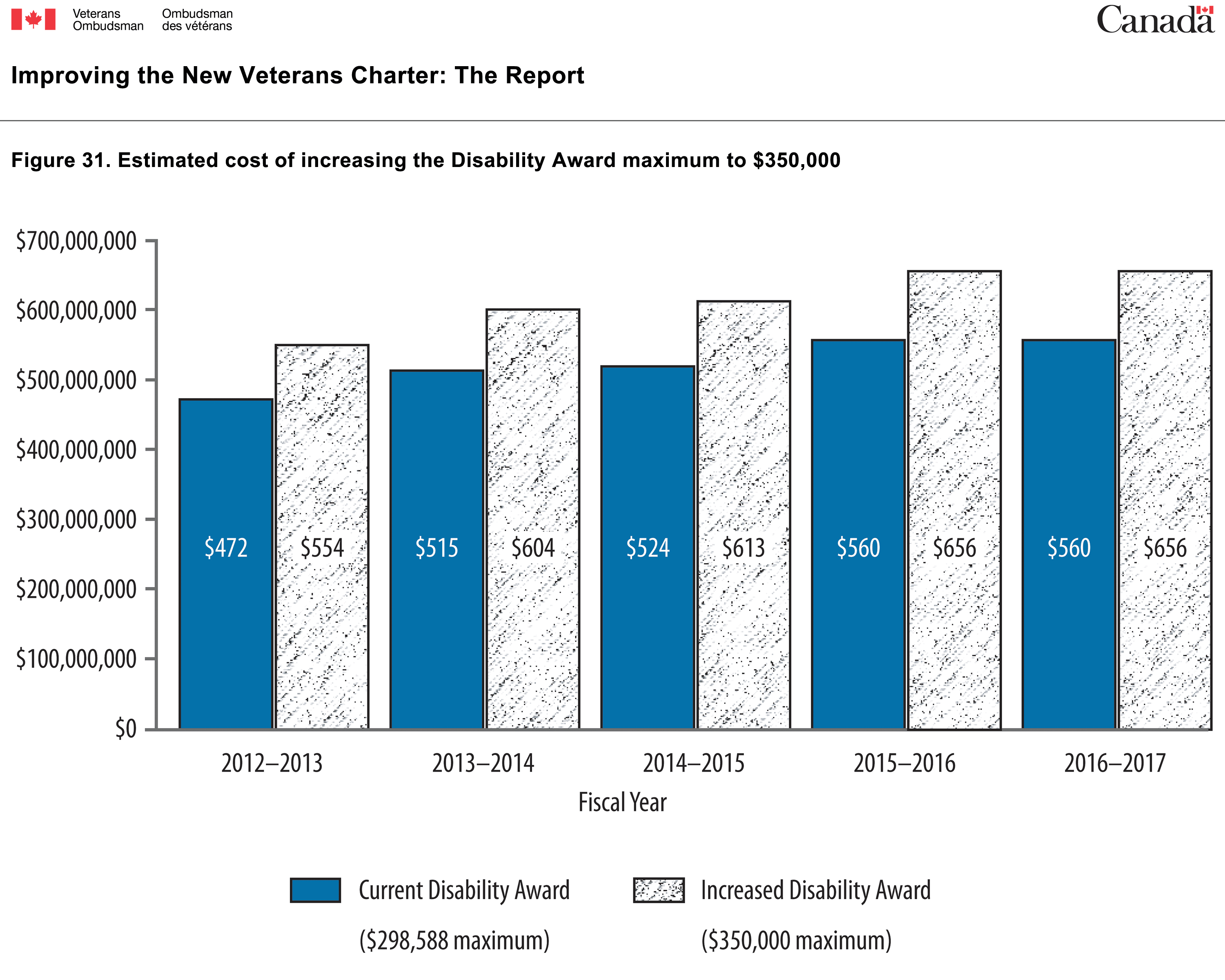

To recap the information presented in the Veterans Ombudsman’s review paper, the main shortcoming with the Disability Award is that it has not kept pace with two of the original benchmarks upon which the amount was based. Other than annual indexing, the Disability Award has not been increased since the benefit came into effect in 2006.

As of March 2013, there were 38,380 Veterans in receipt of the Disability Award. Veterans Affairs Canada estimates that the number of disability award recipients will increase by approximately 5,000 per year over the next 5 years.Footnote 69 As detailed in Appendix 2, 73 percent of disability award recipients are assessed a disability level of less than 32 percent, while 5 percent are assessed a disability greater than 78 percent.Footnote 70

One of the benchmarks used by Veterans Affairs Canada to develop the Disability Award Program was lump sum amounts awarded by Australia and the United Kingdom to its disabled military personnel. The Veterans Ombudsman is of the opinion that the Department should not establish Veteran benefits based on what other countries provide to their disabled Veterans. There are too many differences in the way countries administer and deliver programs to disabled Veterans, such as different eligibility criteria and different cost of living considerations. Deficiencies with New Veterans Charter benefits require Canadian solutions.

The minimum Veterans Affairs Canada needs to do is to increase the maximum amount of the Disability Award to at least match the current judicial cap for pain and suffering resulting from injury (non-pecuniary damages) awarded by Canadian courts.Footnote 71 This maximum amount is currently $342,000. Then, considering the unabated controversy within the Veterans community surrounding the adequacy of the Disability Award, Veterans Affairs Canada needs to conduct research and engage Veterans’ stakeholders to determine what the appropriate maximum amount should be to fairly compensate Canadian Forces members and Veterans for pain and suffering resulting from an injury or illness in service to Canada.

In addition to increasing the Disability Award, VAC should review the adequacy of the amount provided for financial counselling. The $500 provided for financial counselling has not changed since 2006, and it would be appropriate to determine if it remains adequate.

In the final analysis, the Disability Award is not income support and does not compensate for economic loss. Therefore, while an increase to the Disability Award is necessary, it should not be viewed as the solution to resolving shortcomings with the New Veterans Charter financial benefits that compensate for the economic impacts of an injury or illness.

Modelling can be found in Appendix 6 of the effect of increasing the Disability Award to a maximum of $350,000.

Summary

There are two objectives to these proposed improvements to the New Veterans Charter financial support benefits. First, and most importantly, the objective is to ensure that economic support is sufficient to enable Veterans to meet their needs during transition to civilian life, or until end of life if required, with minimal reduction in the standard of living they had before their military careers ended unexpectedly and prematurely because of injury or illness. Second, Canadian Forces Veterans should receive non-economic compensation for pain and suffering resulting from a service-related injury or illness that is at least equivalent to the maximum amount that is awarded to Canadians by Canadian courts for pain and suffering.

The effects that the Government of Canada can achieve by implementing these proposed improvements to the New Veterans Charter’s financial benefits are as follows:

- The most seriously disabled Veterans are able to live their retirement years with a reasonable standard of living, with after-age 65 financial support that is based on a commonly accepted benchmark for retirement income;

- By maintaining a standard of living during transition from military to civilian life that is similar to that experienced prior to release from the Canadian Forces, and with income support that is adjusted annually based on the Consumer Price Index, Veterans are more likely to accept an early start to rehabilitation. This is a key determinant of transition success. Importantly, the successful transition of disabled Veterans to new careers could serve as a model for the Government of Canada to guide the development of its Public Service disability management initiative;

- Veterans who suffer a service-related injury or illness while on part-time Reserve Force service are treated fairly by receiving the same income support as that received by Veterans who served on full-time Reserve Force service; and,

- Totally and permanently incapacitated Veterans have better access to the benefit that compensates them for the effects that a serious disability has on their ability to work and to achieve career progression.

Recommendations

The Veterans Ombudsman recommends that the Minister of Veterans Affairs improve the New Veterans Charter’s economic financial support benefits provided to Veterans by:

- Providing additional financial support after age 65 to eligible totally and permanently incapacitated Veterans to ensure that their monthly benefits are no less than 70 percent of their indexed pre-release salary;

- Increasing the Earnings Loss Benefit to 90 percent of pre-release salary;

- Providing the same Earnings Loss Benefit to former part-time Reserve Force members whose injury or illness is related to service;

- Calculating the annual cost of living adjustment to the Earnings Loss Benefit based on actual annual increases in the cost of living as measured by the Consumer Price Index; and,